| A new study by Equitable and InvestmentNews Research |

Introduction: Financial Planning Is Far More Than Finance

As the profession continues to evolve, the title of financial advisor is due for a figurative rewrite. Increasingly, as advice becomes more holistic, life planner or life whisperer may be more apt. The changing nature of advice is particularly true today, as a pandemic has added to the breadth and depth of conversations advisors have with their clients.

As the COVID-19 pandemic reshapes every facet of daily life, it has pulled forward a transition already

underway in the financial advice industry: Advisor-client relationships are becoming more involved,

stretching far beyond the scope of a basic investment and financial plan.

The virus’ threat has likely forced everyone to reflect on their own mortality and vulnerability. Advisors have

had to have very real conversations about the “what ifs” no client wants to consider or openly dwell on.

The pandemic has also brought other considerations to the forefront. Advisors are checking in with clients

about their emotional well-being and discussing the livelihood of their clients’ small businesses. For clients

in their 20s or early 30s, the current market environment is likely their first taste of portfolio volatility, and

advisors are interacting to make sure behavioral instincts don’t get the best of these investors.

While events since February magnified how the advisor-client relationship is changing, longer-term

trends were already making financial advice more holistic. As clients live longer, healthier lives, financial

services firms must consider bringing to bear a broader array of experience and focus to help provide the

comprehensive planning that families demand.

As the range of conversations broadens, so, too, are the family members involved in those discussions.

Many advisors are making a concerted effort to ensure both spouses participate in planning

conversations, and that children are involved in the planning process.

To many seasoned advisors, these issues are nothing new. The most successful professionals

understand that successful, long-term client relationships often do extend beyond discussion of financial

matters alone. Even so, advisors recognize there is more work to be done.

In a new study, InvestmentNews Research and Equitable surveyed advisors to find the changes clients

are asking for and how professionals are making their services and advice more comprehensive. Among

other issues, the research explores:

• The holistic planning topics advisors discuss most and the issues they expect to talk more

about in the future;

• Changes in client needs and the topics that resonate most with male and female clients;

• The different rates at which male and female advisors broach these life-planning discussions;

• The avenues advisors are taking to open dialogue with both spouses or a client’s children.

Advisors can use this study to see where the industry is headed and what their clients seem likely to

expect in the future. We hope these findings get more advisors to embrace the difficult conversations

they need to have, and that it will help professionals deepen their client relationships. The strength of

those bonds has never been more important. To find out why this is an important industry topic for Equitable, please read the following message from their president, Nick Lane.

The Evolving Client Relationship – From Money Manager to Life Manager

While the bond between every advisor and client is unique, the industry is in near full agreement that the nature of those relationships is changing. In short, conversations are getting deeper, and the advisor’s role is getting broader.

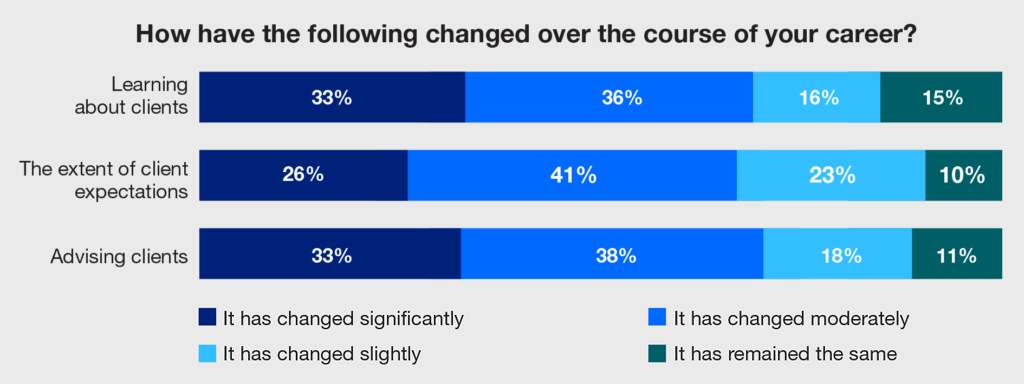

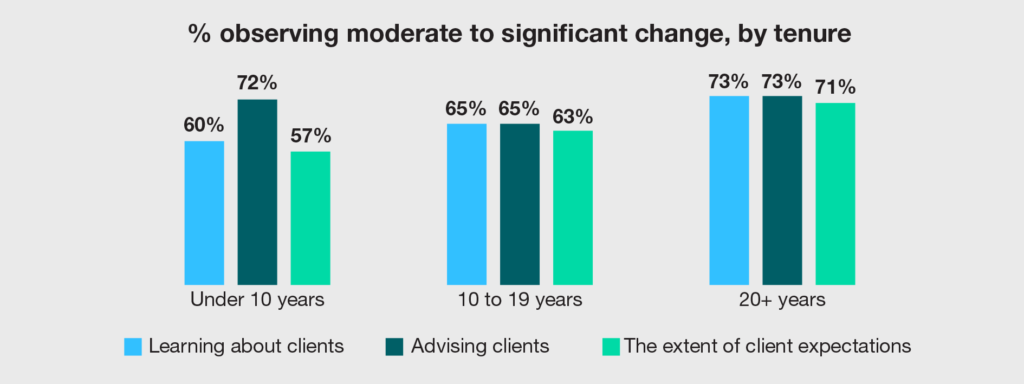

According to the majority of advisors surveyed, client expectations, what advisors learn about their clients and the very nature of working with those clients have all changed significantly during their careers (see charts below). Notably, this is not just the perspective of seasoned advisors who have had more time to develop relationships. Even the majority of advisors with less than 10 years of experience have undergone a great deal of change in their practices, suggesting that the evolution of service and, as applicable, advice is ongoing.

While the bond between every advisor and client is unique, the industry is in near full agreement that the nature of those relationships is changing.

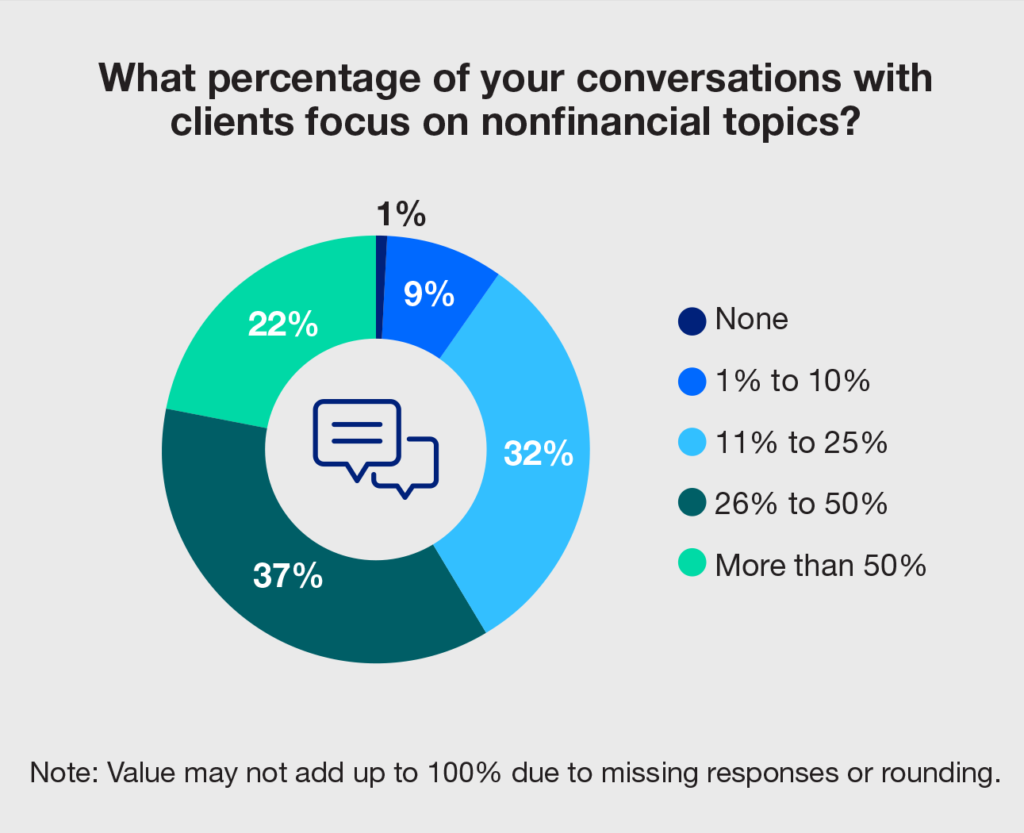

The pie chart right paints a picture of how advisor-client relationships are changing. In short, more and more conversations stray from financial and investment topics toward other aspects of clients’ lives. Notably, both newer and longer-tenured advisors noted they were having a lot of conversations beyond finance, implying that having broader conversations isn’t simply a byproduct of knowing a client longer, but an expectation that advisors should get to know their clients better.

While the chart shows advisors are having many nonfinancial conversations, the rate of those other conversations is not standard. For 42% of advisors, only a quarter or less of conversations cover these broader issues. But more than a fifth of advisors surveyed said nonfinancial topics dominate at least half of their client conversations. The wide variation suggests that increased dialogue about broader life issues could be a competitive differentiator for advisors.

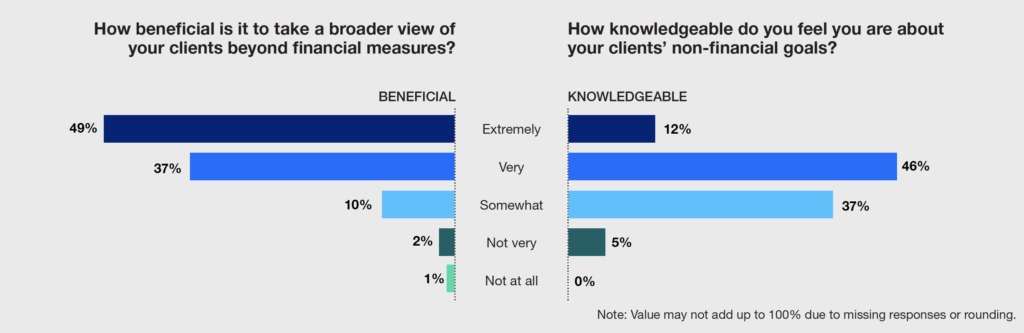

Our research also reveals that although advisors acknowledge that clients desire more holistic life planning, many professionals struggle to get their head around all these issues. As the charts below show, 86% of advisors said they believe a broader view of their clients that transcends traditional financial measures is “extremely” or “very” beneficial; yet only 58% said they are “extremely” or “very” knowledgeable about their clients’ nonfinancial goals.

Holistic Planning: Who Demands It, and What Do They Want?

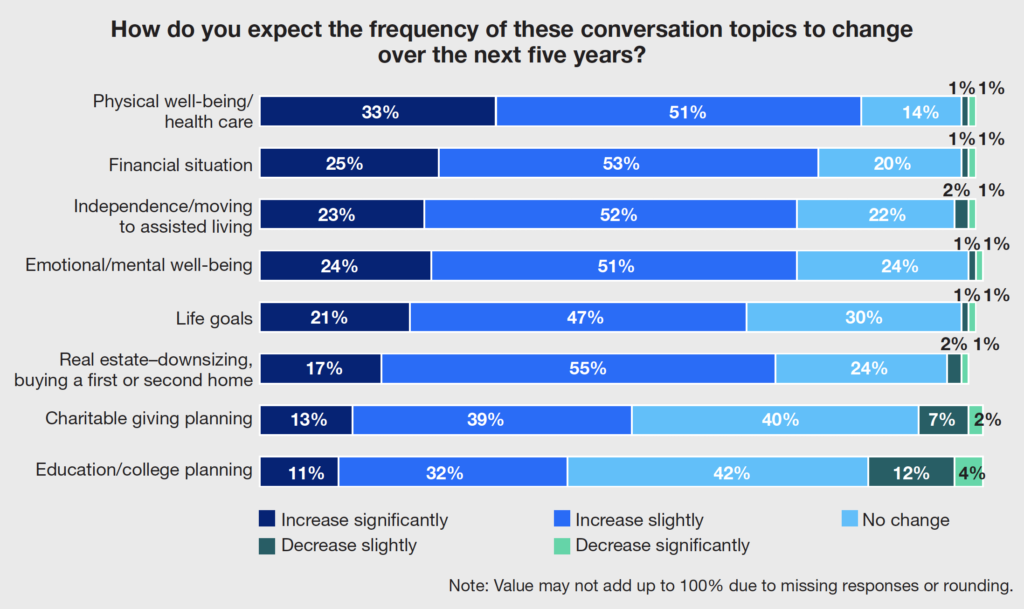

As clients demand that the financial planning process encompass more issues, advisors surveyed said they expect to discuss all topics under the “holistic” umbrella more frequently over the next five years. (See chart below.) But they said they expect the largest increase in conversations to be around health care and physical well-being. Most advisors also said they expect a meaningful uptick in conversations about their clients’ financial situations – which are inevitably affected by all the new issues advisors are planning for – and about clients’ ability to live independently and their emotional and mental well-being.

Female Clients Want Broader Conversations, and Female Advisors Are

Discussing Those Topics More Often

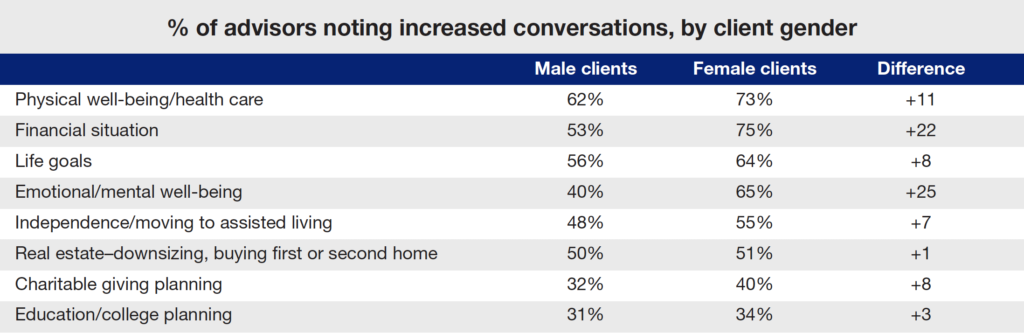

Our research uncovered differences in how often advisors discuss various holistic planning issues with male and female clients. Perhaps more important for the industry, the research also suggests that female advisors are engaging female clients about these issues more often than male advisors are.

For every topic advisors were asked about, survey participants noted that conversations were increasing more with female clients than with male clients. The differences were most pronounced in three areas: the client’s emotional well-being, financial situation and physical well-being/health care.

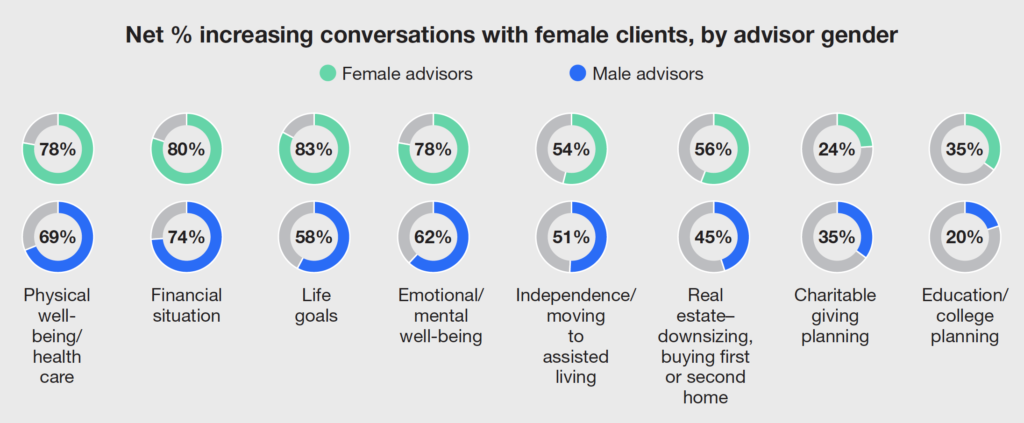

In addition, female advisors appear to be broaching these subjects with women clients more often than male advisors. The next chart shows the percentage of male and female advisors who noted an increasing number of conversations with their female clients about various holistic planning topics. Charitable giving was the only area in which male advisors noted a higher increase in conversations than female advisors. Meanwhile, far more female advisors surveyed noted an increase in conversations around life goals and emotional/mental well-being.

Our survey also asked male and female advisors whether they were having more conversations with male clients about these same issues. Although conversations with male clients increased across the board, the increase was less significant than those with female clients, and the gender of the advisor was not a meaningful predictor of the level of engagement with male clients.

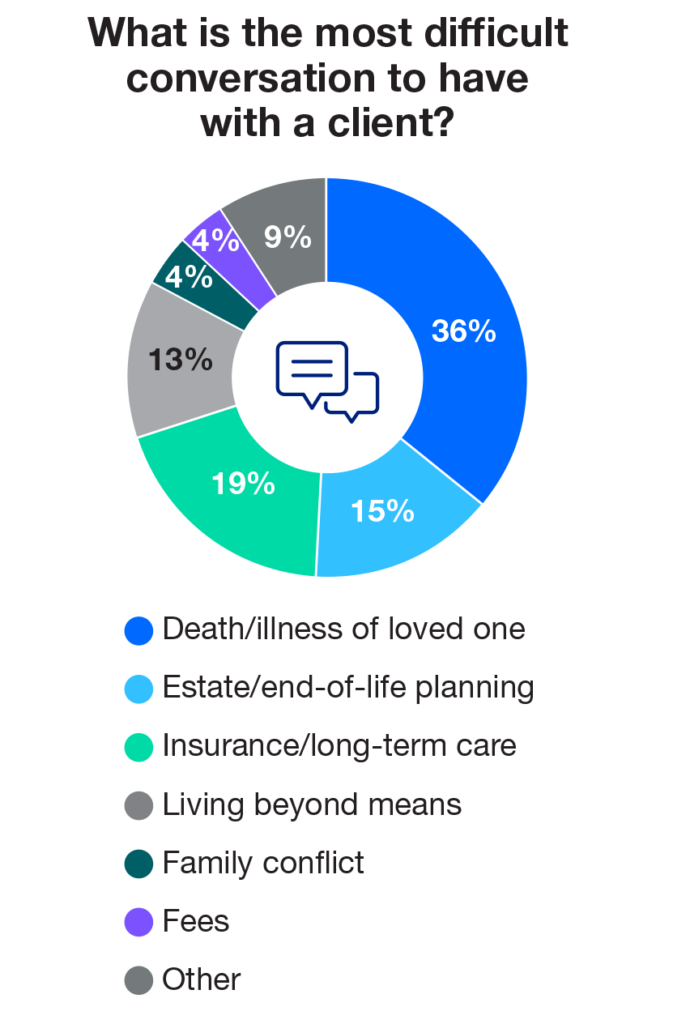

| Leaning In: Advisors Are Having Some Tough Conversations A natural byproduct of covering more topics with clients is that advisors are having to work through some really difficult conversations. Increasingly, advisors are expected to get the family together to talk about the tough issues many people would rather avoid. |

Who Demands Holistic Planning Most?

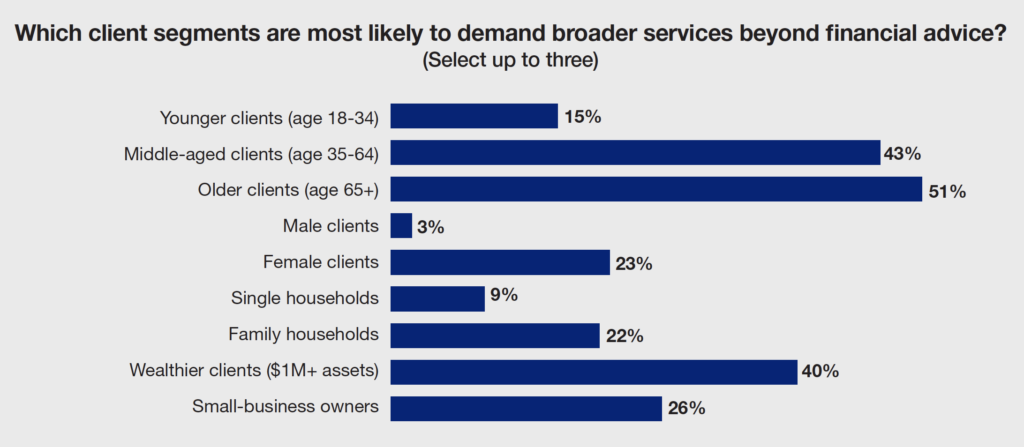

When it comes to holistic planning, demand is concentrated among a few client groups. When asked to identify the three client segments that demand broader planning services, 23% of advisors surveyed included females in that selection, while only 3% selected males. That translates to females being 9.1 times more likely to demand broader services than their male counterparts.

Older, middle-aged and wealthier clients were also more likely than other client segments to demand broader services. Those results were less surprising, however, given the more intricate planning required for someone who has accumulated more assets or an older client who must navigate the complexities of retirement, health, children and possibly grandchildren.

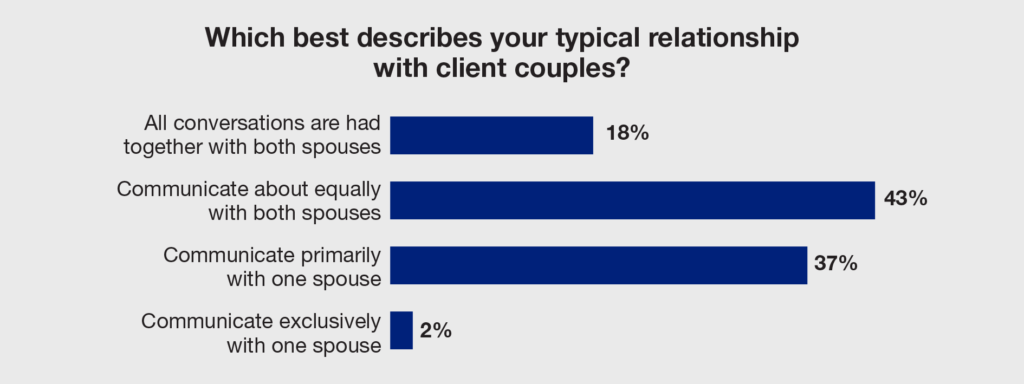

Engaging the Entire Family

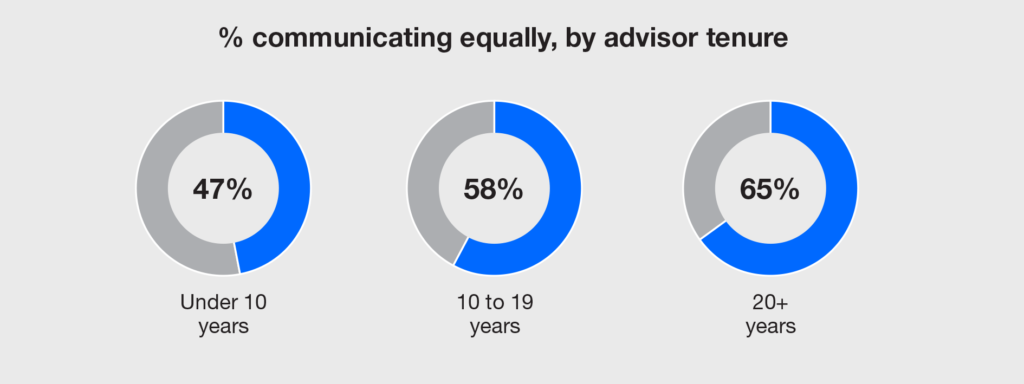

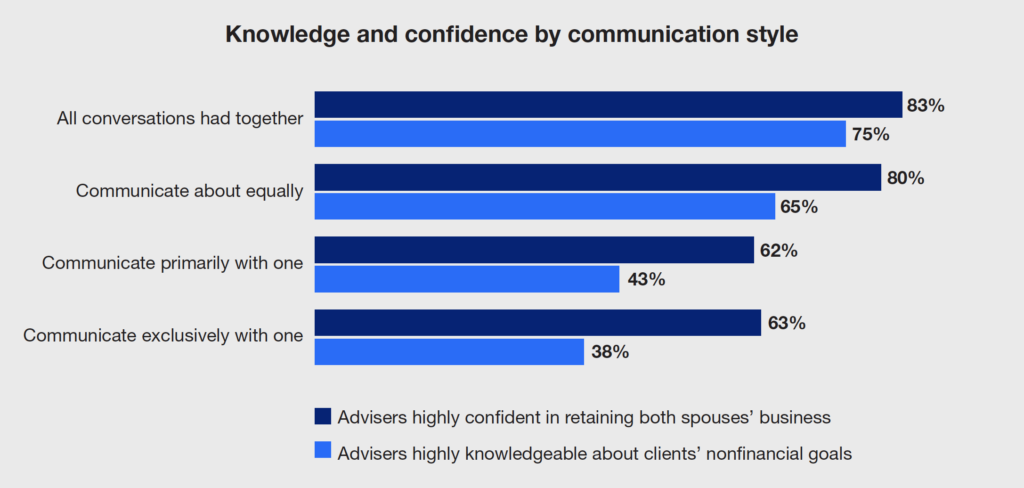

Holistic life planning entails more than adding details and topics to a client’s life plan. It also means including more family members in the conversation. This is an area where advisors could do more. When working with married couples, nearly 40% of all advisors surveyed said they communicate predominantly with one spouse. Longer-tenured advisors said they tend to include both partners more often; 65% of advisors with 20 or more years of experience communicate equally with both spouses, compared with just 47% of advisors with under 10 years of experience.

Those who communicate with both spouses may also be creating a more lasting client relationship. Advisors who said they communicate equally with both partners expressed higher confidence in their ability to maintain a relationship following a client’s divorce or death of a spouse. They also said they feel more knowledgeable about their clients’ nonfinancial goals.

Working With Children

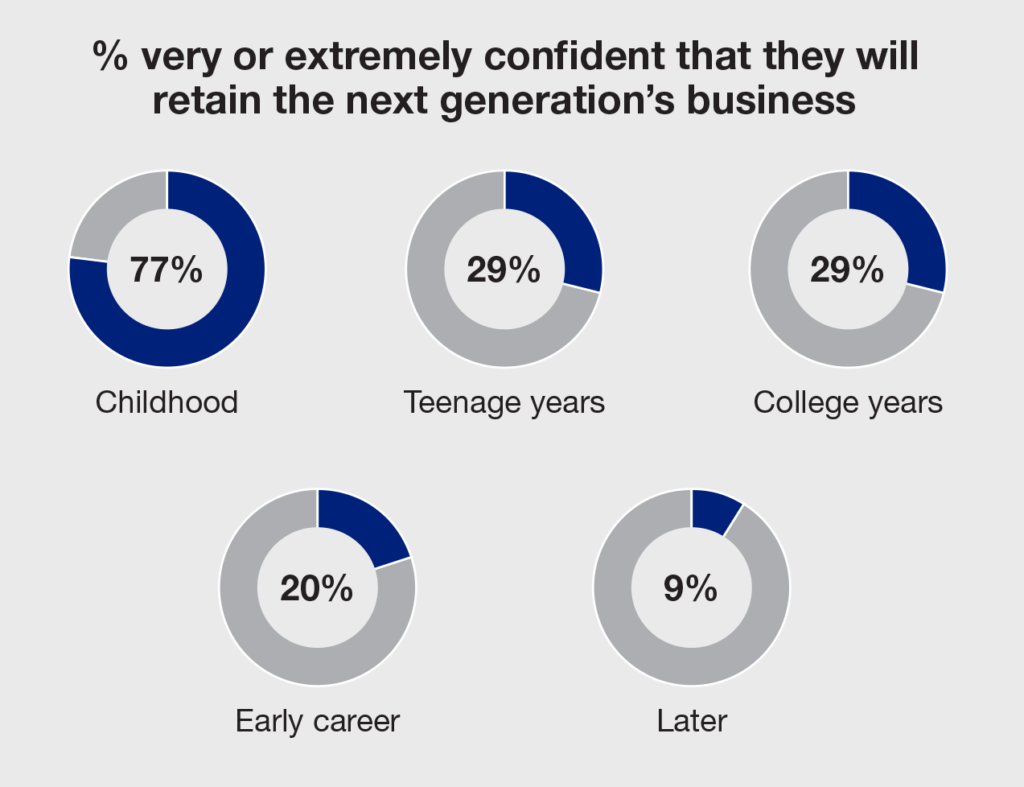

Advisors also reported increased interaction with clients’ children, but many said they are uncertain those efforts will result in retaining the next generation’s business. Sixty-three percent of advisors surveyed claimed their contact with clients’ children has risen in recent years, yet only a quarter said they are highly confident they will assist that next generation in managing its wealth.

Engaging children at a younger age could make the difference. Seventy-seven percent of advisors who said they work with a client’s children before their teenage years expressed a high level of confidence that they will retain the children’s business. That percentage dropped to 29% for advisors who don’t work with children until their college years, and just 20% among advisors who engage with the next generation early in their working years.

Working With Children

Advisors also reported increased interaction with clients’ children, but many said they are uncertain those efforts will result in retaining the next generation’s business. Sixty-three percent of advisors surveyed claimed their contact with clients’ children has risen in recent years, yet only a quarter said they are highly confident they will assist that next generation in managing its wealth.

Engaging children at a younger age could make the difference. Seventy-seven percent of advisors who said they work with a client’s children before their teenage years expressed a high level of confidence that they will retain the children’s business. That percentage dropped to 29% for advisors who don’t work with children until their college years, and just 20% among advisors who engage with the next generation early in their working years.

Conclusion: Key Research Findings and Takeaways

Holistic planning is not going away. Events of the past few months have likely inserted the advisor into a host of additional conversations around life-planning topics. At the same time, more family members have likely been pulled into these conversations.

Advisors should embrace these changes as opportunities to deepen their client relationships. It’s likely that the most successful advisors are already providing holistic in their services and advice, but for many professionals, planning could still be more comprehensive. For those striving to make their practices more holistic, the following key research findings and takeaways can help.

Key Finding: Our survey revealed that for 42% of advisors, only a quarter or fewer of their conversations cover nonfinancial issues. On the other end of the spectrum, more than 20% of advisors said broader life topics make up at least half of their client conversations.

The Takeaway: The wide variation in the frequency of these conversations suggests that having more discussions about broad life issues could be a competitive differentiator. As such, advisors should make a point of engaging clients on holistic topics and determining how often the client wants to cover such issues.

Key Finding: Even though advisors see the benefit in holistic planning, only 58% of those surveyed said they feel very or extremely knowledgeable about their clients’ nonfinancial goals.

The Takeaway: Advisors need to equip themselves with the right tools and team to make sure holistic life planning conversations take place. If conversations don’t occur naturally with clients, advisors should consider using a checklist or discussion guide to make sure they do. Advisors can also benefit from documenting their clients’ personal interests and life goals.

Advisors will also need to educate themselves in areas where they have knowledge gaps. But that doesn’t mean they have to become an expert in everything. Advisors can work with their clients’ other centers of influence (i.e., accountants, attorneys, specialty attorneys, estate planners, and doctors) and play the role of quarterback to connect clients with the holistic support they need.

Key Finding: Our survey found that although discussions about nonfinancial topics are up among all clients, they are up significantly more among female clients, suggesting women may tend to place more importance on these issues.

The Takeaway: Holistic life-planning conversations can go a long way toward deepening relationships with female clients. As women continue to generally outlive men, it is essential that advisors establish connections with both partners in a relationship. Increased discussion of holistic issues – particularly health care costs, emotional or physical well-being, and life goals – could go a long way toward extending trust.

Key Finding: Female advisors in our survey were much more likely than male advisors to note having increased conversations with female clients about issues such as emotional/mental well-being, life goals and physical well-being. The research did not find a similar link between male advisors and male clients.

The Takeaway: Male advisors need to be more attentive to holistic life planning with female clients.

Key Finding: Conversations about health care expenses and long-term care expenses are the two areas advisors said they expect to increase the most over the next five years.

The Takeaway: Advisors looking to make their practices more holistic should start by devoting more resources toward health care and long-term care planning. There are several ways advisors can add value around these issues. They include:

• Using firm-approved material to show clients an estimate of their health care and/or long-term care costs later in life and explaining how they arrived at those estimates

• Establishing relationships with long-term care facilities in a local community so the advisor can help clients navigate the long-term landscape when needed

• Hosting client events that feature wellness experts

• Providing internal thought leadership around health care planning and leading healthier lifestyles

Key Finding: Only a quarter of surveyed advisors said they feel confident about continuing to manage a family’s wealth when it passes to the next generation. This is likely because most advisors are late to engage the next generation. Only 4% of advisors said they engage that next generation during their childhood years, and only 19% said they communicate with the next generation during their teenage years. Those who do engage the next generation as children express much higher confidence in retaining those children as future clients.

The Takeaway: Advisors must start engaging clients’ children at an earlier age. Holding on-site financial education classes for young children and working directly with high schoolers to help plan for college costs provide avenues for an advisor to get to know their clients’ children earlier.

START THE TOUGH CONVERSATIONS EARLY

In conclusion, clients are looking to advisors to prepare them for the toughest situations in life. Embrace that responsibility and engage clients early about long-term care planning and end-of-life issues before these issues are thrust upon them. Such conversations are typically easier and more productive before a life-changing event occurs.

Please visit equitable.com for more information.

IMPORTANT

For purposes of this discussion, “advisor” is used as a general term to describe insurance/annuity, investment sales, and advisory professionals who may hold licensing as insurance agents, registrations with broker-dealers, and registrations as investment advisory representatives (IAR) of registered investment advisors, respectively. “Advisor” in this context is not intended to necessarily refer to IAR-offered fee-based financial advisory/planning services.

Equitable is the brand name of the retirement and protection subsidiaries of Equitable Holdings, Inc., including Equitable Financial Life Insurance Company (NY, NY), Equitable Financial Life Insurance Company of America, an AZ stock company with main administrative headquarters in Jersey City, NJ, and Equitable Distributors, LLC. Equitable Advisors is the brand name of Equitable Advisors, LLC (member FINRA, SIPC) (Equitable Financial Advisors in MI and TN).

ABOUT THIS RESEARCH

This InvestmentNews research study was fielded from January 9, 2020 – January 23, 2020. The online survey was distributed via Qualtrics survey software to a contact list of 100,000+ advisers. The resulting data was collected, checked and analyzed by the InvestmentNews Research team. In total, 360 advisers participated in the survey. Reflecting the InvestmentNews audience, independent advisers comprise a majority of the sample. The results are accurate at the 95% confidence level, with a margin of error of +/- 5%.

The mission of InvestmentNews Research is to provide advisory firms with the industry’s most comprehensive and informative practice management resources, benchmarking reports and targeted research studies. Our benchmarking studies and tools are a leading source of strategic intelligence for the industry’s top advisory firms, custodians, broker-dealers, consultants and professional organizations. InvestmentNews Research is a dedicated business unit of InvestmentNews, which officially launched in 2009 with the acquisition of the former Moss Adams benchmarking studies. The business now offers, in addition to the legacy benchmarking studies, a subscription-based research dashboard, custom research services, dedicated research webcasts, national and regional workshops and in-person presentations.

For more information about InvestmentNews’ benchmarking and custom research, please contact James Gallardo at [email protected].

Equitable, a subsidiary of Equitable Holdings (NYSE: EQH), has been one of America’s leading financial services providers since 1859. With the mission to help clients secure their financial well-being, the company provides advice, protection and retirement strategies to individuals, families and small businesses. Equitable has more than 8,000 employees and Equitable Advisors Financial Professionals and serves 2.8 million clients across the country.