Ariel Investments launches firm to build minority businesses

The private asset management firm, Ariel Alternatives, aims to build certified minority enterprises that can supply Fortune 500 companies.

Ariel Investments has launched a private asset management firm, Ariel Alternatives, whose mission is to help build sustainable minority-owned businesses.

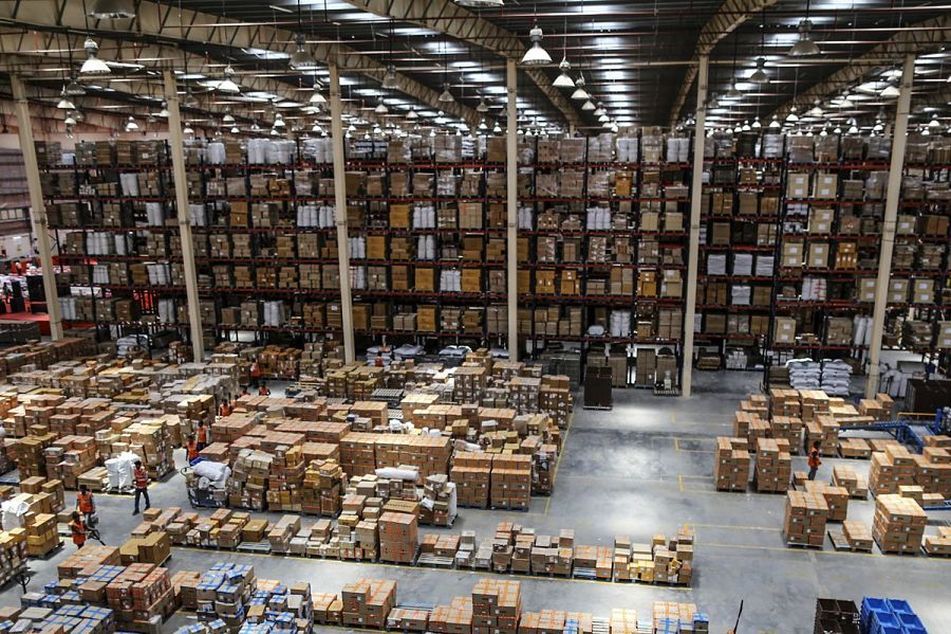

Ariel Alternatives intends to invest in middle-market companies that are not currently minority owned and transform them into certified minority business enterprises, as well as investing in existing Black and Hispanic-owned businesses.

The goal, Ariel said in a release, is to position these companies as leading suppliers to Fortune 500 companies, thereby supporting supply chain diversity.

Ariel said that JPMorgan Chase & Co. has committed up to $200 million to be co-invested alongside what will be known as Project Black.

[More: Diversity among those developing financial products and services is crucial to full engagement]

Financial advice goes viral on social media

Learn more about reprints and licensing for this article.