Retirement millionaires hit record, Fidelity says

The increase in the number of millionaires reflects both higher savings rates and the market's rally

The bull market is minting plenty of millionaires — at least when it comes to retirement accounts.

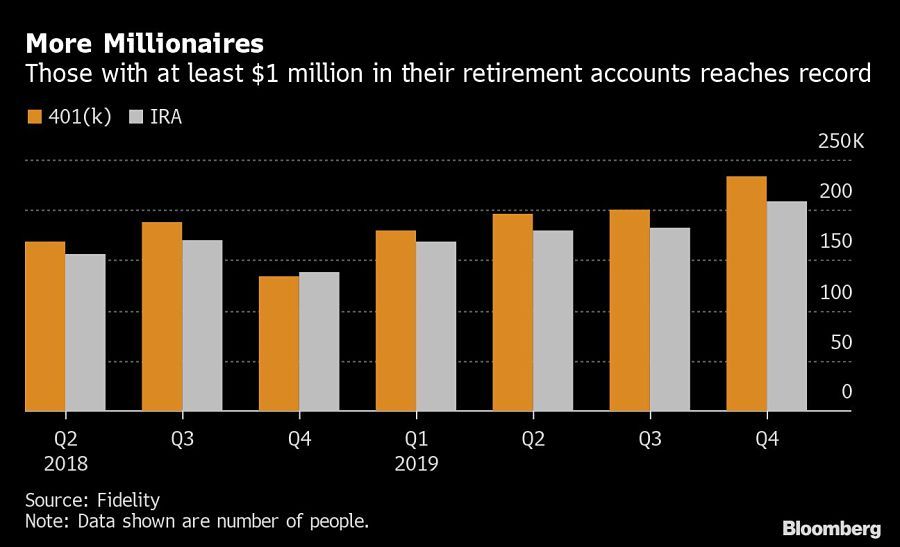

The number of people with $1 million or more in their 401(k) or individual retirement account on the Fidelity Investments platform reached record levels last quarter, fueled by higher savings rates along with market appreciation, the fund company said in a report Thursday.

Some 233,000 savers held seven-figure 401(k)s as of Dec. 31, up about 17% from the prior quarter. Among IRA holders, 208,000 people made the club, a 14% increase. Investor savings rates have been trending higher in part because employers are automatically increasing their contributions.

Fidelity said the average 401(k) account balance at the end of last year was $112,300, which is also a record high and up 7% from the third-quarter balance of $105,200. The average balance in individual retirement accounts hit a record $115,400, up 5% from the third quarter.

[More: Advisers want age to continue to climb for mandatory retirement savings withdrawals]

Learn more about reprints and licensing for this article.