Should I stay or should I grow? Top tech questions to ask when considering a move

At some point in their careers, financial advisers often feel their business has stalled. Now more central to…

At some point in their careers, financial advisers often feel their business has stalled. Now more central to business growth than ever, technology is often cited as the pain point prompting advisers to start shopping for a new affiliation.

Advisers may know what they don’t like about their current technology but are unsure how to thoroughly vet a prospective broker-dealer’s platform and the level of technology support they will receive. Many independent broker-dealers operate under the assumption that advisers will be responsible for selecting, installing and maintaining their own hardware and software, as well as training their own staff in its use. While some advisers may prefer such latitude, others would prefer to leave technology to experts and be able to access superior tech support.

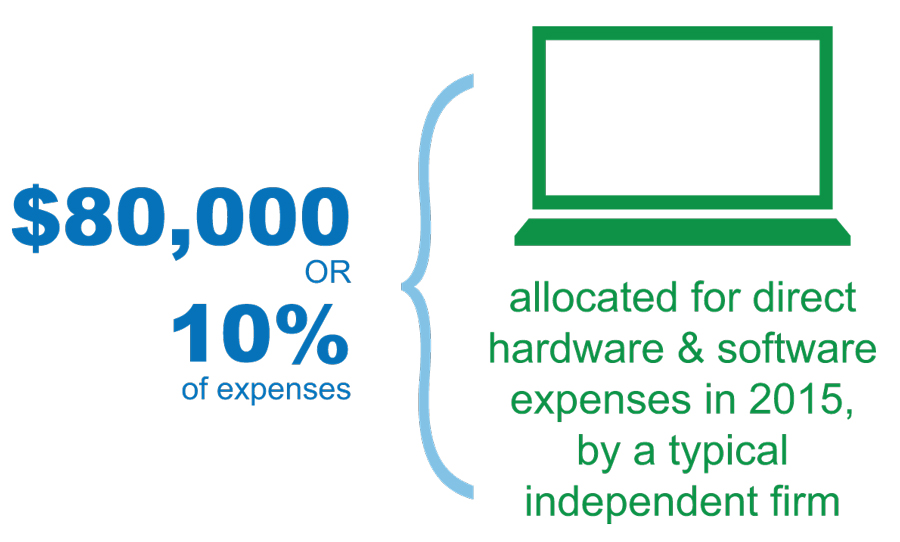

The typical independent firm or branch allocated an average of $80,000 to direct hardware and software investments, according to the 2015 InvestmentNews Adviser Technology Study, or 4% and 10% of revenue and expenses, respectively. This does not include consultant or staff positions dedicated to technology, which are often necessary to fully leverage and maximize an investment in technology.

As technology evolves continuously, so too must the technology platform, as well as the expense: The average independent firm or branch saw its technology costs increase 22.4% over the last year, according to the InvestmentNews Technology Study.

Advisers should also assess any firm being considered for their technology prowess in three critical areas:

• mobile applications

• cybersecurity

• incorporation of robo advice.

As more and more clients — baby boomers and millennials alike — increase their usage of mobile devices, advisers who don’t or can’t embrace and support mobile connectivity will face constraints on business growth. Whether or not an adviser’s current clients use mobile devices now for their investment or financial dealings, future growth could hinge on whether advisers will be accessible 24/7 through whatever communication channels a client wishes to use — and whether those choices ensure the security of client information and offer the greatest protection against cybercrime and identity theft.

Similarly, algorithmically-generated investment selection is growing in popularity and becoming an increasingly attractive way for advisers to serve less affluent investors or those who want a different kind of advisery relationship. Firms that provide robo advice as part of their offering give advisers tools they can use now to establish a leadership position among clients.

Here are some key tech questions to ask yourself, and your next firm.

• To what extent do you want to manage your own technology choices and operations?

• How serious and in-depth is the firm’s commitment to protecting the integrity and security of client and adviser data?

• Are the broker-dealer’s operations capable of handling the full range of the practice’s current business and the new business it plans to do?

To learn more about the key considerations advisers should take into account when contemplating a move, download the Charles Schwab Independent Branch Services white paper, “Should I Stay or Should I Grow?”

Learn more about reprints and licensing for this article.