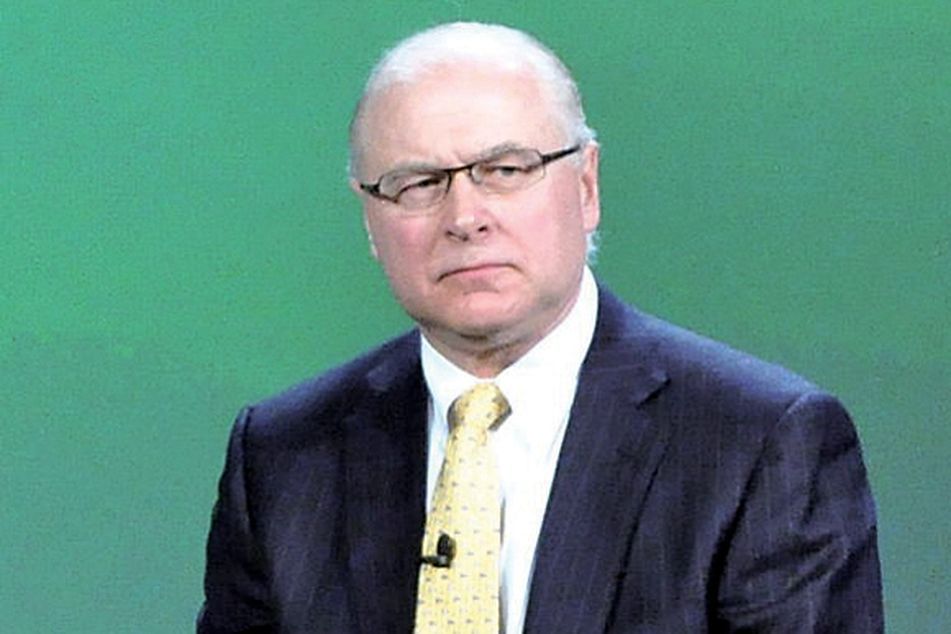

Tomczyk: Long-term rates won’t stay low for long

TD's CEO sees those rates rising this year; short-term interest rates likely to stay low

Long-term interest rates are likely to see some relief this year as Europe nears a resolution to its financial turmoil.

“The uncertainty around Europe is weighing down the yield curve,” Fred Tomczyk, president and chief executive of TD Ameritrade Holding Corp., said at the company’s annual institutional conference. “We expect those rates to start to rise as Europe reaches a resolution in six months to a year.”

The recovery in Europe is starting to take shape, but that doesn’t mean a recession isn’t on the way in the European Union. “Massive austerity measures usually mean a deep recession,” Mr. Tomczyk said. He added that a recession is likely already priced into the European stock market.

The U.S companies that will feel the impact the most are the large multinational companies such as those in the Dow Jones Industrial Average, he said.

Short-term interest rates are still probably going to remain near zero for the next two years, as the Federal Reserve has forecasted.

“The recovery is just too slow. Some recent data has been encouraging, but it’s not enough,” Mr. Tomczyk said.

Low short-term interest rates are particularly harmful to TD. About half of its businesses are interest-rate-sensitive, Mr. Tomczyk said. Margins in those businesses have gone from 480 basis points in 2008 to just over 200 today.

In response, TD has made changes in the way it handles cash management, swapping money market funds for bank deposits, for example.

Learn more about reprints and licensing for this article.