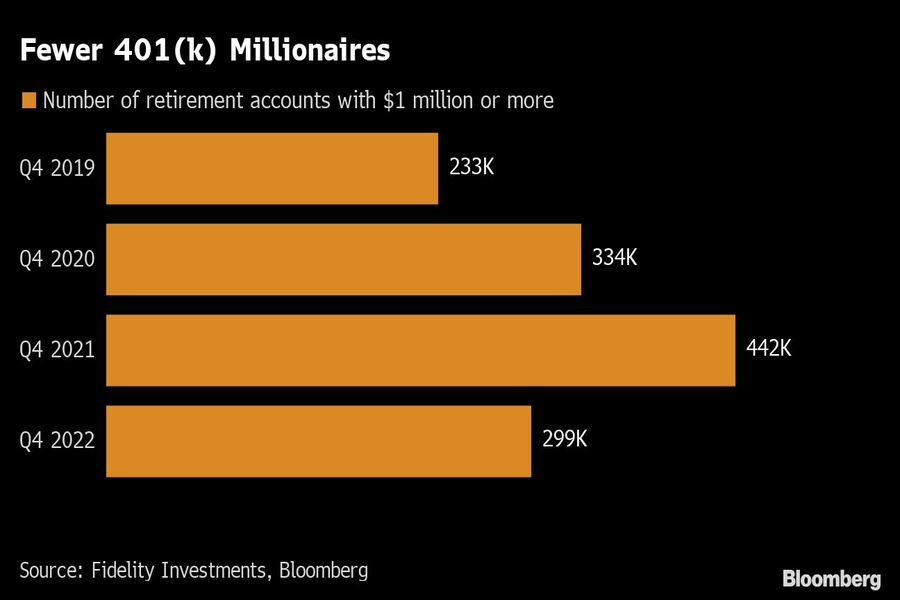

Number of 401(k) millionaires drops by a third in 2022

The outlook isn’t much better for 2023 as investors continue to deal with persistent inflation and economic uncertainty.

The 401(k) millionaire club has shrunk by a third.

Fidelity Investments had just 299,000 seven-figure workplace retirement accounts at the end of 2022, down from 442,000 a year prior, according to data from the asset manager.

The decline in million-dollar-plus savings came as the average 401(k) lost 20% of its value last year, hit by the slump in bonds and mega-cap tech stocks. The outlook isn’t much better for 2023, as investors continue to battle big headwinds from persistent inflation and continued economic uncertainty. Investors including Rob Arnott, co-founder of Research Affiliates, warn that the U.S. stock market “crash is far from finished.”

Investors may have multiple 401(k)s at Fidelity so it isn’t clear exactly how many individuals are represented in the diminished pool of accounts with at least $1 million. Most accounts are far, far smaller, with the average 401(k) account at Fidelity standing at $103,900 in 2022’s fourth quarter.

While many savers would be happy to have even that amount, one group of investors thinks far more is needed to achieve a comfortable retirement — the 553 people surveyed in Bloomberg’s latest MLIV Pulse survey said they’d need between $3 million and $5 million. About a third of investors pegged a comfortable retirement at $3 million, and roughly another third at $5 million.

Most respondents of the MLIV Pulse survey are optimistic they’ll move closer to their retirement goal by ending 2023 with more in retirement savings than at the end of 2022. Last year, inflation and rising borrowing costs hammered stocks, and since bond prices also plunged, the average U.S. 401(k) retirement account was down 20% at plans where Vanguard Group is a record keeper.

How to pick sustainable stocks from the bottom up

Learn more about reprints and licensing for this article.