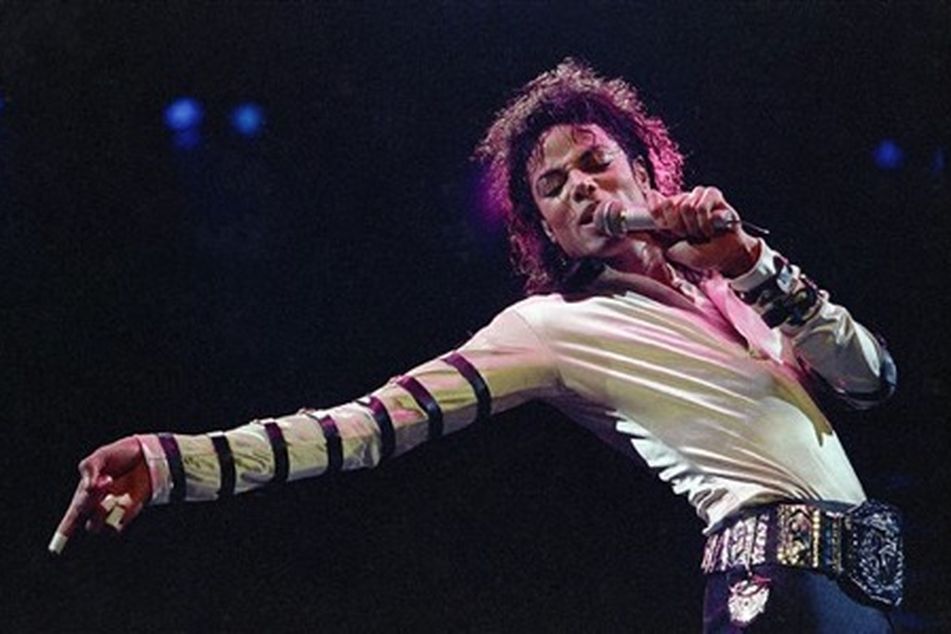

Michael Jackson passed away more than $500M in the red

Court filings by executors of his now $2B estate reveal the King of Pop’s dire financial straits at the time of his death in 2009.

Mo’ money, mo’ problems, as a wise man once declared. And so it seemed to go for the late great Michael Jackson, according to a new development surrounding his estate.

According to new court documents filed last week, the King of Pop was over half a billion dollars in debt when he died in 2009.

The June 21 filing by his estate’s executors, obtained and reported earlier by People, chronicled the significant financial challenges Jackson faced. They reveal that his major assets were encumbered with more than $500 million in “debt and creditors’ claims,” some of which accrued interest at very high rates, while other debts were in default.

That eclipses a previous estimate of $400 million debt Jackson owed upon death, which was reported by the Associated Press in 2010.

Jackson, who passed away on June 25, 2009 at age 50, was set to begin his “This Is It” concert tour, with scheduled stops in major cities including London, Paris, New York, and Mumbai.

His untimely death left his estate financially liable for approximately $40 million owed to the tour’s promoter, AEG, the court filing reportedly noted. On top of that, Jackson faced numerous lawsuits both internationally and within several US states, including California.

The court documents indicate that more than 65 claims had been lodged against Jackson by creditors, sparking further litigation. The executors said that they had managed to settle or resolve most of these claims and other court actions.

The executors also requested reimbursement for their attorneys’ fees from the estate for legal services rendered in 2018 and other expenses.

Over the course of litigation over Jackson’s death in 2013, a public accountant testified on behalf of AEG about Jackson’s financial habits. As reported by the Los Angeles Times, the accountant described Jackson’s lavish spending on jewelry, art, furniture, and gifts, as well as his extensive travel and charitable donations.

The intended beneficiaries of Jackson’s estate – now worth an estimated $2 billion – include his mother, Katherine, and his children Prince, 27; Paris, 25; and Blanket, or Bigi, 22.

However, due to an unresolved dispute with the IRS over a 2021 federal tax return – as far back as 2014, the agency maintained the estate “undervalued its assets” and owed Uncle Sam some $700 million more in taxes and penalties – they have not been receiving financial distributions.

The case of Michael Jackson’s estate certainly isn’t the first time a high-profile musician passed away and left their heirs in dire financial straits. Lisa Marie Presley reportedly owed more than $1 million in taxes upon her death last year.

Throughout his career, Jackson sold over 400 million records. He left the world as one of only a handful of multiple inductees into the Rock and Roll Hall of Fame, having first walked onto the ceremonial stage in 1997 as a member of the Jackson 5, and again in 2001 as a solo artist.

Learn more about reprints and licensing for this article.