TD Ameritrade assets up, profits down

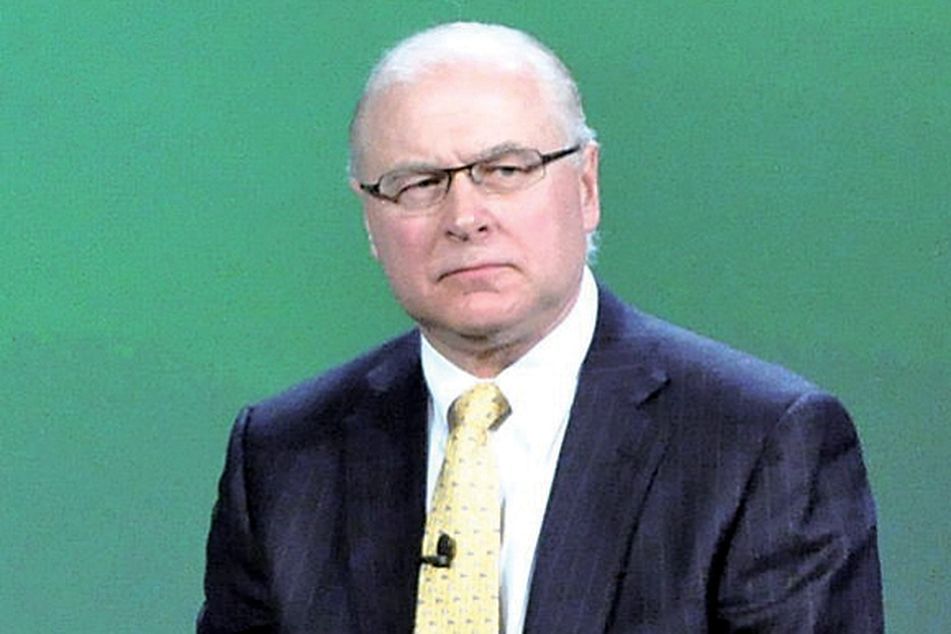

TD Ameritrade Holding Corp. saw its client assets rise to a record level, but its profits still fell in the latest quarter. (CEO Fred Tomczyk, pictured above.)

TD Ameritrade Holding Corp. came up short of profit estimates in its fiscal fourth quarter ended September as trading revenue slowed.

But the firm said that despite the tough environment, it held record client assets of about $355 billion, helped by a gain of $6 billion in net new assets for the quarter — and a record $34 billion for the full fiscal year, the company said in an earnings release today.

The full-year asset gain was “at the high end of our target,” TD Ameritrade CEO Fred Tomczyk said in an interview with InvestmentNews.

The 4,300 independent advisers who custody at TD Ameritrade Institutional account for about one-third of the company’s total assets, or roughly $120 billion.

The firm does not report adviser assets separately.

Both the retail-investor business and the adviser custody unit had “strong years” in asset gathering, Mr. Tomczyk said, but slower trading activity hurt profits overall.

Net income fell 27 percent to $114 million, or 20 cents a share, during the fourth quarter, compared with $156.7 million, or 26 cents, a year earlier. Analysts were expecting a 23-cent average, according to Bloomberg News.

TD Ameritrade is forecasting a 2011 profit of 90 cents to $1.20 a share, versus an average projection of $1.14, according to Bloomberg News.

Mr. Tomczyk said the adviser side of the business was a “bit more robust” in terms of trading volume.

Active traders on the individual-investor side of the business have also remained in the market, he said, but “the long-term [retail] investor … has been much more in cash and bond funds.”

Reporting by Bloomberg News was used to supplement this report.

Learn more about reprints and licensing for this article.