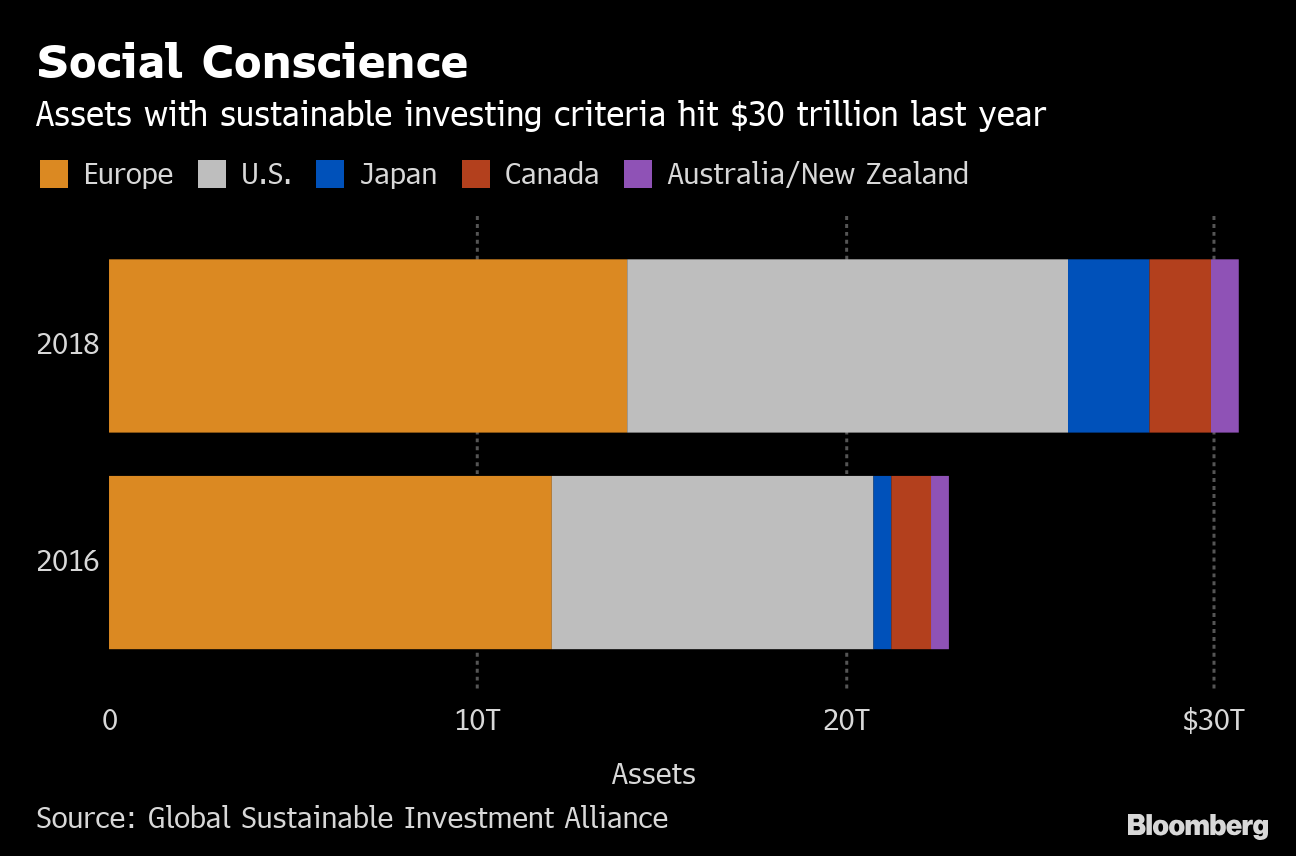

Socially responsible investments reach $30.7 trillion

Climate change became a leading issue for investors this year, money managers said

Climate change became a leading issue for investors this year, money managers said

Climate change has become a leading issue for investors worldwide.

Global socially responsible investments grew by 34% to $30.7 trillion over the past two years, lifted by Japanese pension funds, retail investors everywhere and broad, growing concern about climate change.

Europe remains the biggest region for sustainable investors with about $14 trillion devoted to these strategies, up 11% from 2016, according to the biennial report from the Global Sustainable Investment Alliance, which aggregates data from regional sustainable investment groups around the world.

Other markets, while smaller, are growing faster. Japan saw the biggest jump, with assets in sustainable strategies up fourfold to $2.2 trillion. They now represent 18% of the professionally managed money in the market, up from just 3% two years ago. The country’s corporate governance code overhaul in the past few years has encouraged focus in this area and the 150.7 trillion yen ($1.4 trillion) Government Pension Investment Fund signed the United Nations-backed Principles for Responsible Investment in 2015.

(More: Giving advisers ESG insight so they can grow)

Money managers around the globe said clients were increasingly asking for sustainable strategies and that climate change became a leading issue for investors this year. Retail investors bought up more ethical funds, according to the report, and now account for about 25% of assets, up from 20% in 2016.

So-called negative screening, where investors rule out one or more specific categories of investments, such as tobacco, gambling or fossil fuels, remains the most popular strategy. Nearly two out of every three dollars — $19.8 trillion in total — were invested this way in 2018, the group said.

Issues often overlap. Investors who integrate environment, social and governance principles into their portfolios, now represent about $17.5 trillion, up 69% from 2016. Assets that focus on corporate engagement and shareholder activism around environmental and social issues rose to $9.8 trillion in 2018, up from $8.4 trillion.

Learn more about reprints and licensing for this article.