Hedge fund insider spills the beans: You’re better off with Treasuries

Over the hedgies?

Over the hedgies?

His research shows returns have dipped substantially since the 1990s; compensation eating into payouts

If the tailor who whipped up the emperor’s new clothes were around today, there’s a good chance he’d be a hedge fund manager. In what other job could an ambitious person with average abilities make so much money and produce so little?

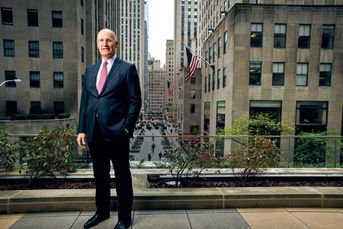

It’s not that the fund managers are overtly out to trick anyone, and many are quite talented, says Simon Lack, a former hedge fund executive at JPMorgan Chase & Co. and author of the just-published “Hedge Fund Mirage” (John Wiley & Sons, 2012). But Mr. Lack’s research finds that investors would have done twice as well with boring Treasuries over the past decade than being in the high-status, hard-to-research investments they find so captivating.

In fact, Mr. Lack, who now runs SL Advisors in Westfield, N.J., says the reason for hedge fund managers’ exalted, albeit unwarranted, status in the investment pantheon lies more with investors — swooning high-net-worth individuals as well as supposedly sophisticated pension funds and other “smart-money” institutions — than with the managers. The cachet that investors have bestowed upon hedge funds has allowed managers to get away with a level of opacity and mediocrity that other money managers and advisers can only dream about.

“Nobody in the hedge fund business has disputed my point about poor performance,” said Mr. Lack, who delved into hedge funds’ actual returns and found that they shrank as the industry’s asset base grew.

The industry’s best years were in the 1990s, said Mr. Lack, when hedge funds were tiny.

“Then the money started flowing in and returns got progressively worse,” he said.

Today, hedge funds sit on $2 trillion in assets.

“Institutions say their goal when investing in hedge funds is an annual return of 7%, which means that the industry would have to generate $140 billion a year in returns. That would exceed anything they have ever produced,” Mr. Lack said, noting that the hedge fund business is simply experiencing the same mean-reversion return pattern that has occurred in virtually all areas of investing.

He points out that most of the returns of the immensely profitable hedge fund business have gone to — dramatic pause for effect — the hedge fund managers themselves. While “2 and 20” (a flat 2% fee on assets and 20% of profits) has become enshrined as the industry’s compensation scheme, Mr. Lack believes it will have to come down if hedge funds ever are to deliver returns commensurate with the risk investors assume.

For advisers, Mr. Lack says his findings can provide a thoughtful rebuttal to a client who is clamoring to one-up a country club buddy.

“Overall, results are poor, but there are superior hedge fund managers out there,” Mr. Lack told me.

He believes that advisers shouldn’t treat hedge funds like an asset class.

“They should do what they did in the old days — be selective about the few managers they choose, look for consistent top-performers who can deliver absolute returns, and negotiate fees.”

Learn more about reprints and licensing for this article.