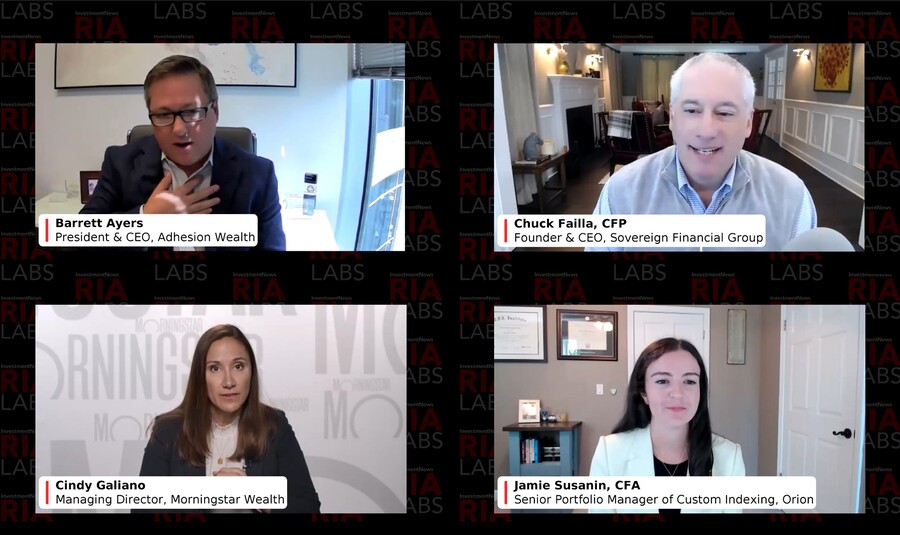

The learning curve for direct indexing is still steep for a lot of financial advisors, according to the feedback at this week’s InvestmentNews RIA Lab, which took a deep dive into the technology-driven portfolio customization.

While much of the focus from platform providers remains on the benefits of tax management, the message was clear that partnering with direct indexing gives advisors an immediate tool for separating themselves from the financial planning pack.

“One of the values of it is taking the direct indexing and managing it as a component model of a larger portfolio,” said Barrett Ayers, president and chief executive of Adhesion Wealth. “It’s a way to differentiate from the advisor down the street who may be just using mutual funds and ETFs.”

Cindy Galiano, managing director in the U.S. wealth platform at Morningstar Wealth, said direct indexing fills a gap in many financial planning practices.

“Advisors have to become more tax savvy, and with direct indexing high after-tax returns can be achieved,” Galiano said.

Jamie Susanin, senior portfolio manager for custom indexing at Orion, also stressed the value of becoming more of a tax-management specialist.

“A lot of times, taxes are one of a few barriers to moving a client over from another advisor,” she said, adding that direct indexing can help clients navigate the tax implications of major capital gains events, such as selling a business.

Chuck Failla, founder of Sovereign Financial Group, who moderated the panel discussion, responded to audience inquiries about how direct indexing works by pointing out how it can “break an index down into components.

“Direct indexing deconstructs an index,” he explained. “If the S&P goes up 10%, it’s not like every stock is going up in lockstep. And even in an up market, you can tax-loss harvest.”

In terms of specific benefits, Ayers said his firm has been paying close attention to the tax-managed alpha generated through direct indexing and reports a “20-basis-point boost by entering direct indexing into the equation.”

While direct indexing is most useful for wealthier clients with taxable accounts, the panel explained that it is becoming a helpful tool for recruiting and managing new business.

Ayers cited two examples, including “an off-the-shelf [direct indexing] portfolio that can be dropped into a client’s account” and a legacy account with low-cost-basis positions.

Direct indexing could even help move forward an advisory firm acquisition, when tax management challenges can be multiplied by hundreds of individual accounts, he said. "“Direct indexing is a solution that overcomes the No. 1 objection from clients and advisors looking to go independent.”

Ultimately, Ayers added, direct indexing is just another vehicle for adding value while freeing up the advisor to focus on financial planning and client servicing.

“It’s all about differentiation, and as an advisor you need to decide if you’re an asset manager or a financial planner,” he said. “It’s very enticing to get in there and build the portfolios, but it’s also a lot of work.”

Looking to refine your strategy for investing in stocks in the US market? Discover expert insights, key trends, and risk management techniques to maximize your returns

The RIA led by Merrill Lynch veteran John Thiel is helping its advisors take part in the growing trend toward fee-based annuities.

Driven by robust transaction activity amid market turbulence and increased focus on billion-dollar plus targets, Echelon Partners expects another all-time high in 2025.

The looming threat of federal funding cuts to state and local governments has lawmakers weighing a levy that was phased out in 1981.

The fintech firms' new tools and integrations address pain points in overseeing investment lineups, account monitoring, and more.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.