Sponsored Content from S&P Dow Jones Indices

Active or Agnostic?

To generate value for clients, an active manager must deviate from a passive benchmark by choosing strategies that the manager predicts will outperform. How accurate do the predictions need to be?

In order to generate value for his clients, an active investment manager must deviate from a passive benchmark—by choosing sectors, or styles, or individual stocks that the manager predicts will outperform. The manager’s value is dependent on the accuracy of his predictions; the better he is at identifying the best sectors, or styles, or stocks, the better his results will be. A passive manager, on the other hand, acknowledges his (literal) ignorance about future returns.

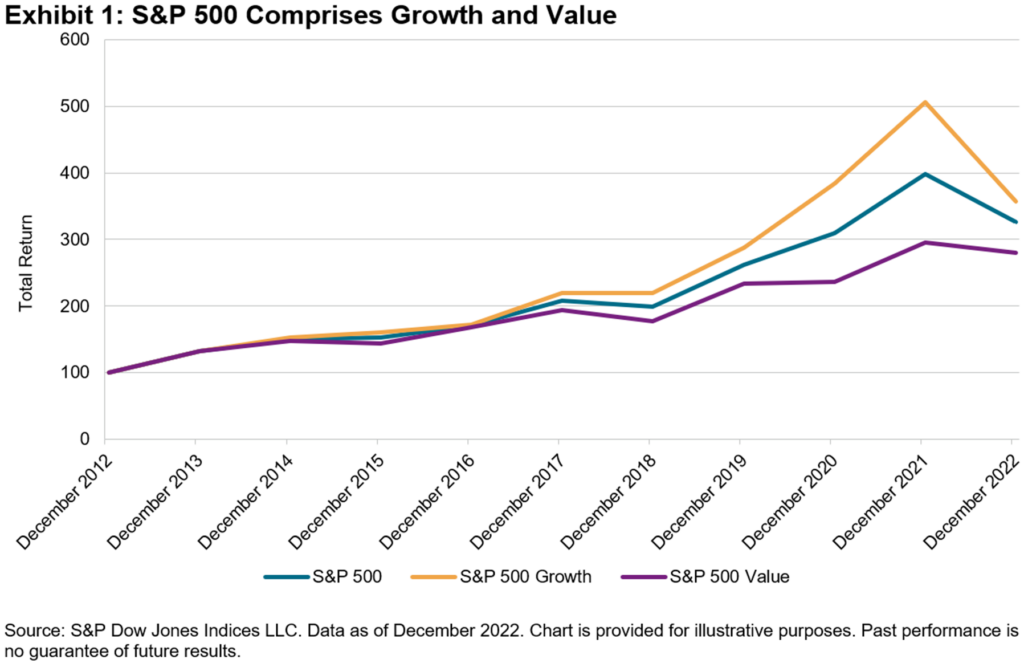

How accurate do active predictions need to be? How accurate are they in practice? A simple thought experiment can help explore these questions: we’ll think simply about rotating between growth and value as a means of outperforming the S&P 500®. For the 10 years ending in December 2022, the S&P 500’s total return was 12.6%, while the S&P 500 Growth and S&P 500 Value indices returned 13.6% and 10.9%, respectively. Since Growth and Value combined compose the S&P 500, Exhibit 1 is unsurprising.

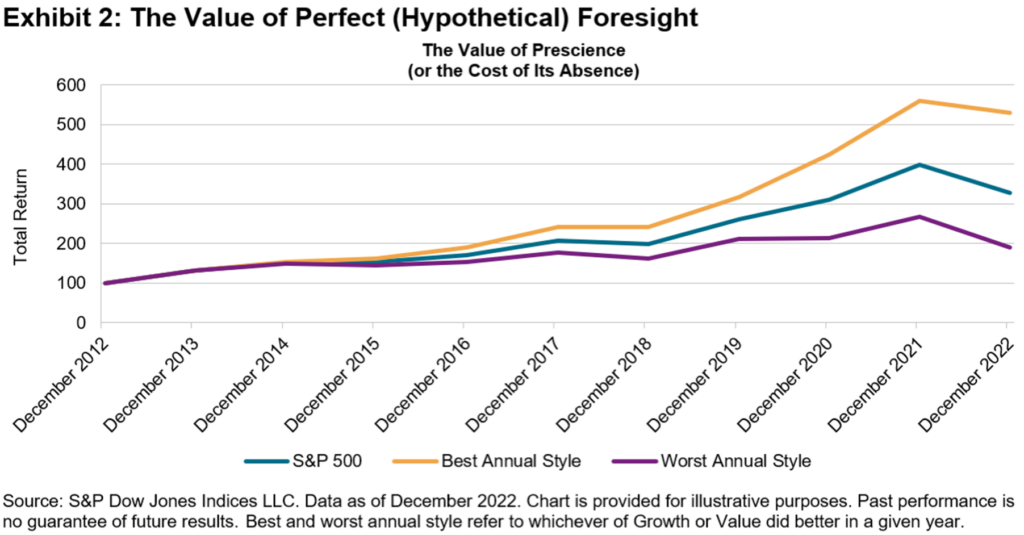

Suppose, arguendo, that an investor shifts annually to the style he predicts will outperform. The limits on such an investor’s performance are shown in Exhibit 2.

An investor who was correct every year would hypothetically earn a compound return of 18.2% for the period; if he was wrong every year the CAGR would fall to 6.6%.

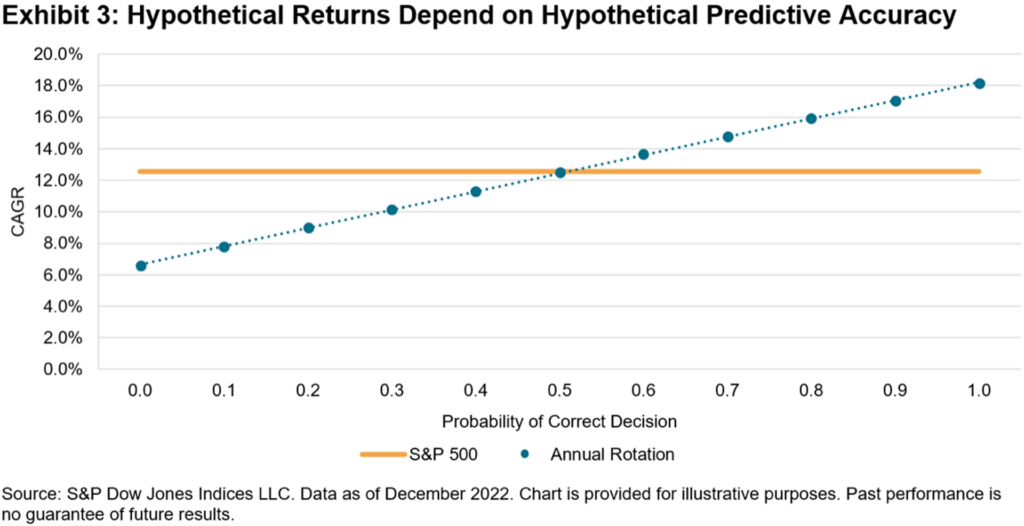

Of course, it’s unlikely that anyone trying this strategy in real life would be correct—or incorrect—every year. Exhibit 3 shows how the return to a tactical rotational strategy would vary depending on the probability of making the correct call. With a probability of 0.1, e.g., at the beginning of every year, the investor would have a 10% likelihood of choosing the better performer and a 90% likelihood of choosing the worse performer.

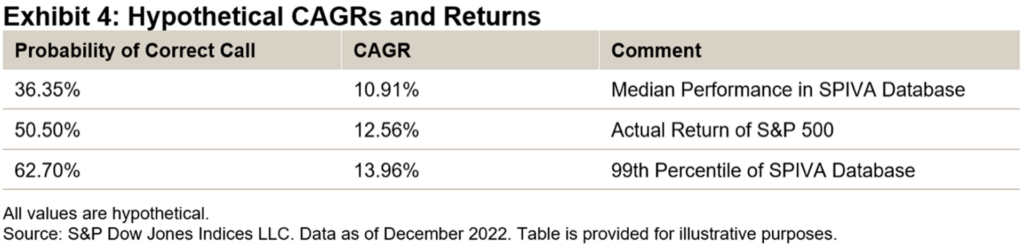

If every decision were right (probability = 1.0), the investor’s CAGR would be 18.2%; if every decision were wrong (probability = 0.0), it would be 6.6%. What’s interesting is to observe what happens between those limits, as summarized in Exhibit 4.

From these observations we can make some inferences about the prospects for successful style rotation:

- The performance of the median large-cap U.S. equity manager in our SPIVA® database is consistent with a 36.35% probability of making the right style call—-i.e., worse than a coin flip.

- Flipping a coin would have produced approximately the return of the S&P 500, which would have meant a top-quartile ranking for a large-cap U.S. equity manager. But if flipping a coin is the best you can do, it’s better not to bother and just track the S&P 500.

- Predictive accuracy levels above 63% would have produced returns that no manager actually produced, which implies that no active manager had that level of predictive accuracy.

Passive investors can be comfortable in their agnosticism.

This article was originally published at Indexology® Blog on June 6, 2023 https://www.indexologyblog.com/2023/06/06/active-or-agnostic/

General Disclaimer

© 2023 S&P Dow Jones Indices. All rights reserved. S&P, S&P 500, SPX, SPY, The 500, US500 , US 30, S&P 100, S&P COMPOSITE 1500, S&P 400, S&P MIDCAP 400, S&P 600, S&P SMALLCAP 600, S&P GIVI, GLOBAL TITANS, DIVIDEND ARISTOCRATS, Select Sector, S&P MAESTRO, S&P PRISM, S&P STRIDE, GICS, SPIVA, SPDR, INDEXOLOGY, iTraxx, iBoxx, ABX, ADBI, CDX, CMBX, MBX, MCDX, PRIMEX, HHPI and SOVX are trademarks of S&P Global, Inc. (“S&P Global”) or its affiliates. DOW JONES, DJIA, THE DOW and DOW JONES INDUSTRIAL AVERAGE are trademarks of Dow Jones Trademark Holdings LLC (“Dow Jones”). These trademarks together with others have been licensed to S&P Dow Jones Indices LLC. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. This document does not constitute an offer of services in jurisdictions where S&P Dow Jones Indices LLC, S&P Global, Dow Jones or their respective affiliates (collectively “S&P Dow Jones Indices”) do not have the necessary licenses. Except for certain custom index calculation services, all information provided by S&P Dow Jones Indices is impersonal and not tailored to the needs of any person, entity or group of persons. S&P Dow Jones Indices receives compensation in connection with licensing its indices to third parties and providing custom calculation services. Past performance of an index is not an indication or guarantee of future results.

It is not possible to invest directly in an index. Exposure to an asset class represented by an index may be available through investable instruments based on that index. S&P Dow Jones Indices does not sponsor, endorse, sell, promote or manage any investment fund or other investment vehicle that is offered by third parties and that seeks to provide an investment return based on the performance of any index. S&P Dow Jones Indices makes no assurance that investment products based on the index will accurately track index performance or provide positive investment returns. S&P Dow Jones Indices LLC is not an investment advisor, and S&P Dow Jones Indices makes no representation regarding the advisability of investing in any such investment fund or other investment vehicle. A decision to invest in any such investment fund or other investment vehicle should not be made in reliance on any of the statements set forth in this document. S&P Dow Jones Indices is not an investment adviser, commodity trading advisor, commodity pool operator, broker dealer, fiduciary, promoter” (as defined in the Investment Company Act of 1940, as amended), “expert” as enumerated within 15 U.S.C. § 77k(a) or tax advisor. Inclusion of a security, commodity, crypto currency or other asset within an index is not a recommendation by S&P Dow Jones Indices to buy, sell, or hold such security, commodity, crypto currency or other asset, nor is it considered to be investment advice or commodity trading advice.

These materials have been prepared solely for informational purposes based upon information generally available to the public and from sources believed to be reliable. No content contained in these materials (including index data, ratings, credit-related analyses and data, research, valuations, model, software or other application or output therefrom) or any part thereof (“Content”) may be modified, reverse-engineered, reproduced or distributed in any form or by any means, or stored in a database or retrieval system, without the prior written permission of S&P Dow Jones Indices. The Content shall not be used for any unlawful or unauthorized purposes. S&P Dow Jones Indices and its third-party data providers and licensors (collectively “S&P Dow Jones Indices Parties”) do not guarantee the accuracy, completeness, timeliness or availability of the Content. S&P Dow Jones Indices Parties are not responsible for any errors or omissions, regardless of the cause, for the results obtained from the use of the Content. THE CONTENT IS PROVIDED ON AN “AS IS” BASIS. S&P DOW JONES INDICES PARTIES DISCLAIM ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, FREEDOM FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE CONTENT’S FUNCTIONING WILL BE UNINTERRUPTED OR THAT THE CONTENT WILL OPERATE WITH ANY SOFTWARE OR HARDWARE CONFIGURATION. In no event shall S&P Dow Jones Indices Parties be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs) in connection with any use of the Content even if advised of the possibility of such damages.

S&P Global keeps certain activities of its various divisions and business units separate from each other in order to preserve the independence and objectivity of their respective activities. As a result, certain divisions and business units of S&P Global may have information that is not available to other business units. S&P Global has established policies and procedures to maintain the confidentiality of certain non-public information received in connection with each analytical process.

In addition, S&P Dow Jones Indices provides a wide range of services to, or relating to, many organizations, including issuers of securities, investment advisers, broker-dealers, investment banks, other financial institutions and financial intermediaries, and accordingly may receive fees or other economic benefits from those organizations, including organizations whose securities or services they may recommend, rate, include in model portfolios, evaluate or otherwise address.

Learn more about reprints and licensing for this article.

This content is made possible by S&P Dow Jones Indices; it is not written by and does not necessarily reflect the views of InvestmentNews' editorial staff.