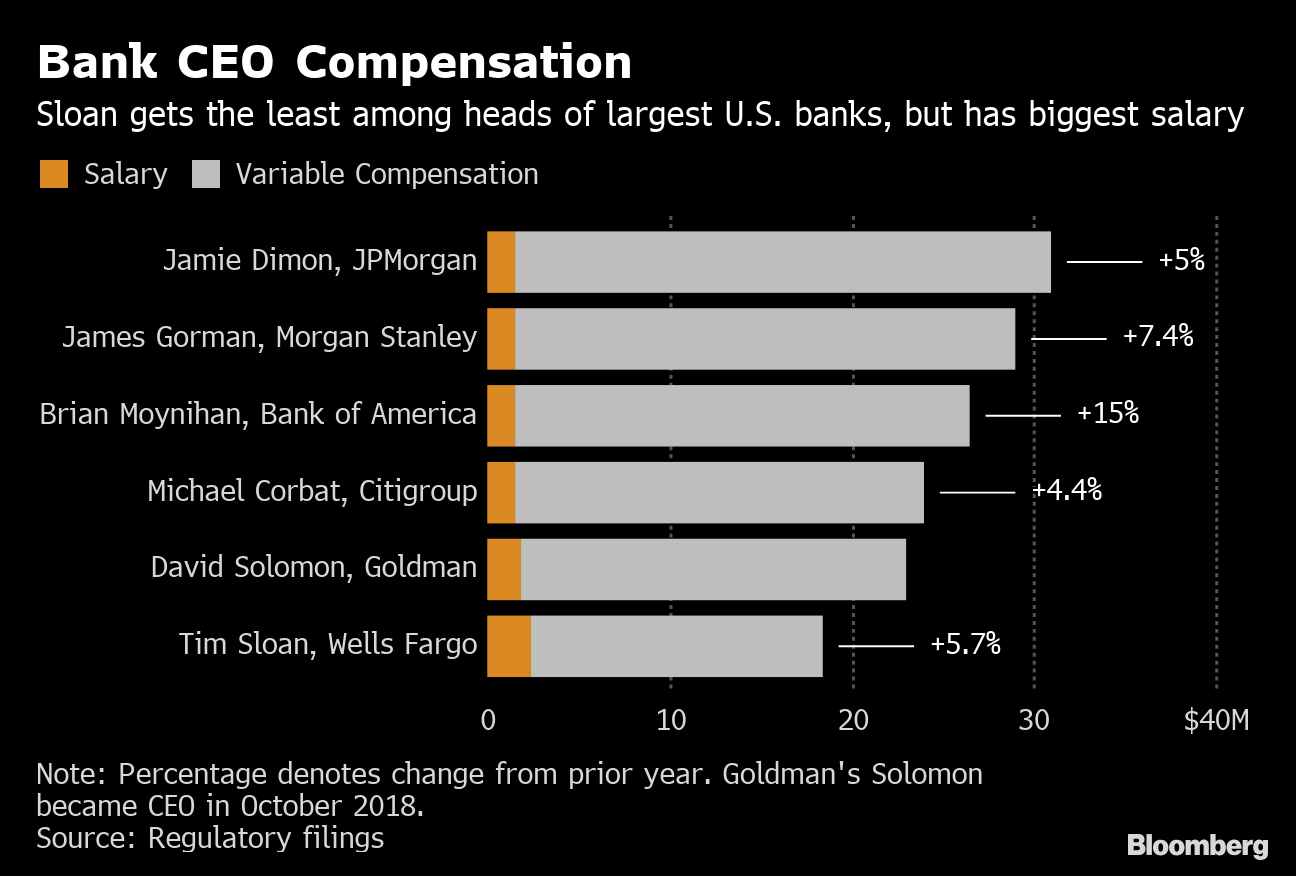

Wells Fargo CEO Tim Sloan gets 5.7 percent pay boost, $2 million bonus

Tim Sloan, president and chief executive officer of Wells Fargo & Co., speaks during a Bloomberg Television interview in San Francisco, California, U.S., on Monday, May 21, 2018. Photographer: David Paul Morris/Bloomberg

Tim Sloan, president and chief executive officer of Wells Fargo & Co., speaks during a Bloomberg Television interview in San Francisco, California, U.S., on Monday, May 21, 2018. Photographer: David Paul Morris/Bloomberg

He received $2.4 million in salary and $14 million of restricted stock linked to performance goals.

Wells Fargo & Co. boosted Chief Executive Officer Tim Sloan’s compensation by 5.7% to $18.4 million for last year as the bank has worked to overcome multiple scandals.

Mr. Sloan got $2.4 million in salary and $14 million of restricted stock linked to performance goals, the San Francisco-based bank said Wednesday in a regulatory filing. He also got a $2 million bonus.

Mr. Sloan’s second full year atop the embattled bank brought more problems. Scandals, including the opening of millions of bogus accounts to meet sales goals, prompted the Federal Reserve to ban the firm from expanding assets beyond 2017 levels. Sen. Elizabeth Warren, a Massachusetts Democrat who’s running for president, was among lawmakers to demand Mr. Sloan’s ouster.

(More: For Wells Fargo Advisors, finding new clients becoming difficult)

Shares of Wells Fargo tumbled 24% last year, compared with the 20% decline of the 24-company KBW Bank Index.

Mr. Sloan, 58, has undertaken changes at the bank since taking the top job, working to root out and fix past problems and prevent new ones. The bank has said he has the full support of the board.

Learn more about reprints and licensing for this article.