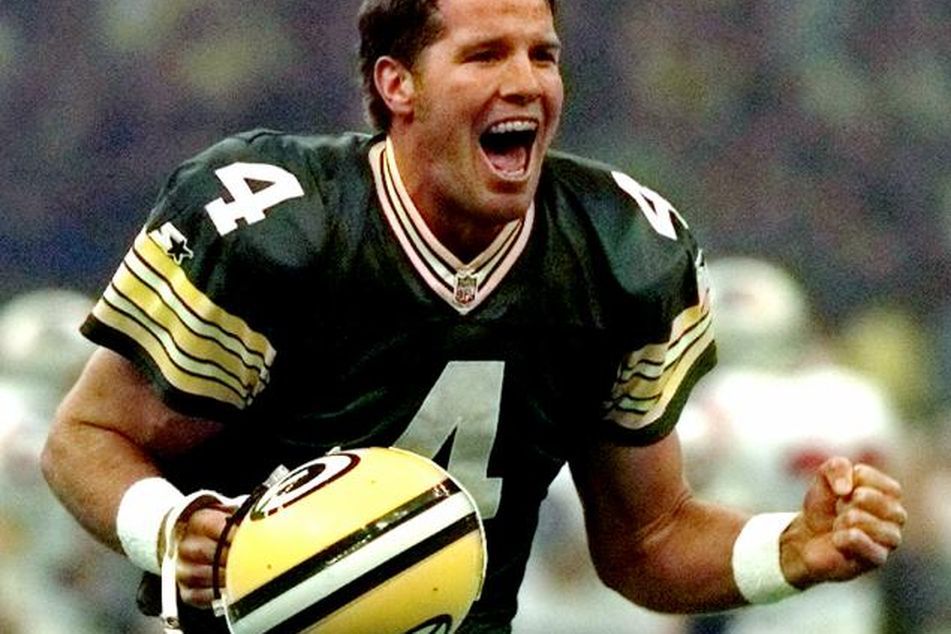

Some cheeseheads love HSAs

Year: 1997

Final Score: Green Bay Packers 35, New England Patriots 21

% S&P 500 Total Return Change: 33.36%

Year: 1997

Final Score: Green Bay Packers 35, New England Patriots 21

% S&P 500 Total Return Change: 33.36%

Health savings accounts are more than four times more popular with employers in a swath of Wisconsin than in the United States as a whole

NEW YORK — Health savings accounts are more than four times more popular with employers in a swath of Wisconsin than in the United States as a whole, but no one knows exactly why.

Thirty percent of employers in 10 counties in the northeastern part of the state offered HSAs as part of their group benefits, while just 7% of employers nationally offered the accounts, according to a recently released survey from Intellectual Marketing LLC in Green Bay, Wis.

Pundits have theorized that the popularity of cheese products in the region has caused high cholesterol and related ailments, and employers view HSAs and their mandatory high-deductible health insurance plans as a way to lower their medical and premium costs.

But the person in charge of the survey disputes that notion.

“I’m not sure there is a cheese link here, but if there is, it would probably have to include beer and brats, as well,” said David Wegge, a partner with Intellectual Marketing.

In addition to being football crazy, Green Bay is a “pretty sophisticated health insurance market,” and about 5,000 people in the area work in the health insurance field, he noted. Green Bay also has an influential bank — Nicolet National Bank — that actively promotes HSAs, Mr. Wegge added.

Employers in the area also “have a very strong ethic of taking very good care of their employees,” he said. The companies — even those that are struggling financially — would rather offer to share health costs than drop their plans entirely, Mr. Wegge said.

“The use of HSAs here in Wisconsin would be even higher if our governor hadn’t vetoed the tax benefit — twice,” he said.

Learn more about reprints and licensing for this article.