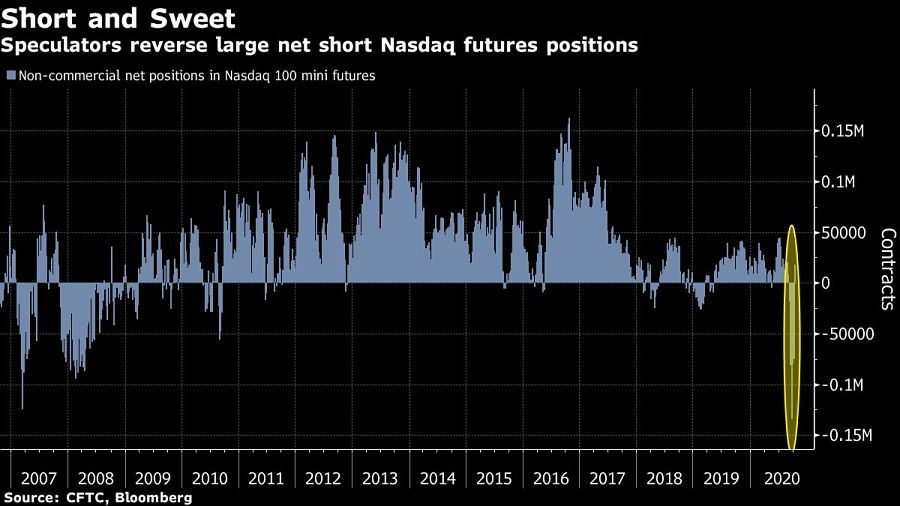

Speculators reverse big Nasdaq short

The buying comes after hedge funds had driven net short bets to the highest level since before the financial crisis

Hedge funds have pulled back from one of the biggest short positions in U.S. tech stocks in over a decade, in a near-record buying spree of Nasdaq futures last week.

Net speculative positions in Nasdaq 100 mini contracts surged by the most in more than 13 years in the week through Oct. 13, according to the latest Commodity Futures Trading Commission data. The increase was the second biggest on record in data going back to 1999 and left speculators net long the futures for the first time since the beginning of last month.

The buying frenzy comes after fast-money accounts had driven net short bets to the highest level since before the financial crisis during September.

The U.S. tech gauge has risen more 9% from its Sept. 23 low amid signs of a return of bullish options activity that helped push it to an all-time high earlier that month. It remains about 5% below that record.

The dialing back of bearish expectations for tech stocks coincided with an increase in wagers that equity volatility will decline. Net short non-commercial positions on futures linked to the Cboe Volatility Index hit the largest since February, the CFTC data showed.

[More: Value stocks could shine after the election]

Learn more about reprints and licensing for this article.