Apple wades deeper into financial services territory

An Apple Inc. logo is displayed on a screen during the Apple Worldwide Developers Conference (WWDC) in San Jose, California, U.S., on Monday, June 5, 2017. The conference aims to inspire developers from around the world to turn their passions into the next great innovations and apps that customers use every day across iPhone, iPad, Apple Watch, Apple TV and Mac. Photographer: David Paul Morris/Bloomberg

An Apple Inc. logo is displayed on a screen during the Apple Worldwide Developers Conference (WWDC) in San Jose, California, U.S., on Monday, June 5, 2017. The conference aims to inspire developers from around the world to turn their passions into the next great innovations and apps that customers use every day across iPhone, iPad, Apple Watch, Apple TV and Mac. Photographer: David Paul Morris/Bloomberg

The tech giant isn't a threat to advisers yet, but it's easy to see where the company goes from here.

Apple is slowly wading deeper into financial services. After dipping a toe in with Apple Pay in 2014, the company’s latest product — a proprietary credit card offered in partnership with Goldman Sachs — takes a full step into the waters.

(More: Now you can use Apple Pay to transfer money into TD Ameritrade brokerage accounts)

Apple Card will include a cash-back and rewards program that encourages people to spend with their devices, as well as a physical card to use with merchants that don’t accept iPhone. It will also integrate with the Apple wallet app to help users track spending, debt and when payments are due.

Analysts like Bloomberg’s David Ritter say Apple Card is unlikely to disrupt the existing credit card market, “since its core features are similar to those of numerous other cards offered by leaders such as Citi and Chase, which also provide a much wider range of benefits and reward-redemption options.”

Nonetheless, the devotion millions of consumers have to the Apple brand will inevitably result in decent participation, and that’s going to help Apple lay the foundation for a larger play in financial services: a financial advice and planning platform.

According to a September report from Moody’s Investors Service, the greatest risk to incumbent financial institutions is that retail-facing technology giants like Apple take control of customer relationships and the distribution of financial products.

Apple Card hopes to tackle some of the issues consumers have long had with credit card statements and how information like interest rates and due dates are presented to cardholders, Bloomberg reported. Apple will try to clearly label its transactions with merchant names and locations and provide color coding that gives consumers an easier-to-grasp breakdown of their spending on categories such as food, shopping and entertainment.

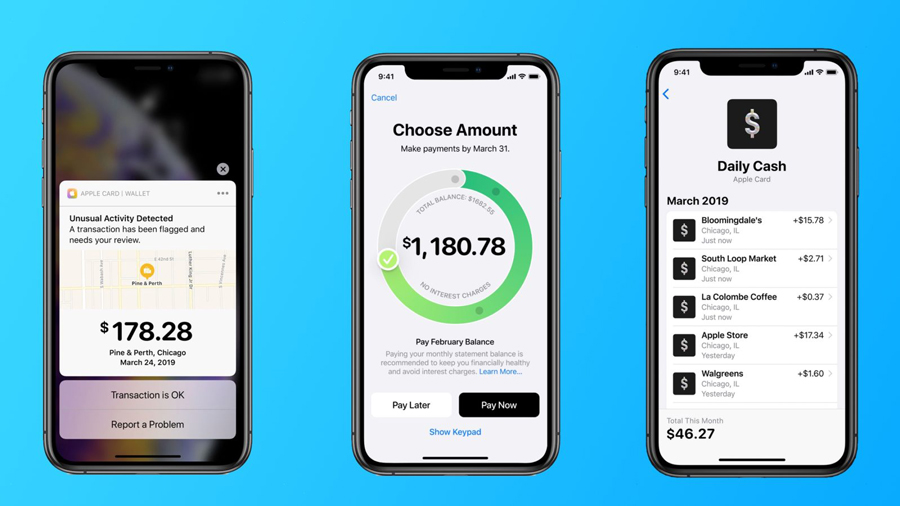

Just look at the user interface:

It’s just budgeting for now, but the design is similar to what’s offered at consumer-facing robo-advisers, and far better than what most traditional advisory firms can provide. It really doesn’t take the imagination of a Steve Jobs to picture Apple extending this interface to offer loans, CDs or high-yield savings accounts.

It just so happens their new credit card partner offers those products in the form of Marcus.

After that, Apple simply needs to partner with asset managers for access to low-cost index funds and insurance, and build out some investment advice and financial planning algorithms. With Apple providing the technology, asset managers get a distribution platform that’s already in the hands of millions of loyal customers.

Apple isn’t the only technology giant developing this. Microsoft is working with BlackRock to build some type of new retirement platform.

(More: BlackRock pivoting to technology could serve as blueprint for other asset managers)

Tech allows asset managers to cut out the middle man and put products directly in front of customers. While at first these technology companies will be looking squarely at the mass market rather than the high-net-worth investors most advisers serve, they could eventually become a major threat.

Whenever technology companies make forays into financial services, defensive advisers retort that financial services is a highly complex and regulated industry. Why would Apple, Amazon, Google or anyone else to get involved?

The answer, as always, is money. Apple’s share of the phone market declined from 18% in Q4 2017 to 16% in Q4 2018, said Ted Rossman, an analyst with CreditCards.com.

“I definitely see why Apple is doing this: They want to juice Apple Pay usage,” Mr. Rossman said, adding that only 32 million people use Apple Pay compared to PayPal/Venmo’s user base of 267 million.

“Plus, as a merchant, they’ll save on interchange fees when Apple Card users buy something from Apple,” he said. “And as a service provider, they’ll get a cut of Apple Card transactions elsewhere.”

To stymie revenue losses, Apple CEO Tim Cook laid out a plan in February to shift the company’s focus to services, including subscription entertainment, artificial intelligence, smart homes, self-driving cars and health care. Financial services would be just another feather in the company’s cap, one that would help ensure Apple devices remain valuable items.

Learn more about reprints and licensing for this article.