RIAs are killing it in 2020 recruiting

The numbers are way up, even as firms struggle amid the COVID-19 pandemic

Registered investment advisers have racked up impressive personnel gains in 2020, even as firms continue to struggle to operate at full steam amid the COVID-19 pandemic.

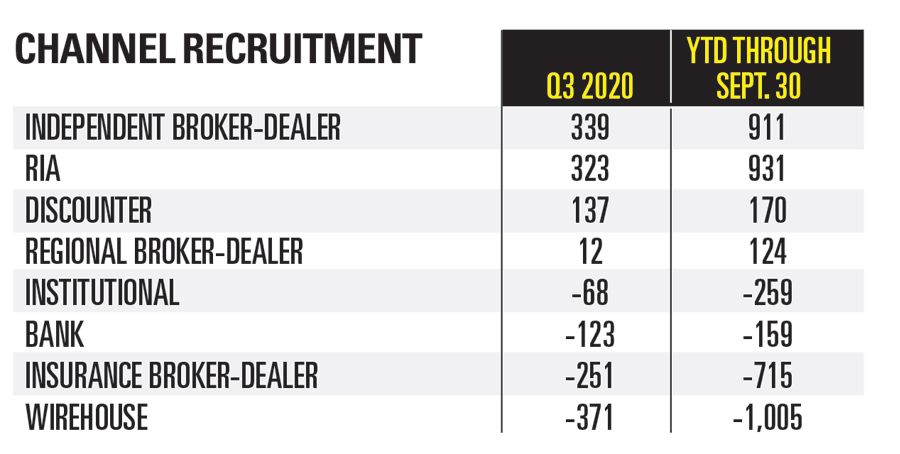

According to data compiled by InvestmentNews Research, RIAs over the first nine months of 2020 saw a net gain of 931 financial advisers who have jumped from one firm to another, the most for any of the eight business channels that InvestmentNews Research tracks. And this comes as RIAs buy other RIAs at a blistering pace.

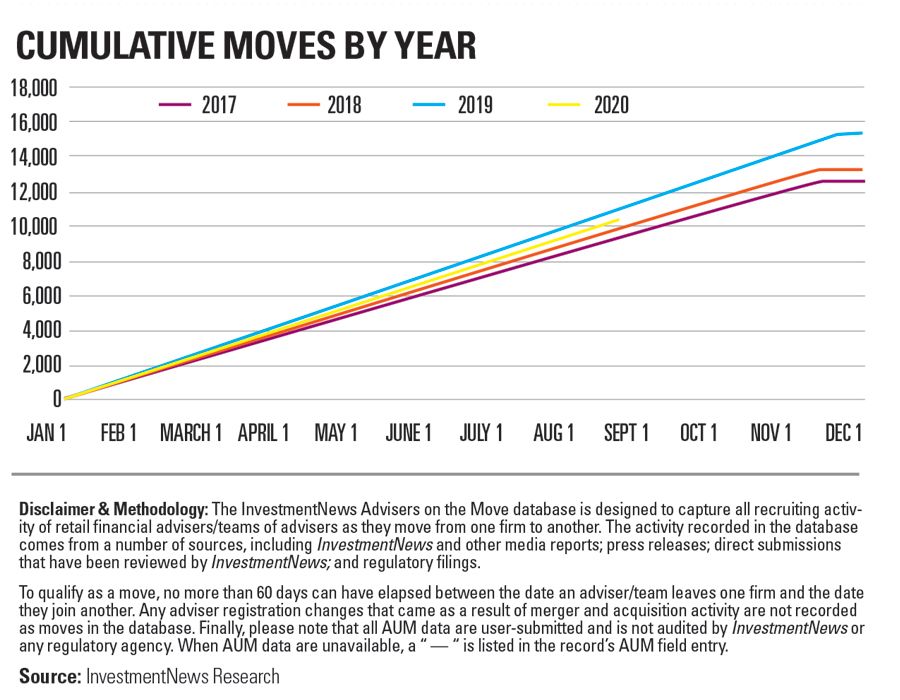

That’s down a bit from last year, when RIAs had a net increase of 998 advisers over the first nine months of 2019, a bump of 6.7%

Meanwhile, the wirehouse channel, which has been bleeding advisers to the competition for years, is the worst performing in terms of gaining experienced advisers, posting a net loss of 1,005 advisers for the first three quarters of the year.

Looming over the landscape for advisers jumping to a new firm or considering starting their own at the moment is the massive acquisition by the Charles Schwab Corp. of TD Ameritrade, both of which operate giant custodians that work directly to support the business operations of RIAs. What will that combination eventually look like?

This could have an impact on the so-called hybrid firm, which operates both as an RIA that charges clients fees and as a broker, which charges commissions for transactions, said one recruiter.

“You’re going to continue to see more and more hybrid advisers going from one broker-dealer to another or one custodian to another looking for flexibility on pricing for technology and custody services,” said Jeremy Belfiore, CEO of Trusted Visions Placement & Consulting.

“This has been the year of the wirehouse adviser for us, as well as other employee models,” said Daniel Schwamb, executive vice president of business development at Kestra Financial. “The pandemic and working from home have opened the eyes of many of those types of advisers to the fact that they don’t need the office and support staff they thought they needed.”

“Instead, technology is more important than ever — having digital signature of documents and the ability to view client accounts on any device has come to the fore,” he said. “The question for those advisers is how can they do business without being in front of the client? That means those captive or employee firms will continue to be under pressure.”

Working as an independent RIA has upsides and downsides for advisers compared to working at one of the four wirehouses.

RIAs have lower overhead and advisers typically keep a higher share of revenue — in the range of 60 cents to 70 cents per dollar generated — than advisers at wirehouses, who are paid typically in the range of 35 cents to 40 cents per dollar of revenue.

Advisers who own their own RIAs also have certain tax advantages as small-business owners, while wirehouse advisers often receive steady referrals of clients because of the national brands of the banks.

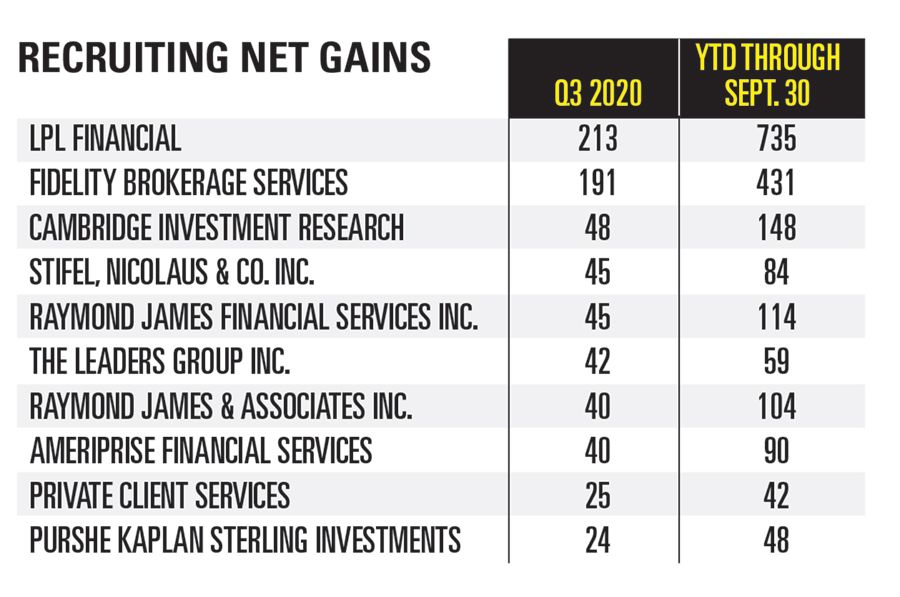

Also of note, Fidelity Brokerage Services had a net gain of 191 advisers in the third quarter and 431 over the first nine months of the year, according to InvestmentNews Research.

Fidelity Investments said last month it intends to hire 4,000 people over the next six months as the money manager benefits from this year’s turmoil while some of its rivals struggle.

The company said in October that the additions would be in areas including financial advisers and customer service agents and represent a 15% increase in associates who focus on clients.

Learn more about reprints and licensing for this article.