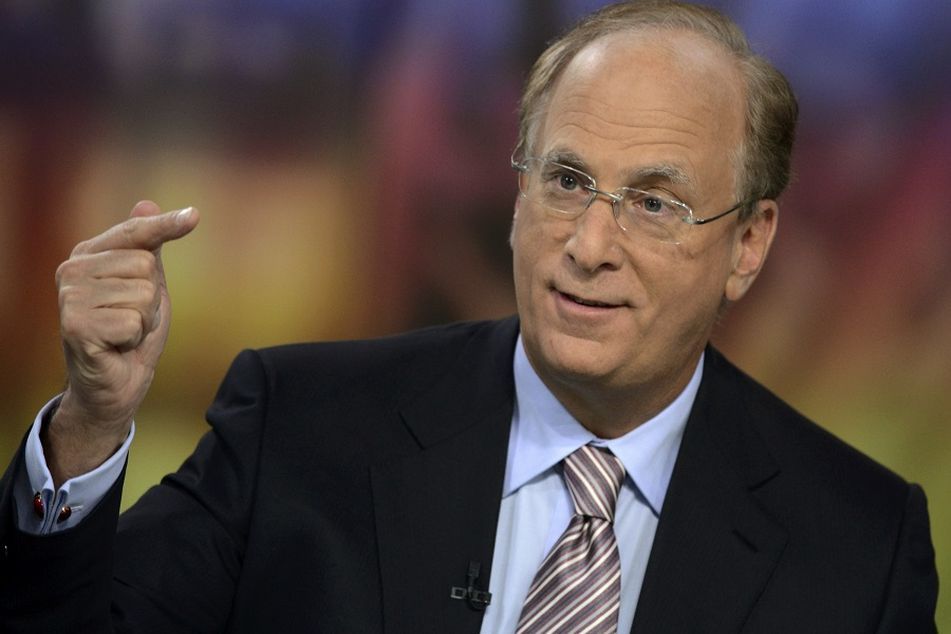

BlackRock CEO Larry Fink says everyone should worry about China debt

Mr. Fink says he is still “bullish” on China in long term

BlackRock Inc.’s Laurence D. Fink, who oversees the world’s largest money manager with $4.7 trillion of client assets, said “we all have to be worried” about China’s mounting debt amid slowing growth, even as he remains bullish on the economy in the long run.

“You can’t grow at 6 percent and have your balance sheets grow faster,” Mr. Fink said in a Bloomberg Television interview with Angie Lau on the sidelines of a forum in Hong Kong on Tuesday. “In the future, I would prefer seeing the economy growing 6 percent with some form of deleveraging.”

China, whose surprise August yuan devaluation sent shock waves worldwide, is dividing the biggest names in finance more than any other market. While Mr. Fink said in April that investors would regret not betting on China this year because government stimulus may result in higher economic growth than many expect, billionaire investor George Soros said last month that the nation’s debt-fueled economy resembles the U.S. in 2007 and 2008, at the onset of the global financial crisis.

New credit in China increased a record 4.6 trillion yuan ($706 billion) in the first quarter, surpassing the level of 2009 during the depths of the global financial crisis. Total debt from companies, governments and households was 247% of gross domestic product last year, up from 164% in 2008, according to data compiled by Bloomberg.

Some investors are betting the credit bubble will pop, devastating the economy. Kyle Bass, the founder of Hayman Capital Management, a Dallas-based hedge fund firm, told investors earlier this year that China’s banking system may see losses more than four times those suffered by U.S. banks in the financial crisis.

The world’s second-largest economy grew 6.7% in the first quarter, within a government target range, with surging credit in March shifting concern back to the durability of the recovery.

Growth in aggregate financing fell below analyst estimates last month in a Bloomberg survey, after the record flow of credit in the previous three months led policymakers to shy away from boosting growth at all costs. Commercial banks may be becoming more reluctant to lend after soured loans rose to the highest level in 11 years, with defaults spreading from small private firms to large state-owned enterprises. Nonperforming loans rose 9% to 1.39 trillion yuan in March from December, the fastest increase in three quarters, data from the China Banking Regulatory Commission showed this week.

At the forum in Hong Kong, Mr. Fink said he is very impressed with China’s leaders, especially with respect to how they’ve sought to transform the manufacturing and export-oriented economy into one that’s domestic and services-oriented. It took some developed economies 50 years to manage that, and several recessions during the process, he said.

“I would say the Chinese leadership has done a very good job of identifying the need to reorient their economy, much more proactive than other leaders of other countries,” Mr. Fink said.

China has had to grapple with a global and domestic economic slowdown during this transition as well as excessive leverage of many of its financial institutions, Mr. Fink said.

“They need to be more aggressive in their reforms,” he said, adding there are still too many state-owned companies and signs of credit explosion again in the last three or four months. “However, I’m relatively bullish on China.”

Mr. Fink said the “safest neighborhood” to invest right now is North America. Negative rates are “terrible” for Japan, which is overly reliant on monetary policy, he said.

China’s August devaluation, growth concerns and capital outflows fueled speculation of further depreciation in the first quarter, with hedge fund managers from Bill Ackman to Crispin Odey positioned for declines.

“I believe China would be very against their plan to devalue the currency,” Mr. Fink said on Tuesday. “Their plan is about domestic consumption, having cheaper import prices, whether it’s agriculture goods, energy goods or the important goods of what Chinese are demanding in their purchases. A devaluation would only make that more difficult.”

Learn more about reprints and licensing for this article.