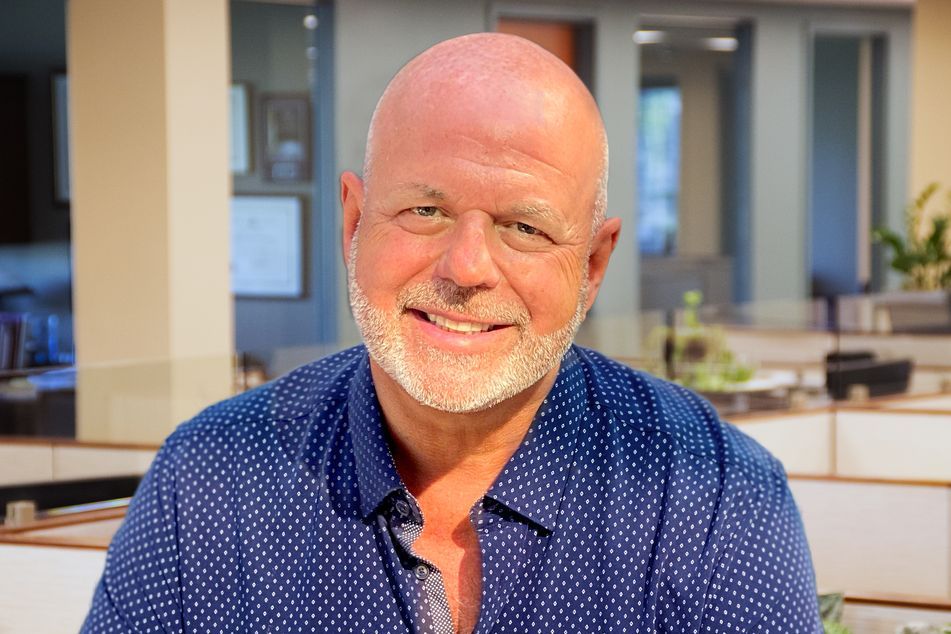

Robert Moore returns to advice business to lead giant LPL branch

The shift in management is not a sign that New Jersey-based Private Advisor Group is for sale, owner says

Robert “RJ” Moore, a senior executive for more than a decade in the independent broker-dealer industry, is returning to the financial advice business after a 1½-year absence to become CEO of Private Advisor Group, the largest office on the platform of LPL Financial with $21 billion in client assets.

Patrick Sullivan and John Hyland are co-founders and now managing directors of Morristown, New Jersey-based Private Advisor Group, which has 650 advisers in its network. Moore will also acquire a “significant” equity stake in the enterprise, Private Advisor Group said in a statement, but it did not release the terms of that agreement.

Moore, an industry veteran, has been in the middle of two of the most consequential transactions of the past ten years in the independent broker-dealer business. To be clear, he is not an employee of LPL but working as the head of a branch that uses LPL for its back office and varied brokerage services.

Moore was chief financial officer of LPL in 2010 when it listed its initial public stock offering, and he was CEO of Cetera Financial Network, which had only recently emerged from bankruptcy, when it was sold to Genstar Capital in 2018.

Both transactions involved firms with thousands of reps and advisers under their roofs. Moore left Cetera in February 2019 due to unspecified health reasons. He then ran a firm that invested in real estate investment trusts.

The wealth management business is literally awash in cash from private equity investors and bankers looking to buy practices, particularly giants like Private Advisor Group. But Moore’s joining the firm should not be mistaken as a sign that the firm is looking to sell, Hyland said in an interview Wednesday morning.

“We have absolutely no plans to sell Private Advisor Group,” Hyland said, adding that he and Sullivan had been seeking a new CEO for almost a year before deciding on Moore, a long-term confidant. “It’s not on our radar. This is really about growing the firm for the future.”

“The outlook for me is to take over the CEO role and make an immediate impact on Private Advisor Group as a destination of choice for financial advisers during this period of wide industry consolidation,” Moore said in the same interview. “I have certainly not been brought in to engineer a quick transaction. That is not the thinking here at all.”

Moore added that his health had improved and he was in a position to fully focus on the firm’s advisers and growth.

Meanwhile, Hyland, who in the past has been public about his fight with cancer, has recently been battling health issues. In August, he was diagnosed with throat cancer; he finished treatment about a month ago.

“My doctors are very optimistic,” Hyland said. “It’s been a rough road, but I believe it’s going to be OK.”

Learn more about reprints and licensing for this article.