Wall Street, advisory firms funneling big bucks to Romney

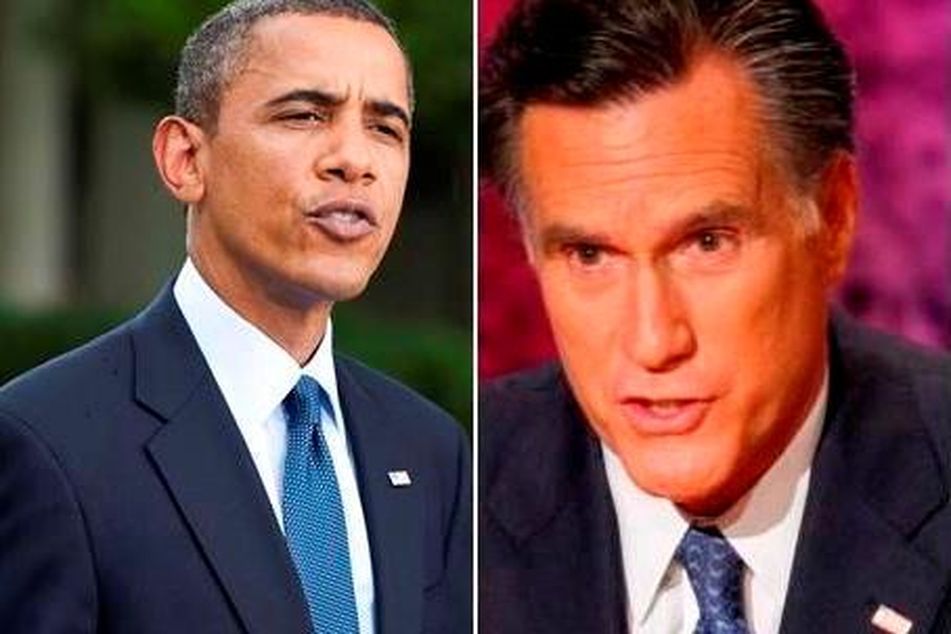

President Obama, Governor Romney: PAC men

President Obama, Governor Romney: PAC men

Both presidential candidates are getting serious bucks from political action committees. Barack Obama's top donors? Universities. Mitt Romney's? Wall Street banks.

If Republican presidential candidate Mitt Romney answers a question about the Dodd-Frank financial reform law during tonight’s debate with President Barack Obama, he’s sure to get the attention of his biggest donors.

That’s because they’re all Wall Street firms , according to the Center for Responsive Politics.

The Goldman Sachs Group Inc. ($891,140), Bank of America Corp. ($668,139) JPMorgan Chase & Co. ($663,219), Morgan Stanley ($649,847), Credit Suisse Group AG ($554,066), Citigroup Inc. ($418,263), Wells Fargo & Co. ($414,750) and Barclays PLC ($403,800) are Mr. Romney’s most generous supporters.

The firms themselves cannot donate directly to Mr. Romney’s campaign. Rather, donations come from the companies’ employees and political action committees.

Mr. Obama has only one financial firm among his top 20 donors — Wells Fargo ($202,216). Mr. Obama’s biggest contributors are the University of California ($706,931), Microsoft Corp. ($544,445), Google Inc. ($526,009), Harvard University ($433,860) and U.S. government employees ($389,100).

The investment advice sector also favors Mr. Romney heavily when voting with its wallet. Employees of the top 10 registered investment advisory firms and the top 10 broker-dealers have given $199,747 to Mr. Romney during the 2012 campaign cycle, according to Federal Election Commission data analyzed by InvestmentNews. Employees of those firms have given just $93,453 to Mr. Obama.

Mr. Obama was more popular in the advice sector four years ago, when measured by campaign donations. During the 2008 campaign, he received $142,610 from advisory firms, while his GOP opponent, Sen. John McCain, R-Ariz., received $70,759.

The top 10 RIAs by assets under management, according to the InvestmentNews Data Center, include Financial Engines Advisors LLC, Hall Capital Partners LLC, Silvercrest Asset Management Group LLC, Chevy Chase Trust Co., Oxford Financial Group Ltd., SCS Capital Management LLC, Comprehensive Financial Management LLC, Rockefeller Financial, Tag Associates LLC and Aspiriant LLC.

The top 10 B-Ds by assets under management, according to the InvestmentNews Data Center, are LPL Financial LLC, Ameriprise Financial Services Inc., Raymond James Financial Services Inc., Lincoln Financial Network, Commonwealth Financial Network, Axa Advisors LLC, MetLife Securities Inc., Wells Fargo Advisors Financial Network, Northwestern Mutual and Securities America Inc.

Learn more about reprints and licensing for this article.