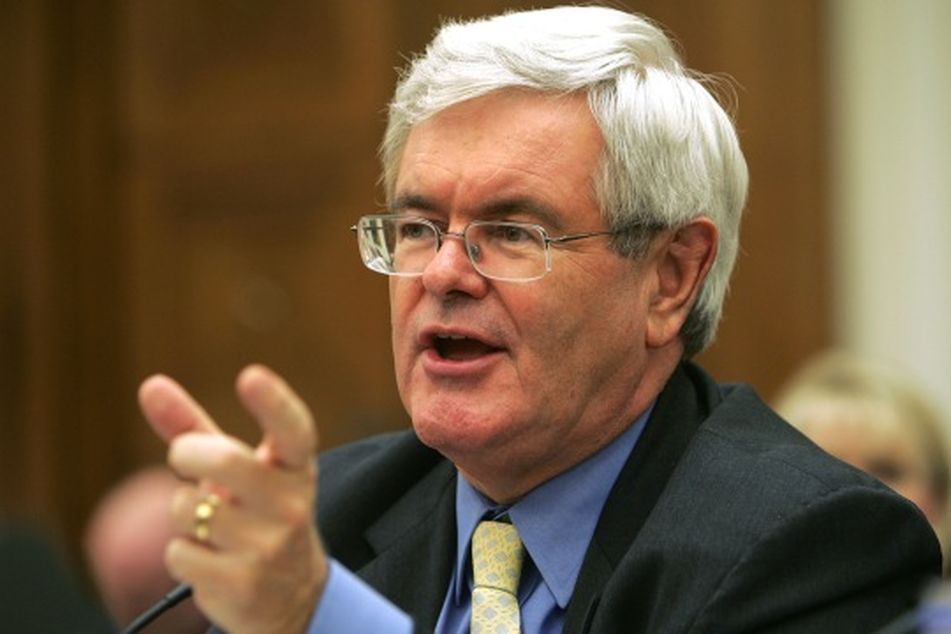

Gingrich’s gift to highest earners

Analysis of Newt Gingrich's tax plan would cut taxes for 70% of households and reduce rates for the highest earners compared with what they pay now.

The economic plan proposed by Republican presidential candidate Newt Gingrich would add $1.3 trillion to the U.S. budget deficit in 2015 alone, according to an analysis by the nonpartisan Tax Policy Center.

The figures compare the federal government’s take under Gingrich’s proposal with projected U.S. revenue if current tax law ran its course and existing income tax cuts expired.

The analysis, released today in Washington, finds that Gingrich’s plan would cut taxes for 70% of households and reduce rates for the highest earners compared with what they pay now.

“It blows a huge hole in the deficit,” said Roberton Williams, a senior fellow at the center.

Gingrich’s plan would create an optional 15% flat tax with a per-person deduction of $12,000. He would drop the corporate tax rate to 12.5% from 35%, allow businesses to write off capital expenses and eliminate taxes on capital gains and estates, according to his website.

People earning more than $1 million a year would receive an average tax cut of $613,689 in 2015, compared with what they pay now. That change would boost their after-tax income by 28.7% and put their average tax rate at 11.9%.

Tax Cuts

Gingrich’s plan would cut taxes for people in all income groups and raise them for no one. For households earning between $50,000 and $75,000 a year, 91.3% would receive tax cuts averaging $1,847, boosting their after-tax income by 3.1%.

Gingrich, 68, the former speaker of the U.S. House of Representatives, is leading the 2012 Republican presidential field in some national polls.

R.C. Hammond, a spokesman for Gingrich’s campaign, didn’t immediately respond to a request for comment about the Tax Policy Center’s report.

Adam Geller, a Republican pollster in New York, said the desire for a quick fix to the country’s economic woes could benefit Gingrich.

“Most of the Republican base is so frustrated with what we would term Obamanomics, or big government spending, that a push from the other direction that sounds like it’s of equal force sounds mightily appealing,” he said.

Republican Rivals

The Republican candidates are competing to offer politically attractive proposals, said Marc Goldwein, policy director for the Committee for a Responsible Federal Budget, a bipartisan group that advocates for budget discipline, and a former aide to the deficit-reduction supercommittee.

“Unless there are spending cuts to more than match those, there will be an increase in the debt,” he said. “We’re not going to be able to afford a huge, new unpaid-for tax cut. It’s just not in the cards until we deal with this debt situation.”

Gingrich’s main rival for the Republican nomination, former Massachusetts Governor Mitt Romney, has proposed extending current tax rates, cutting the corporate rate to 25% and eliminating taxes on investment income for households earning less than $200,000 a year.

–Bloomberg News–

Learn more about reprints and licensing for this article.