Settlements at old Schorsch REIT could cost shareholders $730 million

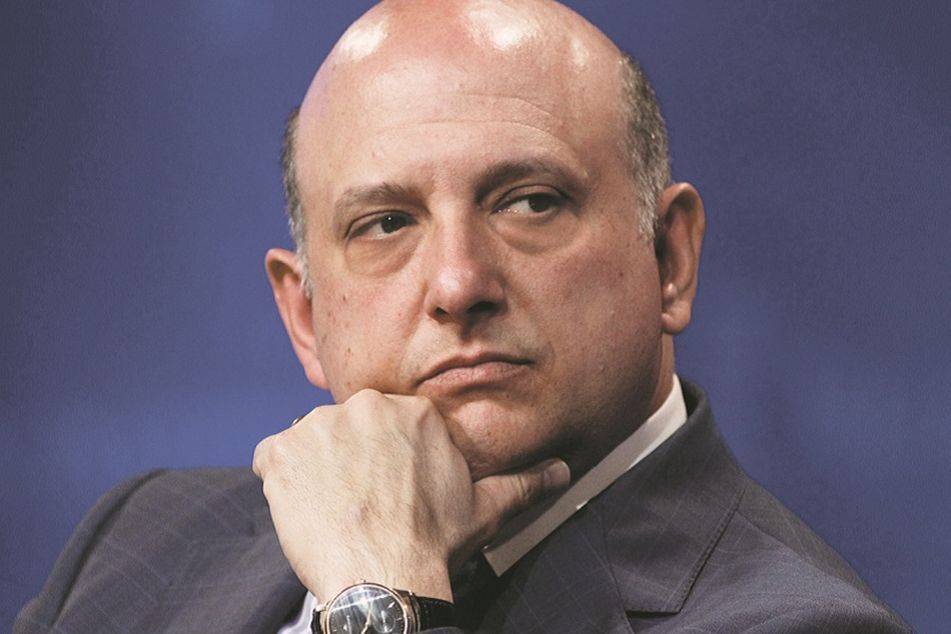

Nicholas Schorsch

Nicholas Schorsch

Accounting scandal from 2014 could wind up costing shareholders 75 cents per share, analyst says.

Vereit Inc., a net lease real estate investment trust, could be on the hook for as much as $730 million in settlement payments stemming from an accounting scandal four years ago when the company was controlled by Nicholas Schorsch, the former nontraded REIT czar.

The object of a number of investor complaints, Vereit on Tuesday said that it had reached settlement agreements with eight plaintiffs for $85 million over the matter; earlier in June, the company said it had agreed to pay mutual fund giant Vanguard $90 million to settle the matter.

Vereit still faces a class action lawsuit from other investors, and giant investment manager TIAA-CREF is the lead plaintiff in that complaint. Another large payment to investors could be looming.

One analyst noted that the settlements to date for $175 million accounted for about 24% of the claims being made against the company. That puts “the implicit mark on the whole settlement at $730 million,” or about 75 cents per share, according to a research note by Anthony Paolone of J.P. Morgan Securities.

“We think that the fact [Vereit] is getting through these lawsuits is a positive despite the settlements running higher than expected,” Mr. Paolone wrote. “The lawsuits have acted as a significant drag on value and have impeded the stock’s ability to re-rate, in our view. There is ample room for the settlements to run higher than what we’ve assumed in our model and still leave room for the stock to move up.”

Vereit’s agreements with the investors don’t contain any admission of liability, wrongdoing, or responsibility of any of the parties, the company said in a statement.

A spokesman for the company, Stefan Prelog, declined to comment further.

Michael Anderson, a spokesman for AR Global, the privately held real estate investment manager Mr. Schorsch controls, was not available Wednesday to comment.

Vereit was formerly known as American Realty Capital Properties Inc., or ARCP, when the accounting scandal broke in October 2014. At the time, ARCP revealed a $23 million accounting error that had resulted in the company reporting inflated financial results. ARCP’s stock plunged 21% on the day the accounting error was announced and has never recovered.

On Wednesday morning, Vereit shares opened trading at $7.20, down 7.8% for the year.

Vanguard sued Vereit, Mr. Schorsch and other former executives in October 2015, alleging “a multi-year fraud and attempted cover-up orchestrated by the top corporate executives at ARCP” when Mr. Schorsch was CEO and chairman of the company. The allegations in the other investor complaints are similar.

The fallout from the ARCP 2014 accounting scandal has been significant.

Brian Block, ARCP’s former chief financial officer, was convicted of securities fraud and sentenced to 18 months in prison and fined $100,000. The government had sought a sentence of at least seven years. Mr. Block is appealing the conviction.

Learn more about reprints and licensing for this article.