A record $170 billion flooded into bond ETFs this year

The Fed's March announcement that it would buy corporate debt ETFs served as a stamp of approve for the sector

Things were looking pretty bleak for bond exchange-traded funds back in March. The COVID-19 sell-off created a liquidity crunch that drove their prices to trade at deep discounts to the value of the underlying assets. Skeptics questioned whether these products could ever be trusted again.

Then the Federal Reserve stepped in. On March 23, it announced that that it would begin buying corporate debt ETFs. This ignited a wave of front-running investments and served as a stamp of approval for the market sector.

A thank you note to Jerome Powell may be in order. Flows into U.S. fixed-income products this year have surpassed the total for all of last year. New funds are coming down the pipeline. And investors are increasingly using corporate bond ETFs to bet on an economic recovery and hedge against what could be a volatile post-election season.

“The events from the onset of the pandemic have only accelerated the growth of fixed-income ETFs,” said Matthew Bartolini, head of SPDR Americas Research at State Street Global Advisors.

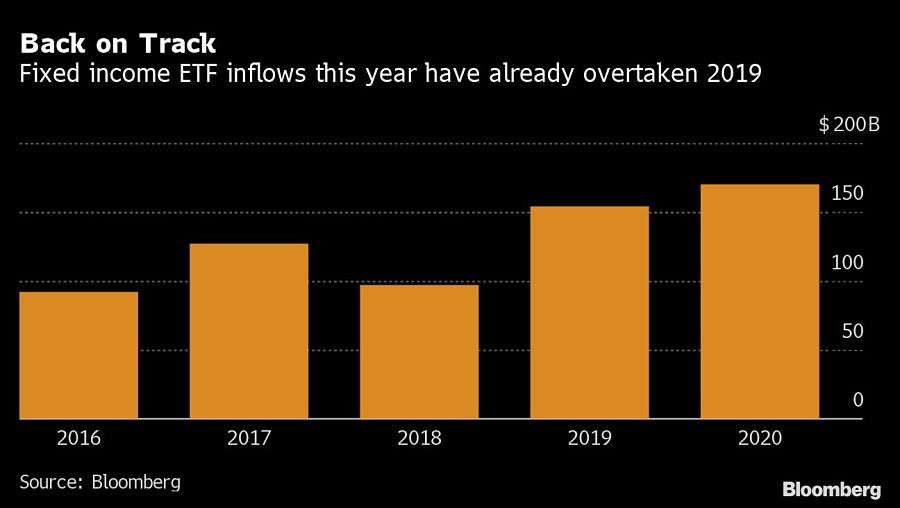

So far this year, inflows to bond funds total $170 billion, compared with $154 billion in all of 2019, according to data compiled by Bloomberg.

Of course, another sharp downturn could reopen a chasm between bond ETF prices and their underlying assets, and the Fed’s eventual unwinding of its holdings might spur distress. But the central bank hasn’t given indications about its exit timeline, so purchases of fixed-income funds remain strong.

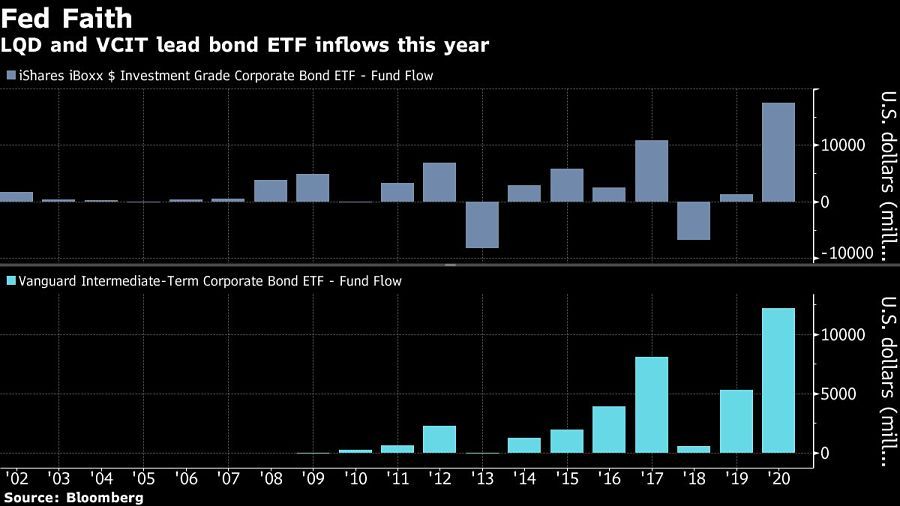

The Fed has bought 16 different corporate bond ETFs, with purchases peaking in June at $4.2 billion, according to data from Bloomberg Intelligence. Investors anticipating the central bank’s moves added $28 billion to those products.

Two of the funds the Fed bought ended up topping the list of biggest sector gainers this year. BlackRock’s iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) is leading with $17.5 billion, while Vanguard’s Intermediate-Term Corporate Bond ETF (VCIT) has attracted $12.2 billion.

Even some funds without the Fed backing have seen stellar years. Vanguard’s Total Bond Market ETF (BND) and BlackRock’s iShares Core U.S. Aggregate Bond ETF (AGG) have added $12.1 billion and $8.2 billion, respectively.

“We’re already in record territory, and we’re likely to blow that record away, given the volatility headed into an election,” said Todd Rosenbluth, head of ETF and mutual fund research for CFRA Research.

NOVEL USES

Investors have been shoveling money into U.S. government and mortgage-backed bond ETFs in the past month, anticipating further choppiness from uncertainties over fiscal stimulus and the outcome of the presidential election. Other strategies for bond funds recently include shorting high-yield securities and hedging long positions.

“There’s a variety of ways they can be used in portfolios, and I think that helps to draw a more diverse investor base,” said Dave Perlman, ETF strategist for UBS Global Wealth Management.

These ETFs also enable clearer price discovery in the less-liquid bond markets and make it easier for investors to amass a diversified portfolio of specific types of securities.

“Institutional investors are getting more comfortable using ETFs to gain more targeted exposure” instead of buying individual bonds, Rosenbluth said.

This, in turn, has created a flurry of new funds. So far this year, 39 fixed-income ETFs have begun trading, compared with 38 at the same point last year and 37 in 2018. Two new ones in 2020 — iShares 0-3 Month Treasury Bond ETF (SGOV) and Franklin Liberty U.S. Treasury Bond ETF (FLGV) — have already attracted $890 million and $423 million respectively.

FED HANGOVER

Yet the good times may have their limits. The Fed stopped buying bond ETFs in August. And early birds who bought ahead of the Fed could start taking profits.

Corporate bond products might see up to $30 billion in outflows in the next month or two, according to Bloomberg Intelligence. The category lost $3.2 billion in September, but has regained $6.1 billion in October so far.

And bond ETFs haven’t converted everyone. Some investors still prefer purchasing the individual bonds.

Jim Paulsen, chief investment strategist for Leuthold Group, said that when it comes to high-quality bonds like Treasuries, he would rather just buy them directly so he doesn’t have to worry about any fees. But for complex formulas and diversifying holdings, the ETFs can come in handy, he said.

“As you get into more credit risk or structure mortgages or prepay instruments, then I think ETFs can play a role,” Paulsen said.

[More: ETF price wars may resume]

Learn more about reprints and licensing for this article.