First Republic stock falls in early trading after S&P cuts rating for second time

The rating agency lowered the bank's long-term issuer credit rating to B+ from BB+, having already downgraded the lender to junk last Wednesday.

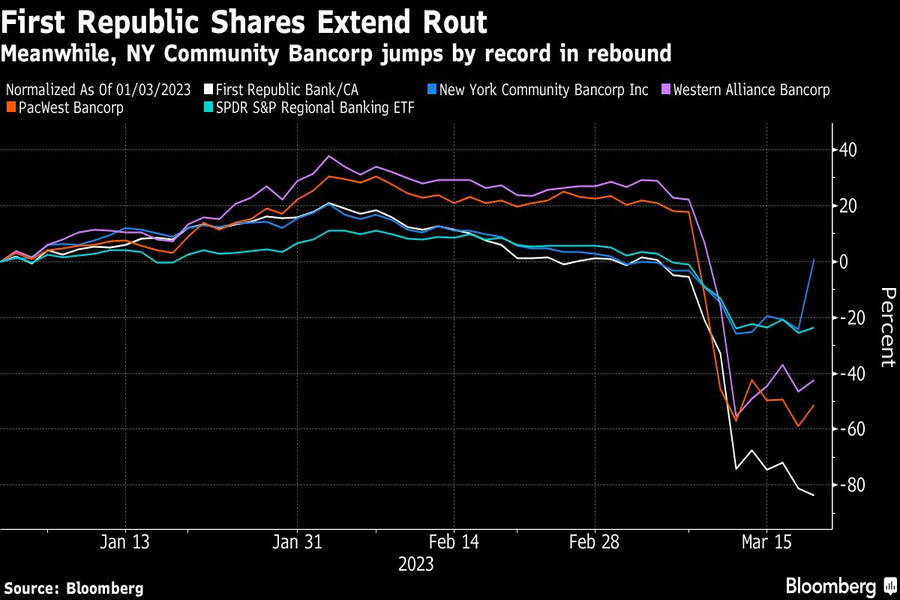

First Republic Bank plunged in premarket trading Monday, missing out on a strong rebound by its regional bank peers, after S&P Global Inc. cut its credit rating for the second time in a week, warning that a $30 billion rescue deal had not resolved the lender’s challenges.

Shares of the struggling bank slumped as much as 37% in premarket, putting First Republic on track to extend its recent 80% rout. Meanwhile, other mid-sized U.S. lenders saw renewed interest from investors as New York Community Bancorp jumped 40% after taking over Signature Bank’s deposits and some of its loans. Western Alliance Bancorp rose 12%, while PacWest Bancorp gained 28% and the SPDR S&P Regional Banking ETF added 2.5%.

“While this is the most serious bank crisis since 2008, the selloff is overdone, in our view, creating a buying opportunity for our Smid-Cap names,” Maxim analyst Michael Diana wrote in a note. Diana cut his price target on multiple firms — including buy-rated First Republic.

S&P lowered First Republic’s long-term issuer credit rating to B+ from BB+, having already downgraded the lender to sub-investment grade, or junk, territory last Wednesday. The ratings agency said a recent $30 billion infusion from some of Wall Street’s biggest lenders may not solve the “substantial” challenges the bank is now likely facing, even if it does ease near-term pressure on liquidity.

Investors worldwide are watching for signs of fresh troubles following the collapse of Silicon Valley Bank and the deposit aid for First Republic. The episodes have sparked worries of deposit flight from regional banks, harming liquidity and potentially sparking a credit crunch.

“We believe this is one of the best risk/reward trade-offs in this group that we have seen in our 23-year career,” said Baird analyst David George, noting the KBW Bank Index’s 15% drop last week. “The stocks are more inexpensive today than they were during the pandemic, and if you don’t buy banks here, we aren’t sure when you do.”

Wall Street’s bigger were mostly positive with Wells Fargo & Co., Goldman Sachs Group Inc., Bank of America Corp. and Citigroup Inc all climbing by 1% or more.

Shares of UBS Group AG briefly erased losses of as much as 16% in European trading following its emergency Sunday takeover of Swiss rival Credit Suisse Group AG.

Why flexibility remains essential when it comes to retirement spending

Learn more about reprints and licensing for this article.