It’s a rap: Studio boss charged with bilking Saints

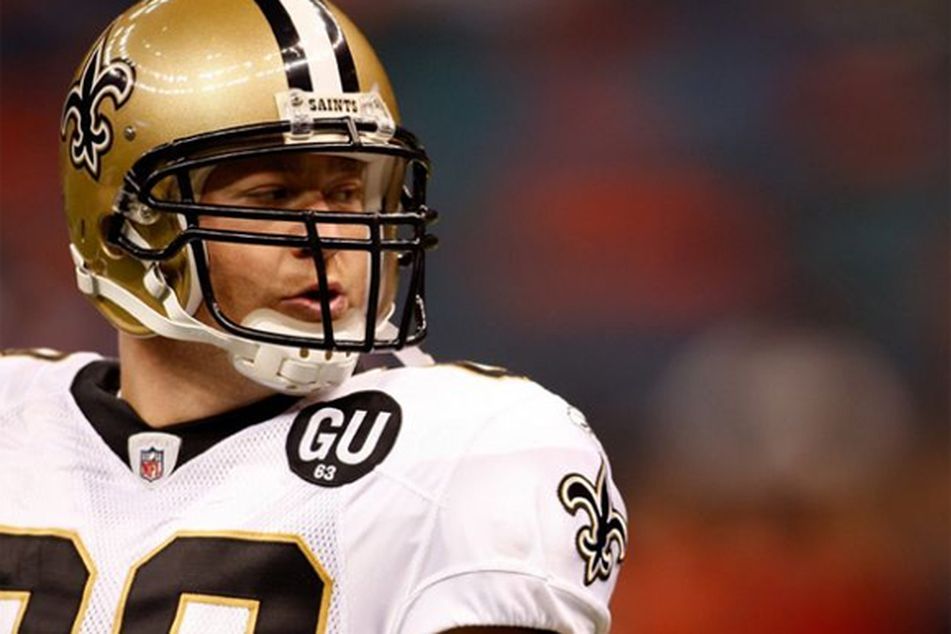

Sean Payton, Drew Brees, Archie Manning were among those who paid for film tax credits from Louisiana Film Studios. Now, studio head Wayne Read is facing federal fraud charges

Federal criminal charges were filed Monday against the head of a defunct film studio that persuaded some coaches and players for New Orleans Saints to pay about $1.9 million for what they thought would be state movie industry tax credits.

Wayne Read, of Wonder Lake, Ill., was charged with one count of interstate transportation of stolen funds and one count of wire fraud in connection the investments in Louisiana Film Studios LLC.

Louisiana’s film tax credit program is designed to promote the movie industry in the state. Buyers of tax credits get a reduction in the actual amount of income taxes they pay, unlike a deduction, which only reduces taxable income. The credits can be bought and sold.

Fifteen current and former Saints members — including head coach Sean Payton, quarterback Drew Brees and former star Archie Manning — paid Louisiana Film Studios in 2008 for what they thought would be state movie industry tax credits returning $1.33 for each dollar invested. State officials said the studio, which operated in suburban Jefferson Parish, never applied for the credits and the money has not been returned.

“Read used the stolen proceeds of the sale to pay off his personal debts in another state, to include the prevention of a sheriff’s sale on his personal residence and as satisfaction of a local judgment,” the bill of information said. A telephone message seeking comment from Read was not immediately returned Monday. The federal public defender’s office in New Orleans said an attorney assigned to the case was not available for comment.

U.S. Attorney Jim Letten’s office said Read, if convicted, would face as many as 20 years in prison and a fine of as much as $250,000 for the wire fraud charge; and as many as 10 years in prison and a fine of up to $250,000 for the interstate transportation of stolen funds. He could also be required to forfeit up to $1.9 million.

Last year, Read said he was looking for other investors in the studio and initial expenses had been higher than anticipated. He said the credits were never applied for because of confusion over what expenses qualified.

Some of the credit buyers forced the studio into involuntary Chapter 11 reorganization in July 2008. In February, U.S. Bankruptcy Judge Elizabeth Magner converted the case into a Chapter 7 liquidation after a court-appointed trustee said it was unlikely the studio could develop a business reorganization plan to pay off its creditors.

Learn more about reprints and licensing for this article.