Gross clears out U.S. debt from flagship fund: Report

Total Return Fund said to hold no government paper as of the end of February

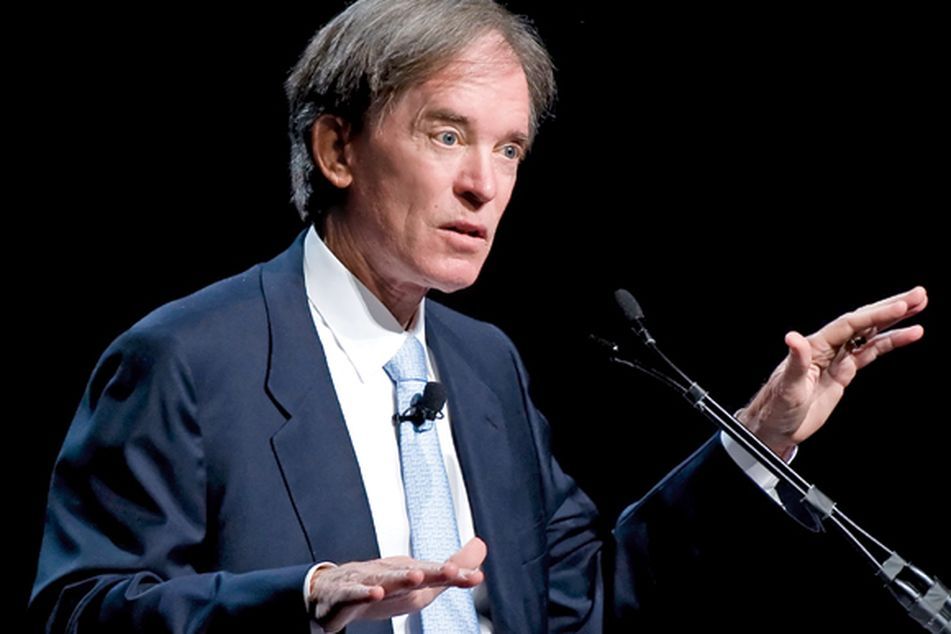

Bill Gross, who runs the world’s biggest bond fund at Pacific Investment Management Co., eliminated government-related debt from his flagship fund, according to the Zero Hedge website.

Michael Reid, a Pimco spokesman in New York, declined to comment about the accuracy of the report. Zero Hedge didn’t say how it got the figures for holdings as of February.

Pimco’s $237 billion Total Return Fund last held zero government-related debt in January 2009. Gross had cut the holdings to 12 percent of assets in January, according to the Newport Beach, California-based company’s website.

Gross said yields on Treasuries may be too low to sustain demand for U.S. government debt as the Federal Reserve approaches the end of its second round of quantitative easing, he wrote in a monthly investment outlook posted on the company’s website on March 2.

Pimco’s U.S. government-related debt category can include conventional and inflation-linked Treasuries, agency debt, interest-rate derivatives, Treasury futures and options and bank debt backed by the Federal Deposit Insurance Corp., according to the company’s website.

–Bloomberg News–

Learn more about reprints and licensing for this article.