Third Bitcoin futures ETF launches

The VanEck Bitcoin Strategy ETF began trading after a multiweek wait, and days after the SEC rejected the firm's proposal for an ETF that would hold Bitcoin directly.

VanEck’s Bitcoin futures ETF finally launched Tuesday after a multiweek wait and a rejection by regulators of a physically backed product.

The VanEck Bitcoin Strategy ETF (XBTF) began trading with a management fee of 0.65%, the lowest expense ratio among the three such funds available, according to a press release.

VanEck’s ETF had been expected to debut in October, but heavy demand for the ProShares Bitcoin Strategy ETF (BITO) — one of the most successful debuts of all time — stretched capacity among futures commission merchants, according to a person familiar with the matter.

The launch comes days after the Securities and Exchange Commission rejected the firm’s proposal for an ETF that would directly hold Bitcoin. Up to this point, SEC Chair Gary Gensler has said he’s comfortable with futures-based ETFs because Bitcoin futures trade on highly regulated exchanges.

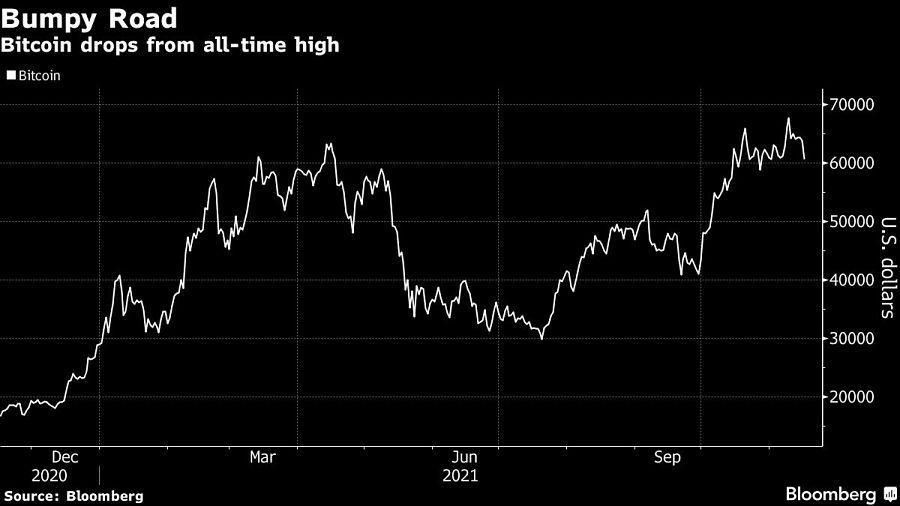

XBTF began trading on a rocky day for the world’s largest cryptocurrency. Bitcoin dropped as much as 8.2% to break below $60,000 before trimming its losses to about 5%.

Learn more about reprints and licensing for this article.