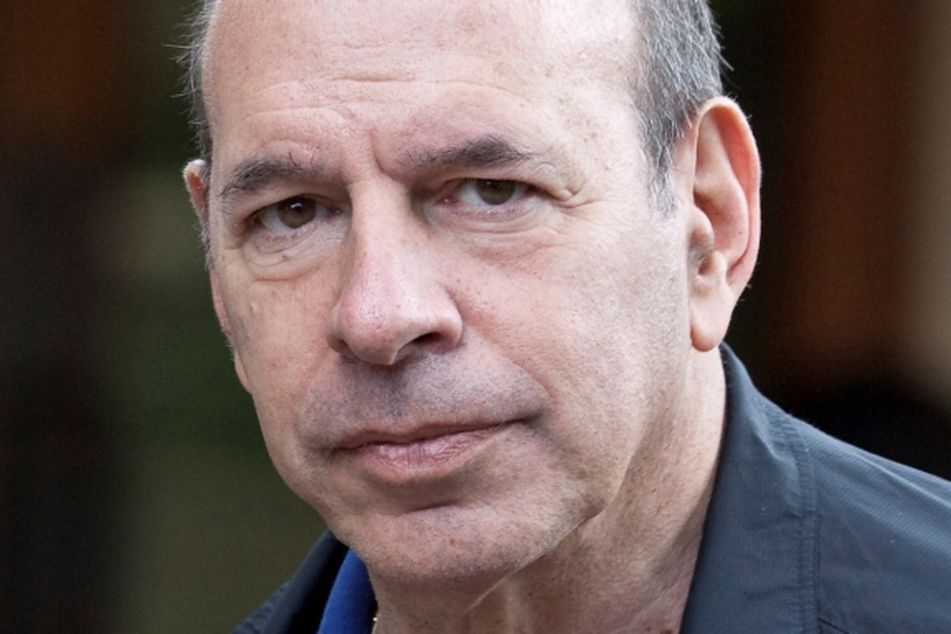

SEC sues Ken Starr lawyer for helping steal $25M adviser’s clients

The U.S. Securities and Exchange Commission sued an attorney for Kenneth Starr, claiming he helped the former New York money manager steal more than $25 million from investors.

The U.S. Securities and Exchange Commission sued an attorney for Kenneth Starr, claiming he helped the former New York money manager steal more than $25 million from investors.

Jonathan Bristol, a former partner at Winston & Strawn LLP, funneled stolen investor funds to Starr through attorney trust accounts from November 2008 through May of this year, the SEC said today in a lawsuit filed at federal court in New York. Starr pleaded guilty in September to defrauding his clients of as much as $50 million.

Bristol, 55, never disclosed the existence of the attorney trust accounts to his law firm, and monthly account statements listing the names of Starr’s clients as the source of funds were sent to Bristol’s home instead of the law firm, according to the lawsuit.

“Bristol had a legal and professional responsibility not to assist Ken Starr in conduct he knew was unlawful,” George Canellos, director of the SEC’s New York regional office, said in a statement. “Bristol crossed the line from lawyer to conspirator when he failed to safeguard funds entrusted to him, helped Starr steal client money, and lied to the victims to perpetuate the scheme.”

Bristol lied to one of Starr’s victims after being confronted about an unauthorized $1 million transfer, the SEC said in its complaint. He told the investor the funds were being bundled with other clients’ money for an investment when in reality it had been used to pay a multimillion-dollar legal settlement with another former client, the agency said.

Gerard Hanlon, an attorney for Bristol at Hanlon, Dunn & Robertson, didn’t immediately return a call seeking comment.

Starr, who handled a roster of celebrity clients including actors Sylvester Stallone and Wesley Snipes, could face more than 12 years in prison when he is sentenced Feb. 2.

Bloomberg

Learn more about reprints and licensing for this article.