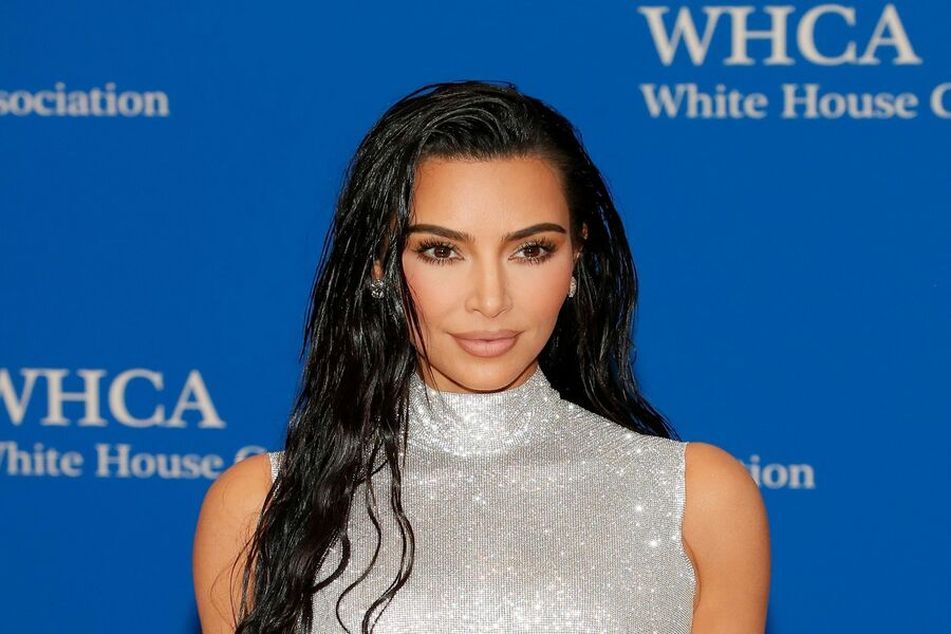

SEC fines Kim Kardashian $1.26 million for endorsing crypto token on Instagram

The securities watchdog said she broke US rules by not disclosing she was paid for the promotion.

Kim Kardashian will pay $1.26 million to settle Securities and Exchange Commission allegations that she broke U.S. rules by touting a crypto token without disclosing she was paid for the promotion.

The SEC said Monday Kardashian was paid $250,000 to post on her Instagram account about EMAX tokens, a crypto asset offered by EthereumMax. Kardashian didn’t admit or deny the regulator’s allegations as part of the settlement, in which she agreed not to tout any digital assets for three years.

The SEC has previously warned that celebrities touting cryptocurrencies it deems securities need to make clear to investors if they’re paid for the backing. In 2018, the regulator fined boxer Floyd Mayweather and music producer DJ Khaled for failing to disclose payments they received for hyping initial coin offerings.

“This case is a reminder that, when celebrities or influencers endorse investment opportunities, including crypto asset securities, it doesn’t mean that those investment products are right for all investors,” SEC Chair Gary Gensler said in a statement on Monday. “We encourage investors to consider an investment’s potential risks and opportunities in light of their own financial goals.”

Kardashian included “#AD” at the bottom of the post in 2021, according to the SEC. Despite that, the SEC said investors weren’t made aware of her being paid for the ad. An attorney for the celebrity didn’t immediately respond to a request for comment.

Wall Street’s main regulator has long asserted that many virtual tokens are securities and under its jurisdiction. To determine whether something is a security, the SEC applies a legal test, which comes from a 1946 Supreme Court decision. Under that framework, an asset can be under SEC purview when it involves investors kicking in money with the intention of profiting from the efforts of the organization’s leadership.

The advertisement was also singled out by the U.K.’s financial regulator last year as part of a crackdown on crypto endorsements by social influencers. Charles Randell, then chair of the Financial Conduct Authority, said Kardashian’s Instagram post “may have been the financial promotion with the single biggest audience reach in history.”

‘IN the Nasdaq’ with Jack Janasiewicz, lead portfolio strategist at Natixis

Learn more about reprints and licensing for this article.