Want to short high-yield debt? Here’s an ETF for you

Tabula Investment Management launched an exchange-traded fund that lets investors bet against high-yield debt issued by North American companies

Junk-bond bears have had a tough run lately, but that’s not stopping industry players from touting new and cheap ways for credit naysayers to ramp up their short bets.

London-based Tabula Investment Management launched an exchange-traded fund Tuesday that lets investors wager against a basket of high-yield debt from around 100 companies across North America.

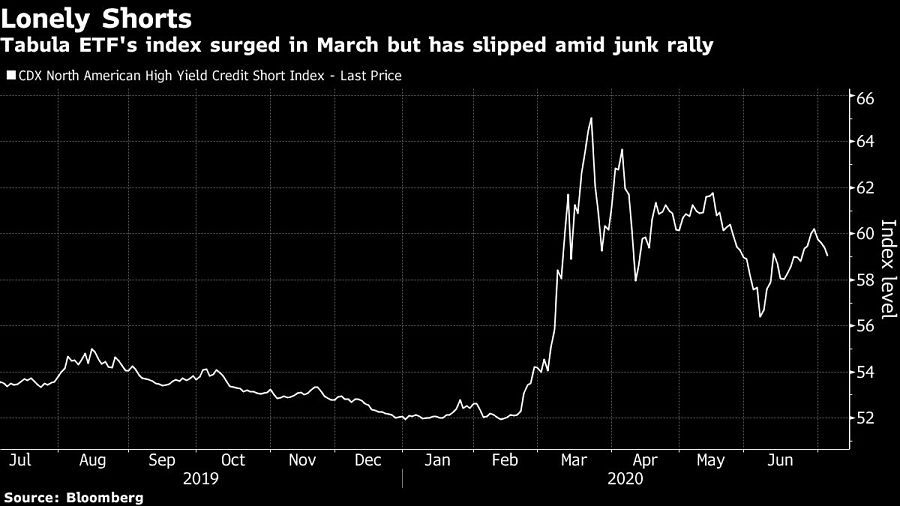

The Europe-listed fund (TABS) uses credit derivatives to track the performance of the CDX North American High Yield Credit Short Index, which is dominated by BB-rated names and heavily weighted in the consumer and industrials sectors.

At a net asset value of around $100 per share and a cost of 50 basis points a year, the ETF aims to provide an easy way to hedge a high-yield portfolio — or bet that a wave of defaults stops the recent sub-investment-grade rally in its tracks.

“Financial market indicators are optimistic relative to both credit and economic indicators,” said Jason Smith, Tabula’s chief investment officer. “Investors need to review their exposure to high-yield U.S. debt and consider strategies for protecting against any rise in defaults.”

Bolstered by Federal Reserve buying and rebounding from a brutal first quarter, junk bonds just capped their best three months in a decade while new issuance surged to a record of more than $58 billion in June. Companies rated high yield that have been walloped by the coronavirus are tapping lenders who are betting that the pain will be temporary.

Bears point to fresh outbreaks of the pandemic, while the speculative-grade corporate default rate could triple by next March, according to S&P Global Ratings.

Investors bearish on junk typically resort to trading derivatives on CDS indexes directly or borrowing shares of U.S.-listed high-yield ETFs, or shorting individual bonds.

Tabula is no stranger to exotic credit funds, having rolled out a short-volatility product last year. That fund held as much as 153 million euros ($173 million) in assets last year, though it holds just 12 million euros now.

Learn more about reprints and licensing for this article.