Advisers need to talk clients off the ledge when it comes to impractical investments

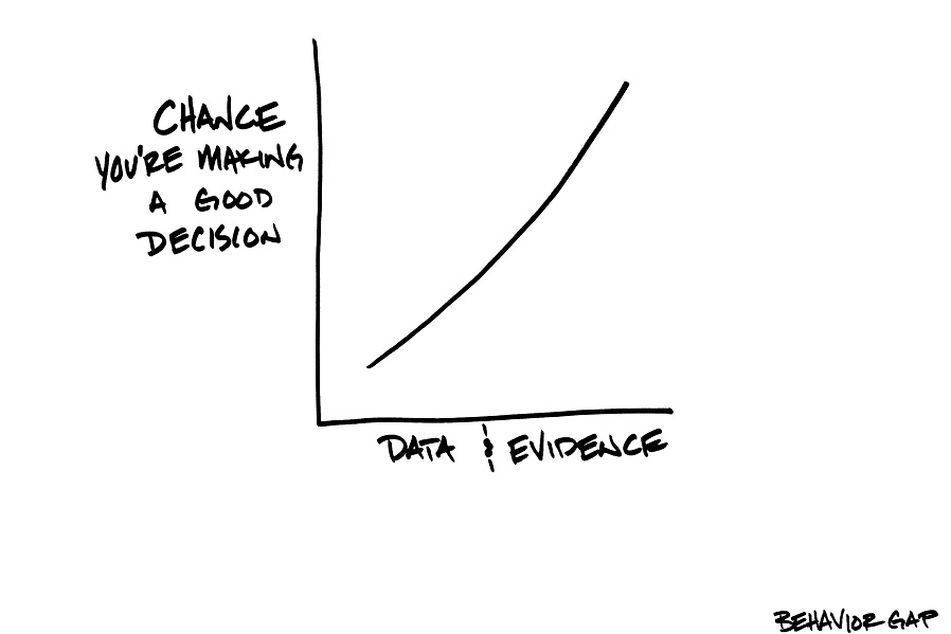

Have conversations with clients about how investment decisions should be based on data and evidence.

“I just heard about this great investment opportunity.”

We’ve all gotten a phone call, read an email or had a meeting with clients who said these magic words. The sole reason for calling it “great”? Someone else said so.

Look, we all know what happens when investors rely on anecdotes, friends and super-secret, you-must-buy-now investments. It’s usually a disaster. All of this leads me to an important practice we need to adopt (if we haven’t already).

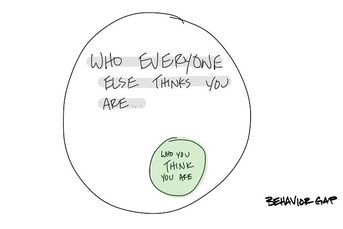

We need to talk people in off the ledge and stop them from making financial decisions based on recent performance. People love to tell the stories about how they “just knew” an investment was going to take off. Lo and behold, the investment does just that, and your clients are crazy if they don’t jump in now. What isn’t talked about are the bad guesses. People don’t like sharing how they made a huge investing mistake based on what they thought they knew. It’s much more enjoyable to talk only about the wins.

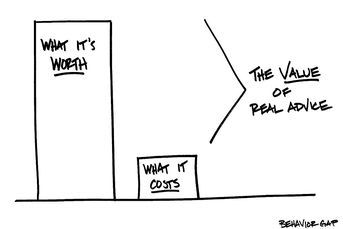

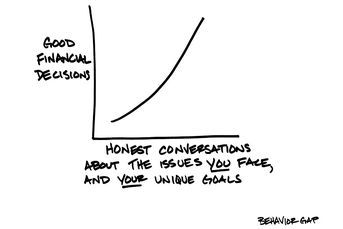

To counter these storytellers, clients need to have conversations with us in which we can show how we invest based on data and evidence. It’s an incredibly valuable way to ground what we do and give it meaning to our clients. It doesn’t rely on hearsay or myths. It relies on facts. Of course, if you’re not clear on all the evidence, you owe it to your clients to understand why you’re recommending what you do.

After all, that’s one of the best things about finance. We can follow the trail of bread crumbs. What do the data say? What do we learn that can help clients separate fact from fiction?

There will always be people with a good story to tell about amazing investments. There will always be people who believe that personal stories trump the data and evidence saying otherwise. Our job as trusted advisers is to help our clients understand the true risk of relying on someone else’s opinion to justify big financial decisions.

Carl Richards is a certified financial planner and director of investor education for the BAM Alliance. He’s also the author of the weekly “Sketch Guy” column at the New York Times. He published his second book, “The One-Page Financial Plan: A Simple Way to Be Smart About Your Money” (Portfolio), last year. You can email Carl here, and learn more about him and his work at BehaviorGap.com.

Learn more about reprints and licensing for this article.