JPMorgan says to book profits on bonds before next possible rate hike

The bank says Fed isn’t done with hiking and sees another rate increase next week.

Bond investors who had bet that central banks were too hawkish in the face of recession risks should now book profits as this week’s rally is overdone.

That’s the view of strategists at JPMorgan Chase & Co. and TD Securities Inc. who say it’s time to close out long positions in Treasuries as the Federal Reserve may still tighten policy next week. U.S. government bonds have surged in recent days as traders cut wagers on Fed rate hikes amid turmoil in the banking sector.

“I don’t want to chase this bond rally, it seems silly,” said Amy Xie Patrick, head of income strategies at Pendal Group Ltd. in Sydney. She had gone long on bonds earlier this month, but now she is skeptical of bets on rate cuts. “The broad theme I guess is I’m back closer to neutral now. I’ve been taking chips off the table, just taking duration off across the curve.”

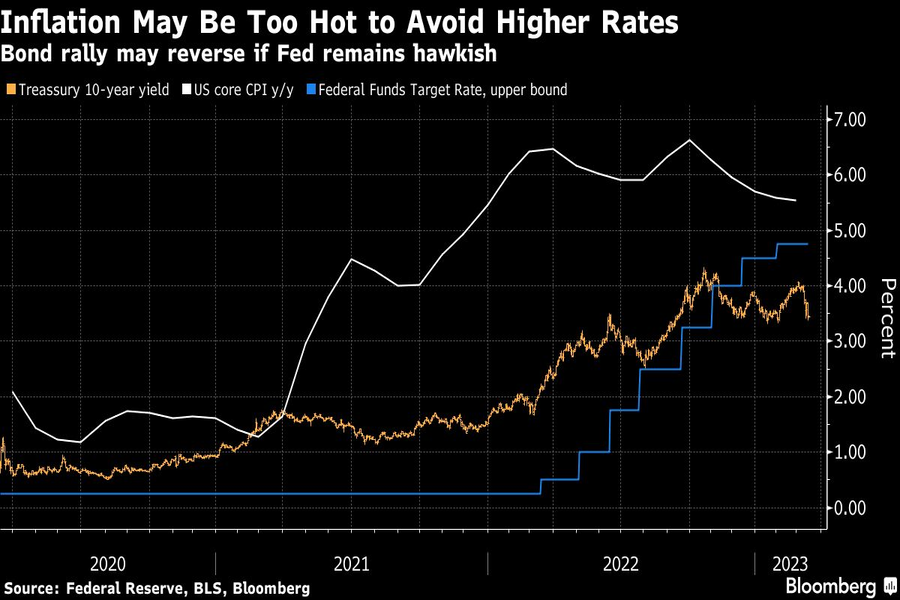

Two-year Treasury yields have plummeted over 60 basis points this week, leading some investors to question if the rally has overshot fundamentals. A report on Tuesday showing that U.S. inflation remains elevated underscores the risk for traders who are betting that the Fed will pause at its March 22 decision.

“We think the Fed isn’t done and we continue to look for another 25-basis point hike next week, and a final hike in May,” JPMorgan analysts led by Jay Barry wrote in a note to clients. “We suggest taking profits on the remaining portion of a long five-year note trade from 4.21% entry at the market.”

Some of the world’s top money managers said this week they’re holding onto large profits after the collapse of Silicon Valley Bank roiled markets. Turmoil at Credit Suisse Group AG has added fuel to the rally in bonds even as CEO Ulrich Koerner said the bank’s financial position is sound.

The U.S. five-year yield rose four basis points to 3.6% on Thursday, down from 4.35% on March 8 after Fed Chair Jerome Powell signaled he was open to the possibility of hiking rates by half a point this month. Two-year yields climbed seven basis points to 3.96%, still a long way down from the 5.08% they touched last week.

TD Securities closed a 10-year Treasuries trade initiated in February when the yield was at 3.77%, after the rate dropped through 3.46% this week, according to a note. The bank had expected yields to decline because of the likelihood of a recession in the U.S.

“The events over the last week will likely move the timing earlier and make the severity of the recession worse,” strategists led by Priya Misra wrote in the note. “However, inflation is still high and we think that the Fed will likely hike next week or at least commit to more hikes down the road.”

Silicon Valley Bank rescue won’t bring down bond market

Learn more about reprints and licensing for this article.