Displaying 245 results

These three companies are dividend superstars

When it comes to shareholder payouts, a trio of businesses stand out, says Goldman PM Troy Shaver

Losing some shine, gold still glitters

Despite last week's sudden pullback in the price of gold, most financial advisers and market watchers aren't ready to abandon the precious metal just yet.

Inflation hedges attractive, but…

Ask financial advisers about their biggest concern over the next 12 to 18 months and most will talk…

Peter Schiff: Why it’s time to dump most U.S. stocks

Stocks are widely believed to provide inflation protection since factories, equipment and inventories rise in value as prices…

Pimco, Neuberger: Big bank debt a good bet

Money managers at both firms say U.S. financial instituations can weather gathering storm in Europe

Interest rate rise unlikely soon, advisers believe

Although they aren't ready to give up their bearish long-term stance on bonds just yet, most financial advisers and other market participants seem to be adjusting downward their short-run expectations for higher rates and economic growth

Inflation: Will lawmakers change the way it’s officially measured?

A proposal to cut Social Security costs and raise tax revenue by changing the way the government measures inflation ran into opposition from Democrats and Republicans.

Peter Schiff: The fix is in

This week's wild actions on Wall Street should serve as a stark reminder that few investors have any clue as to what is really going on beneath the surface of America's troubled economy.

Treasury investors are like frogs in a pot of hot water, Gross says

Investors in U.S. Treasuries are being lulled into a false sense of security by positive returns this year because yields aren't high enough relative to inflation, according to Bill Gross.

Popular TIPS may not deliver what investors expect

Investors flocking to Treasury inflation-protected securities may be in for a rude awakening when interest rates start to…

Funds that can ride possible inflation wave

Mutual funds that invest in floating-rate bank loans have emerged as one of the most popular strategies for protecting portfolios against rising interest rates

Inflation versus CDs: No contest

Savers with cash in longer-term certificates of deposit are losing out to inflation, according to Market Rates Insight

The inflation situation: More companies now eyeing cost increases

Gas isn't the only thing that is getting more expensive. eying

Canary in the coal mine? Temp wages set to rise

Economists say this may be the first real sign that inflation is coming -- and soon

Is the Fed raising rates on the QT?

A recent mortgage-backed securities sale and reverse repos have gone unnoticed by investors fixated on Fed funds rate.

Advisers rate Obama’s performance – and it’s not pretty

Independent financial advisers slam his economic policies; Reagan still the man

Bill Gross: Job gains show quantitative easing is working

Bill Gross, manager of the world's biggest bond fund at Pacific Investment Management Co., said the larger-than-forecast gain in employment suggests the Federal Reserve's policy of quantitative easing is working.

Advisers big on stocks, survey finds

Financial advisers have had their fill of bonds but have a hunger for stocks, according to the results of a January survey released by The Charles Schwab Corp. last Monday

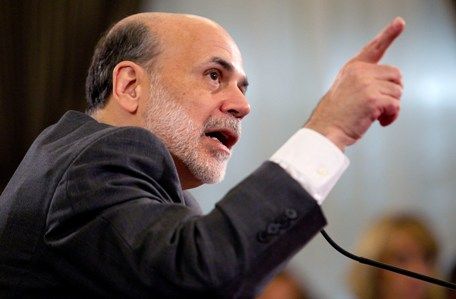

Bill Gross: Why inflation matters more than Bernanke says

Bill Gross, who runs the world's biggest bond fund at Pacific Investment Management Co., said gains in so-called headline inflation matter more for the U.S. economy than Federal Reserve Chairman Ben S. Bernanke suggests.

U.S. in for ’20 years of rising interest rates’: Loomis Sayles

Firm has cut funds' average bond maturities from 19 years to nine