Finra bars Wells Fargo broker who ran Miami nightclub

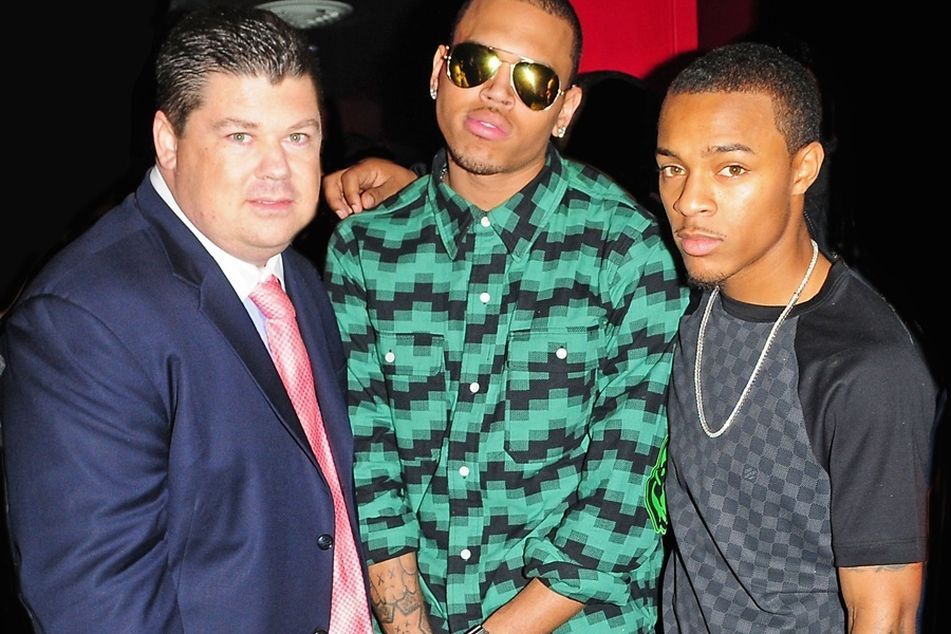

Aaron Parthemer, left, with recording artist Chris Brown, center, and rapper Bow Wow

Aaron Parthemer, left, with recording artist Chris Brown, center, and rapper Bow Wow

Aaron Parthemer, left, a Wells Fargo adviser for a number of NFL and NBA players, allegedly ran a hip hop dance club in South Beach without telling his employer.

The Financial Industry Regulatory Authority Inc. has barred a Wells Fargo adviser-turned-Miami socialite who engaged in a several undisclosed outside businesses, including allegedly running a hip hop dance club in South Beach, according to a settlement letter released late Wednesday.

From 2009 to 2013, Aaron Parthemer, an adviser for a number of NFL and NBA players who appears in photos with celebrities such as singers Chris Brown and Nicki Minaj, allegedly failed to disclose his involvement in the nightclub, Club Play, in addition to an Internet branding startup and a tequila marketing operation, according to the letter.

Mr. Parthemer, who was at Morgan Stanley Wealth Management until 2011, made unapproved loans to clients in connection with the club, and referred clients to invest in the branding startup, Finra said.

Mr. Parthemer accepted the bar without admitting or denying Finra’s findings.

An attorney representing Mr. Parthemer, James Sallah of Sallah Astarita & Cox, said that Mr. Parthemer was not an owner of the club, and never received compensation from the outside businesses. He is still owed money on some of the loans, Mr. Sallah said.

“This is a case where a broker did too much for his clients,” Mr. Sallah said.

Mr. Parthemer, who Finra alleged managed operations at the club until January 2012, loaned almost $400,000 to three professional athletes who were owners at Play as well as customers of Wells Fargo, according to the settlement. The loans were to pay for operating expenses at the club, and violated firm policies against loaning clients money, according to Finra.

Additionally, from 2009 to 2012, while at Morgan Stanley and Wells Fargo, Mr. Parthemer also referred eight of his NFL and NBA clients to invest more than $3 million in an Internet branding company referred to as “GVC,” which was run by a friend, according to the letter of settlement.

The referrals were made “at the behest of several of his clients,” Finra said, and the regulator did not allege any client damages, but Finra has strict rules prohibiting brokers from participating in any private securities transactions without authorization and disclosure to their firm. Finra did not identify any of Mr. Parthemer’s clients.

In compliance questionnaires to Morgan Stanley and Wells Fargo, Mr. Parthemer falsely represented that he was not participating in any outside business activities that required disclosure, according to Finra.

In addition, he provided false information to Finra when the regulator began to request more information about his outside business activities in 2012, according to the letter.

Wells Fargo spokesman Anthony Mattera declined to comment. A Morgan Stanley spokeswoman, Christine Jockle, did not return a call seeking comment.

Mr. Parthemer began his career in the securities industry in 1994 at L.C. Wegard & Co. Inc. and also spent time at Merrill Lynch, according to Brokercheck.

Learn more about reprints and licensing for this article.