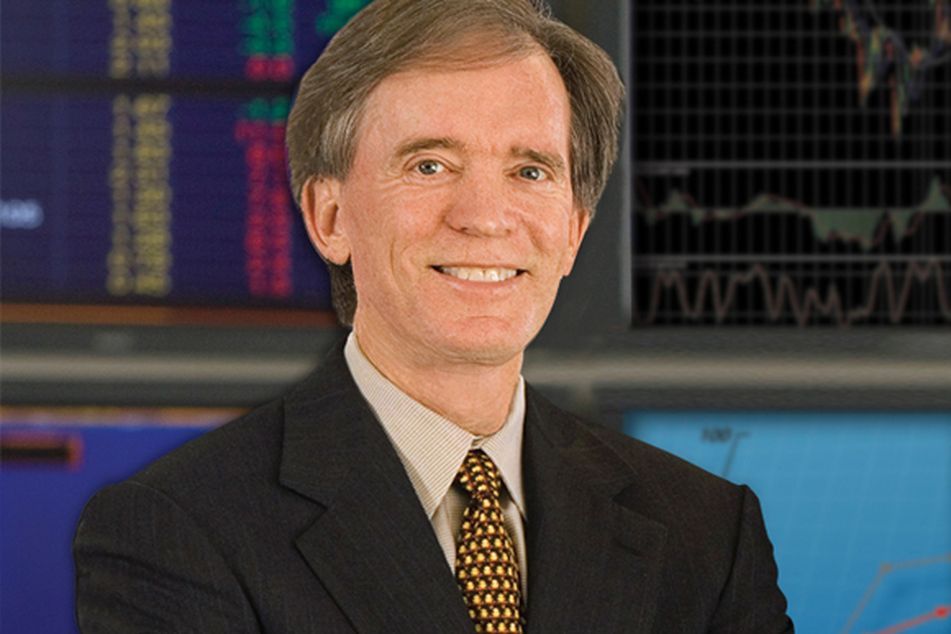

Bill Gross slashes government debt holdings

Bill Gross, who runs the world's biggest bond fund at Pacific Investment Management Co., reduced its holdings of government related debt to the lowest level since January 2009 while saying low yields cheat investors.

Bill Gross, who runs the world’s biggest bond fund at Pacific Investment Management Co., reduced its holdings of government related debt to the lowest level since January 2009 while saying low yields cheat investors.

Gross cut the proportion of U.S. government and related securities in Pimco’s $239 billion Total Return Fund to 12 percent of assets in January from 22 percent in December, according to the Newport Beach, California-based company’s website. He increased the percentage of cash equivalent holdings to 5 percent, the highest since April.

Policy makers are robbing savers by driving down real interest rates as they keep borrowing costs at record lows in a “devil’s bargain,” Gross said in his monthly investment commentary on Feb. 2. He advised investors to reduce holdings of Treasuries and U.K. gilts and buy higher-returning securities such as debt from emerging-market nations.

“Old-fashioned gilts and Treasury bonds may need to be ‘exorcised’ from model portfolios and replaced with more attractive alternatives both from a risk and a reward standpoint,” Gross wrote two weeks ago. Pimco doesn’t comment directly on monthly changes in its portfolio holdings.

Pimco’s U.S. government-related debt category can include conventional and inflation-linked Treasuries, agency debt, interest-rate derivatives, Treasury futures and options and bank debt backed by the Federal Deposit Insurance Corp., according to the company’s website.

Easy Policies

Treasuries returned 5.9 percent in 2010 after losing 2.7 percent in the fourth quarter, according to Bank of America Merrill Lynch Indexes. The securities lost 1.3 percent so far this year.

“A low or negative real interest rate for an ‘extended period of time’ is the most devilish of all policy tools, Gross wrote. “And the asset class holder that it affects, or better yet, infects, is the small saver and institutions such as insurance companies and pension funds.”

Gross kept the holdings of non-U.S. developed debt steady at four percent in January.

Because of so-called easy monetary policies in developed countries, combined with larger debt loads and increasing inflation expectations, investors in developed market sovereign debt are taking a “haircut,” he said. This will continue as the Federal Reserve is unlikely to raise interest rates for at least 12 months because the U.S. economy isn’t generating enough growth to lower unemployment, Gross said Feb. 4 in an interview on “Bloomberg Surveillance” with Tom Keene.

Returns

Gross kept holdings of emerging-market debt at 9 percent in January, the same as the previous month. He trimmed holdings of mortgage securities to 42 percent from 45 percent in December and raised the Total Return Fund’s net cash-and-equivalent position from negative 7 percent. It can have a so-called negative position by using derivatives, futures or by shorting.

Gross’s fund has returned 7 percent in the past year, beating 82 percent of its peers, according to data compiled by Bloomberg. It lost 0.43 percent over the past month.

Derivatives are financial obligations whose value is derived from an underlying asset. Futures are agreements to buy or sell assets at a later specific price and date. Shorting is borrowing and selling an asset in anticipation of making a profit by buying it back after its price has fallen.

Pimco, a unit of the Munich-based insurer Allianz SE, managed $1.24 trillion of assets as of December.

Bloomberg

Learn more about reprints and licensing for this article.