The race to embrace fintech

Independent advisory firms that have long embraced the advantages and advancements in technology are realizing a smoother transition to various forms of virtual communication

There’s nothing quite like a global pandemic that forces entire industries into virtual workspace mode to drive home the value of being up to speed when it comes to technology.

In the financial services space, independent advisory firms that have long embraced the advantages and advancements in technology are realizing a smoother transition to various forms of working from home and virtual communication with clients.

“At least a third of my clients aren’t based near me in L.A., so I was already doing a lot of things online, but now that we’re using screen sharing for clients who are a block away, we’re finding that some of them would probably prefer an online meeting or a Zoom call over a visit to the office,” said David Rae, president and founder of DRM Wealth Management. The registered investment adviser is identified in a new InvestmentNews Research report as a top performer, meaning it ranked in the top quartile in terms of profit margins and productivity.

A survey of 269 independent investment advisers, conducted from February through mid-March, found that top performers are more likely than other firms to embrace software solutions, especially core systems, including CRM, financial planning and account aggregation.

For example, InvestmentNews Research found that 97% of top performers use customer relationship management software, versus 87% of other firms.

When it comes to portfolio rebalancing, 68% of top performers rely on software solutions, compared to 58% of other firms.

In terms of compliance software, the disparity is 44% to 39%. And for financial planning solutions software, the adoption rate among top performers is 84%, compared to 82% for all others.

“You are clearly gaining an advantage by embracing technology, and if you don’t believe that, just look at our current state of affairs,” said David Berman, chief executive of Baltimore-based Berman McAleer.

Berman, whose firm is about as virtual and cloud-based as it gets even in normal times, insists it is not about automating client interactions.

“We are very technology dependent, but we use it to enable us to be more efficient at being hands-on and personal with clients; we’re not trying to use technology to automate the process as it relates to clients,” he said. “Anything that touches the client, we go the opposite direction of technology, and we are downright old-fashioned to the point where you would think we are technophobes.”

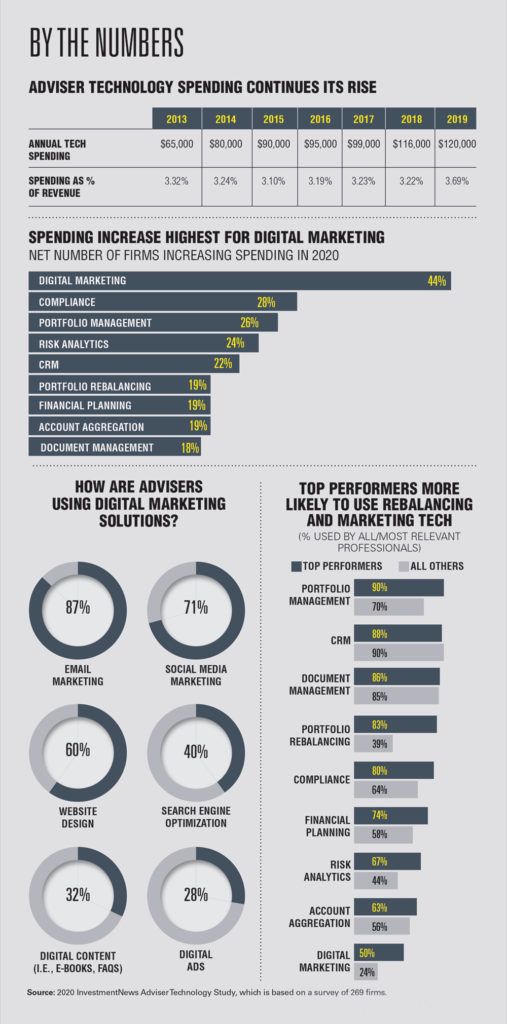

According to InvestmentNews Research, technology spending per independent advisory firm averaged just over $120,000 last year, up 15.8% from 2018.

While the average tech spend as a percentage of revenue came in at 3.7% after six years of hovering around 3.2%, the dollar amount increase has been moving at a steady clip because the stock market has been driving up assets under management and revenues.

“You have to keep in mind that revenues in the independent space have grown double digits most years over the past decade, and the fact that spending on technology has been able to keep up with revenues is impressive,” said James Gallardo, senior research analyst at InvestmentNews.

Of the $120,309 average annual technology spending last year, $66,547, or more than half, was spent on software.

That’s up from $66,400 in 2018, but the trend of software making up the bulk of tech spending is a normal pattern, Gallardo said. “That’s where the innovation is in every industry, and it makes sense the dollars are flowing where innovation is,” he said.

CONSULTING SERVICES GROW

After software, the next largest piece of the tech budget has consistently been consulting services, which came in at more than $21,000 last year. That figure is expected to continue growing as more firms rely on cloud-based services, Gallardo said.

Across the technology stack at most firms, customer relationship management is by far the most developed, with 90% of firms embracing some type of CRM software, followed by financial planning at 83%, and portfolio management by 75% of firms.

USAGE GAP

But the gap in usage is exposed when looking at the adoption of software for digital marketing, compliance and risk analytics.

While 39% of firms are currently using software for risk analytics, the percentage is down from 50% last year.

The use of compliance software has been hovering around 40% for the past three years.

The use of digital marketing software was not included in the annual survey prior to last year, but this year 40% of firms are using it, up from 32% last year.

Digital marketing is a broad area that could include social media, email, website design, search engine optimization, digital content or digital advertising.

As a general software solution, digital marketing ranked as the area on which advisory firms are most intent on increasing spending in the year ahead. Of the nine software categories listed in the survey, 49% of advisers said they plan to increase spending on digital marketing this year.

The next closest categories for increasing software solution spending were compliance, at 30% of respondents, and portfolio management at 29%.

While digital marketing is a wide-open concept, it is also an area advisers should be leveraging, said Dani Fava, director of product strategy and development at TD Ameritrade Institutional.

“Digital marketing is a huge opportunity and the top performers are just starting to figure that out,” she said. “That’s where we will see more adoption, because a lot more fintech firms are launching content marketing and content creation. Advisers need to be connecting with clients and creating content so their clients understand what’s happening and what’s changing.”

LACK OF FINTECH ADOPTION

But even as digital marketing is a leading focus and an area that most advisers can get their heads around, the general lack of fintech adoption across the independent advisory firm landscape is concerning, Fava said.

“TD for years has been trying to convince advisers to embrace technology to automate anything that can be automated,” she said.

While nobody could have predicted the full impact of the COVID-19 pandemic on virtually all aspects of personal and professional lives, Fava said, “An adviser who has not embraced technology and has not experimented with various technologies over the past couple of years has likely had a harder time with this transition.”

Theories on why some independent RIAs are slower to embrace fintech abound, but Fava doesn’t believe it has to do with the costs.

“RIAs are fiercely independent and I really believe they think their value-add in some areas cannot be automated,” she said. “There are a lot of advisers still doing rebalancing on spreadsheets, and if you talk to those advisers, they really believe they’re adding value; they believe if they automated they would be just like everyone else.”

When it comes to such reluctant advisers, Berman agrees that it would be a mistake to leverage technology for “depersonalized scale, which is the ultimate example of a robo-platform.”

But there is a balance between the two extremes, he said.

“You could rebalance manually, and that’s all well and good until you’re thrown into a situation where you have to do it laser quick,” Berman said. “It used to take us a couple of weeks to rebalance all our portfolios, but if it took you even a week now, just think about what would happen in the times we’re in today.”

HIGH TECH VS. HIGH TOUCH

Reginald Armstrong, president of Armstrong Wealth Management Group in Florence, S.C., believes in leveraging fintech to the point where it makes business more efficient, but not beyond that point.

“One of our core values is to leverage technology, but high tech should never be at the expense of high touch,” he said.

Meanwhile, being based in “hurricane country,” Armstrong said ensuring that “everything is virtual is not an option for us.”

Even though he admits some early reluctance and ongoing concerns about cybersecurity when “the server is up in the cloud,” he has come to realize that “the server was probably more vulnerable sitting there in the office where someone could just break in and haul it off.”

And while most non-robo advisory firms are probably not spending a lot of time trying to recruit younger clients who might not have a lot of money to manage, technology does open the doors to the future both in terms of clients and employees.

“I think there’s a high correlation between average client age and tech spending at the firm,” said Josh Brown, chief executive at Ritholtz Wealth Management.

“There’s an adviser mindset at some places where they say, ‘My clients are older people and they’re not looking for more things to login to or forget their passwords for,’” Brown said. “That’s valid, however, if you’re building a new firm and onboarding new clients on a regular basis, tech upgrades are not optional. They should be built into the business plans and the expectation should be a rising tech budget every year.”

‘GOLDEN AGE OF DELIVERING ADVICE’

Bill Finnegan, financial services managing director at fintech firm Seismic, believes a “silver lining of the pandemic” is that this will be “the golden age of delivering advice in multiple media.”

“Financial advisers have got the portfolio management stuff down and they’re doing the CRM stuff, but I think they’re generally weak in digital client engagement, and that’s where the industry is coming of age,” Finnegan said. “I totally believe in the value of personal relationships and handshakes, but for those RIAs not delivering a digital experience, it will be harder for them to recruit employees and clients, because you’re not going to be able to get the next generation with a Morningstar fact sheet and a sandwich.”

Learn more about reprints and licensing for this article.