Financial advisers continued to bolt from Wall Street in 2019

Independent broker-dealers and RIAs scored sizable net gains of advisers at Wall Street's expense

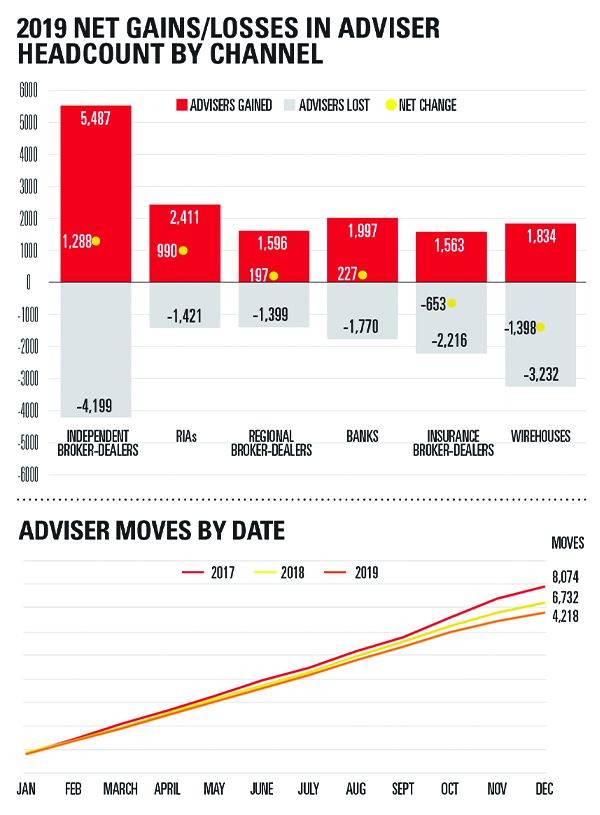

The steady drip, drip, drip of financial advisers leaving Wall Street’s bank wirehouses and moving to a variety of other types of firms, to sell securities and advise clients, continued throughout 2019, with the large wirehouses reporting a net loss of 1,398 financial advisers.

A few years ago, three of the four major wirehouses, Merrill Lynch, Morgan Stanley and UBS, said they were cutting back on recruiting, which is expensive, and focusing instead on technology to boost advisers’ productivity, revenue and training. The banks have also instituted changes to the complex pay grid system they use to compensate advisers, and many of those have not been popular, according to various industry sources.

That means that other business channels, such as independent broker-dealers, registered investment advisers and regional broker-dealers, last year saw significant net gains in advisers, often at the expense of the Wall Street wirehouses. Senior executives at the large banks routinely discount or dismiss out of hand the number of advisers the wirehouses are losing each year, but the figures for 2019 were quite eye-popping.

For example, independent broker-dealers — meaning firms that employ brokers and independent contractors — saw a net gain of 1,288 reps and advisers, while RIAs, many of which are owned by advisers, saw a net gain of 990, according to InvestmentNews data. Regional broker-dealers, which looked all but dead five to 10 years ago, had a net increase of 197.

“There are a lot of people coming in the door, as much as I’ve ever seen, and importantly, a lot of enthusiasm for the model that we’re putting on the table, which is adviser-centric,” said Ron Kruszewski, CEO of Stifel Financial, on Thursday morning during an earnings call with analysts. “We continue to talk about the importance of advisers and that they’re centric to our model and that’s resonating.”

For the year, Stifel increased its number of financial advisers to 2,222 and added 150 advisers with annual fees and commissions of nearly $119 million, and client assets of more than $17 billion, Mr. Kruszewski said.

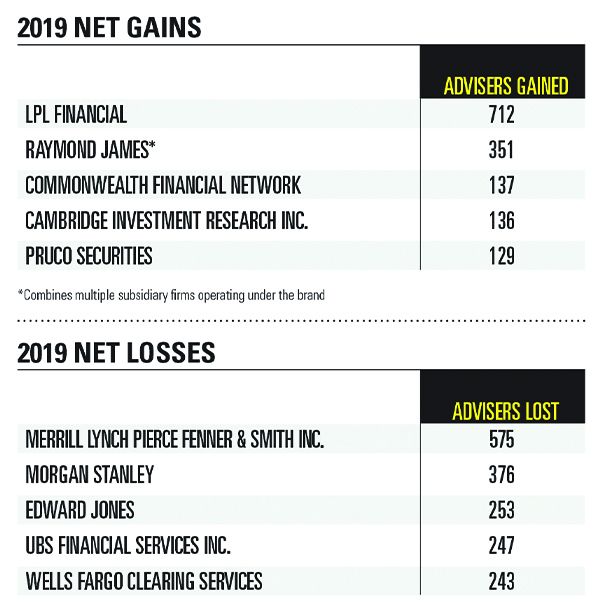

The largest net gainers and losers of financial advisers and registered reps last year are both giants of different business models: LPL Financial, the biggest firm for independent contractor reps had a net gain of 712 advisers, while Merrill, one of the largest Wall Street firms in the country, had a net decline of 575 advisers, according to InvestmentNews data.

LPL Financial ended the year with 16,464 financial advisers and Merrill Lynch with 17,458, the companies reported.

Large firms have a variety of advisers working in different business models, so a large net gain or loss does not translate strictly into a similar gain or loss of financial advisers but is a broad indication of wider industry trends.

LPL Financial’s CEO, Dan Arnold, on Thursday in a conference call to discuss earnings said the firm recruited advisers with $35 billion in assets under management, a new annual high.

“Throughout 2019 we hired advisers in all areas of the firm,” wrote Merrill Lynch spokesman, Matt Card, in an email, including into the training program, an accelerated growth program for young advisers with limited experience and large teams for wealth management.

“Competitive recruiting of experienced advisers picked up last year among our peers,” Mr. Card wrote. “However, our attrition rate for the year remained around 4%, consistent with the average we’ve seen over the last several years.”

Learn more about reprints and licensing for this article.