Notre Dame’s ‘Rudy’ flagged for defrauding sports-drink investors

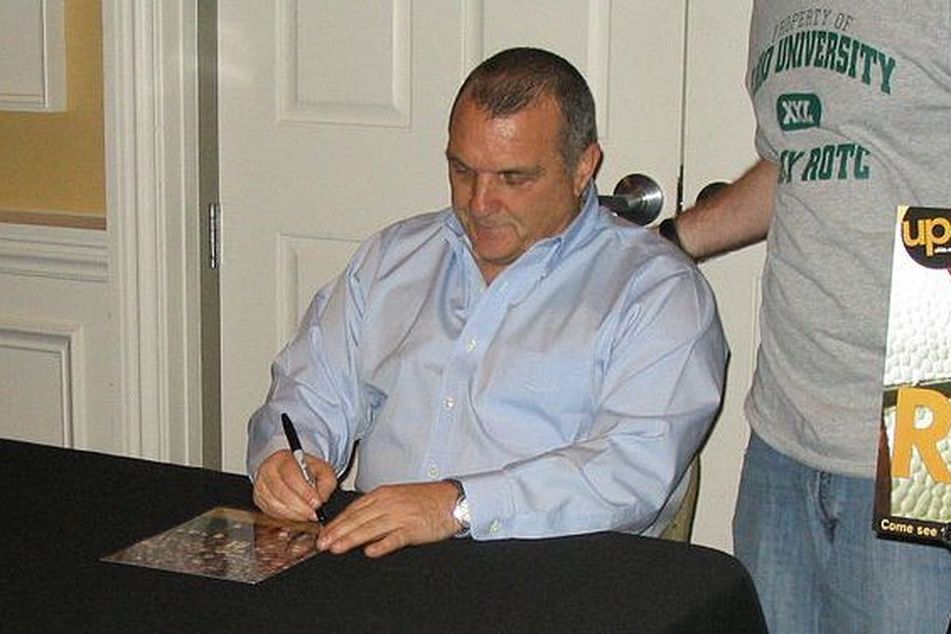

Daniel 'Rudy' Ruettiger signing autographs in 2010. (photo: Ed!)

Daniel 'Rudy' Ruettiger signing autographs in 2010. (photo: Ed!)

Agreed to pay $382,000 to resolve claims that he misled investors by touting fake taste tests and sales

Daniel Ruettiger, the former walk-on football player at the University of Notre Dame who inspired the 1993 film “Rudy,” agreed to pay $382,000 to resolve U.S. regulatory claims he defrauded investors in his sports-drink company by touting fake taste tests and sales.

Ruettiger and 12 others generated more than $11 million in illicit profits by artificially pumping up the stock of Rudy Nutrition, the firm Ruettiger founded, the SEC said in a complaint filed today at U.S. District Court in Las Vegas.

The company sent promotional press releases falsely claiming that Rudy Nutrition outsold sports-drink Gatorade by 2 to 1 in the Southwest and outperformed Gatorade and Powerade in several blind taste tests, according to the complaint. At the same time, the promoters traded Rudy Nutrition stock to inflate the price of unregistered shares they were selling to investors, the SEC said.

Rudy Nutrition used the slogan “Dream Big! Never Quit!” to market the drink, an apparent reference to the film that tells Ruettiger’s story of overcoming obstacles to fulfill his dream of playing football for Notre Dame, the SEC said.

“Investors were lured into the scheme by Mr. Ruettiger’s well-known, feel-good story but found themselves in a situation that did not have a happy ending,” Scott Friestad, an associate director in the SEC’s enforcement division, said in a statement. “The tall tales in this elaborate scheme included phony taste tests and other false information that was used to convince investors they were investing in something special.”

The scheme ended in September 2008, when the SEC halted trading in Rudy Nutrition because of delinquent public filings, the agency said. The suspension blocked the participants’ plan to issue another 2 billion shares at the end of that month, the SEC said.

–Bloomberg News–

Learn more about reprints and licensing for this article.