Valuable ways to have the fiduciary conversation with clients

The Department of Labor's new rule creates an opportunity to have some great conversations.

Earlier this month, I shared how my clients reacted when I told them I’d become a fiduciary. The short version: mostly silence and shoulder shrugs. A few clients tried saying it — “Fiduci-what?” — before they told me they already believed my advice put them first.

So I thought it might be helpful to share one of the most valuable ways I’ve found to have this conversation with clients. After all, the Department of Labor’s new rule creates an opportunity to have some great conversations with clients about what it means to be a fiduciary.

Again, I know some people are concerned about the financial and regulatory impact of the rule. But think about what it means for real financial advisers. It’s a chance for people to learn how you put them first.

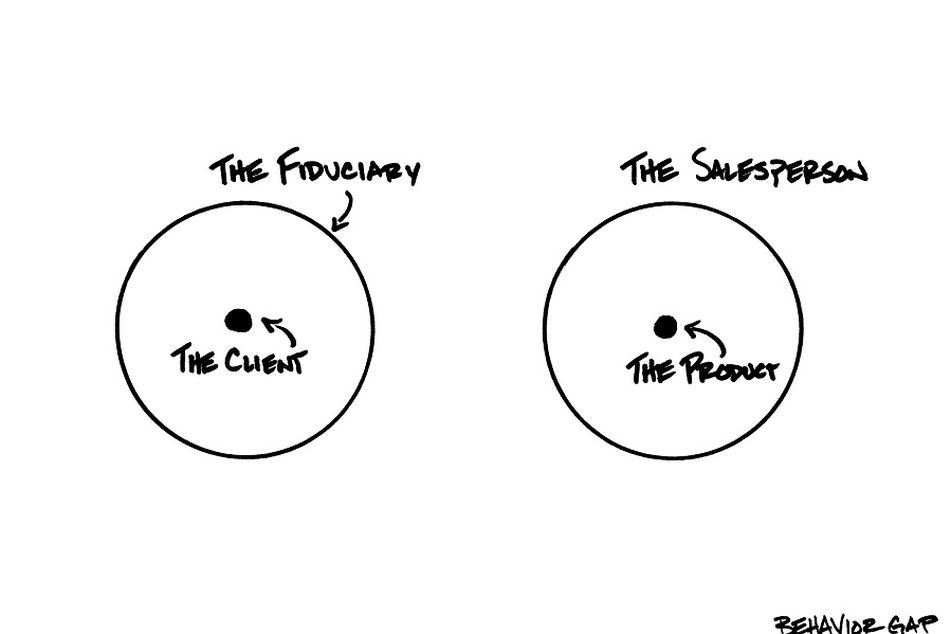

The simplest version goes like this: You put clients at the center of the relationship. In contrast, salespeople, whatever their official title, put products at the center of what they do.

For instance, a salesperson runs around with a product looking for people to sell to … kind of like a hammer running around looking for nails to hit. A real adviser, on the other hand, says, “Help me understand your needs, so I can find the right tool (i.e., product) to serve you best.”

It may seem like a small distinction, but it will make all the difference to your clients. Just imagine you’re going on a trip, and someone is trying to sell you a car to drive there. But this person doesn’t bother to ask where you’re going. So if you’re headed to an island, a car won’t get you very far. That’s a salesperson. An adviser will ask you your destination before suggesting the best way to get there.

I’ve found this sketch to be really helpful when it comes to explaining the difference. Draw it on the whiteboard or print it out. I’m betting your clients’ eyes will light up, and they’ll immediately understand the value of working with you, a real financial adviser.

Carl Richards is a certified financial planner and director of investor education for the BAM Alliance. He’s also the author of the weekly “Sketch Guy” column at the New York Times. He published his second book, “The One-Page Financial Plan: A Simple Way to Be Smart About Your Money” (Portfolio), last year. You can email Carl here, and learn more about him and his work at BehaviorGap.com.

Learn more about reprints and licensing for this article.