Fidelity, Vanguard join forces to help workers move 401(k)s

The two retirement giants, along with Alight Solutions, are forming a consortium to automate the transfer of 401(k) accounts with balances below $5,000 when workers change jobs.

Fidelity Investments and Vanguard announced a rare collaborative effort Wednesday to help employees keep their retirement savings in tax-advantaged accounts like 401(k)s when they switch jobs.

The two retirement giants, along with benefits administrator Alight Solutions, created a jointly owned consortium to automate the transfer of millions of 401(k) accounts with balances below $5,000 when workers change employers. An estimated $92 billion is taken out of retirement savings each year due to cash-outs, according to the Employee Benefit Research Institute.

Auto-portability of workplace retirement plans is an idea that’s been talked about for years but requires scale to make much of a difference. EBRI estimates that if auto-portability is widely adopted, it would keep an additional $1.5 trillion in retirement plans over 40 years, with Black and minority workers saving an additional $619 billion and women saving $365 billion more.

The cash-out problem is likely to worsen as people switch jobs more frequently. Workers who have less than $5,000 saved tend to be lower-income, women and minorities, according to Alison Borland, executive vice president of Wealth Solutions at Alight, who said the effort “is meant to be a low-cost way to preserve savings for those who need it most.”

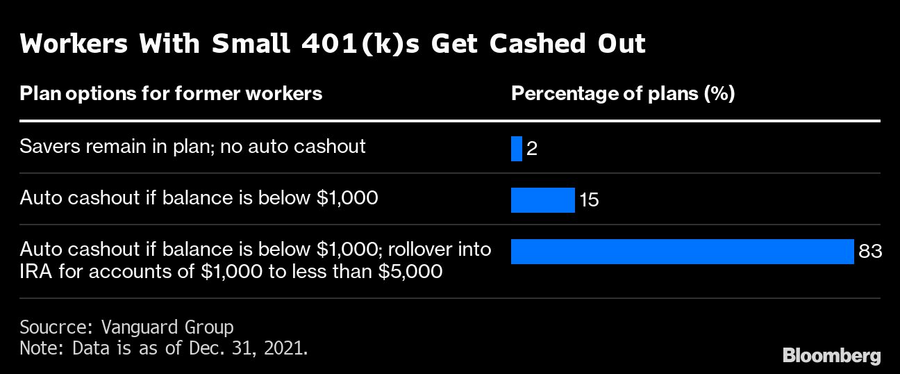

It isn’t always the employee who does the cashing out — balances of less than $1,000 may be cashed out by the former employer and sent via check to the worker. If that check isn’t rolled into a new 401(k) plan or individual retirement account fairly quickly, workers pay tax and a 10% penalty if they’re younger than 59½.

[More: Vanguard rolls out HSAs for 401(k) participants]

An employer may also roll an old employee’s 401(k) of less than $5,000 into an IRA, a practice that has drawn criticism if the money sits in a money market fund being eaten away by fees.

Retirement Clearinghouse, which developed an auto-portability service, will be the digital hub used to locate and match employees. The fees charged to plan participants will be standard, with accounts below $50 transferred for free and a maximum fee of $30.

“We are very intentionally setting the price at the lowest possible cost, and any excess of operating needs we intend to put back into future price decreases,” said Kevin Barry, president of the workplace investing division of Fidelity Investments. “This is not about record-keepers trying to make money on this population.”

For employers, the service solves the sometimes clunky process of rolling over 401(k)s, along with keeping track of and servicing the accounts of ex-employees with low balances.

“Workers should not have to move mountains to move their retirement savings to a new employer,” said John James, managing director and head of Vanguard Institutional Investor Group. Vanguard announced its plan to use the service earlier this year.

[More: Republicans advocate for retirement investments in private equity, crypto]

‘IN the Office’ with Anna Paglia, global head of ETFs at Invesco

Learn more about reprints and licensing for this article.