Emerging markets submerge in worst year since 2008

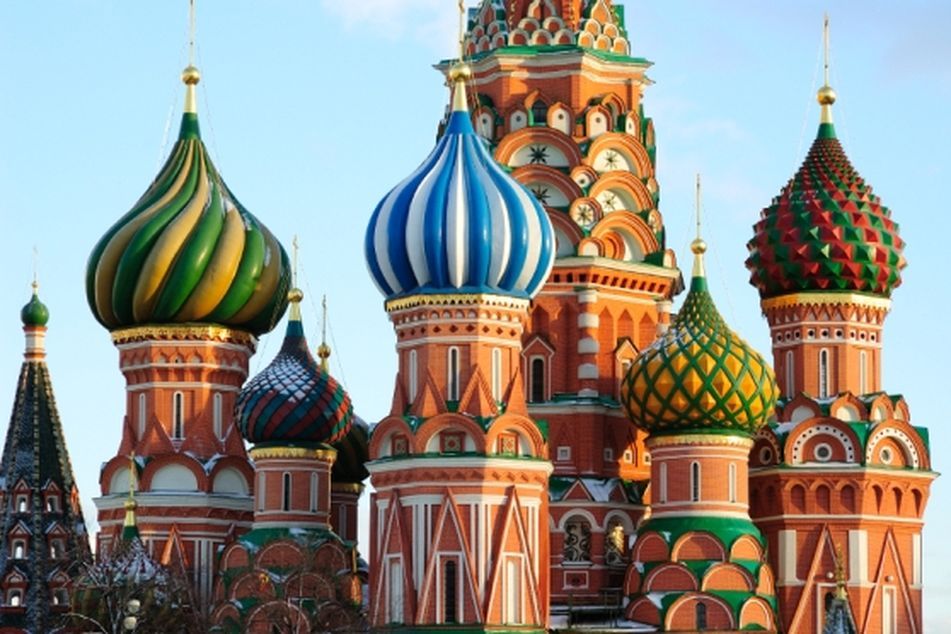

Meanwhile, back in the U.S.S.R.

Meanwhile, back in the U.S.S.R.

Bellwether MSCI index down 20% on the year; Asia poised for modest rebound

Emerging-market stocks rose, paring the benchmark index’s first annual decline since 2008, as better-than-estimated U.S. economic data outweighed concerns over Europe’s debt crisis.

The MSCI Emerging Markets Index (MXEF), which gained 0.2 percent to 916.09 at 10:53 a.m. in New York. The Shanghai Composite Index (SHCOMP) climbed 1.2 percent, trimming its drop this year to 22 percent. The Micex Index (MICEX) jumped 1.2 percent in Moscow. The BUX Index (BUX) slid 1.9 percent in Budapest as parliament approved a law that may curb the central bank’s independence and threaten negotiations on an international aid package.

MSCI’s emerging-markets index has slumped 20 percent this year, while stocks in developed countries have fallen 7.6 percent. Data yesterday showed U.S. home sales rose more than economists forecast and jobless claims dropped over the past month to a three-year low. Spain said it will raise taxes and cut spending to trim a budget deficit that will breach this year’s target.

“The recession risk is significantly reduced” in the U.S., Bob Parker, a senior adviser at Credit Suisse Asset Management, said in an interview with Bloomberg UTV today. “I call 2012 a year of moderate growth for America and Asia and a year of very slow recovery from a difficult position in Europe.”

The MSCI gauge’s slump this year is the first since a 54 percent plunge in 2008, when Lehman Brothers Holdings Inc. collapsed amid the worsening credit crisis. The developing nations’ gauge (MXEF) trades at 10 times estimated profit.

RELATED ITEM Top international funds in 2011 »

The Shanghai Composite Index rose today as a manufacturing gauge signaled contraction, fueling speculation that the central bank may cut lenders’ reserve requirements to boost the economy. The HSBC Holdings Plc and Markit Economics’ purchasing managers’ index (EC11CHPM) showed a reading of 48.7 for December, compared with 47.7 for November. A reading below 50 indicates a contraction.

OTP Bank Nyrt. (OTP), Hungary’s largest lender, declined in Budapest, sliding 3.2 percent as parliament approved a central bank law over the opposition of the International Monetary Fund and the European Union, which cited the legislation for suspending bailout talks earlier this month.

Forint

The forint weakened 1.2 percent against the euro, extending its annual drop to 11 percent, the biggest slump since at least 2000.

Poland’s zloty depreciated 1.2 percent versus the European common currency. The WIG20 Index (WIG20) slid 0.4 percent in Warsaw.

The lira appreciated 1.4 percent against the dollar as Bloomberg HT television reported that Turkey’s central bank sold $750 million in its daily dollar auction.

The rand strengthened 1.1 percent as gold rebounded, extending an 11th annual gain, in London.

The BSE India Sensitive Index, or Sensex (SENSEX), retreated 0.6 percent in Mumbai. The index’s 25 percent loss this year was the worst after 2008 in data that goes back to 1980.

The extra yield (JPEGSOSD) investors demand to own emerging-market debt over U.S. Treasuries rose six basis points, or 0.06 percentage point, to 425, according to JPMorgan Chase & Co. (JPM)’s EMBI Global Index.

–Bloomberg News–

Learn more about reprints and licensing for this article.