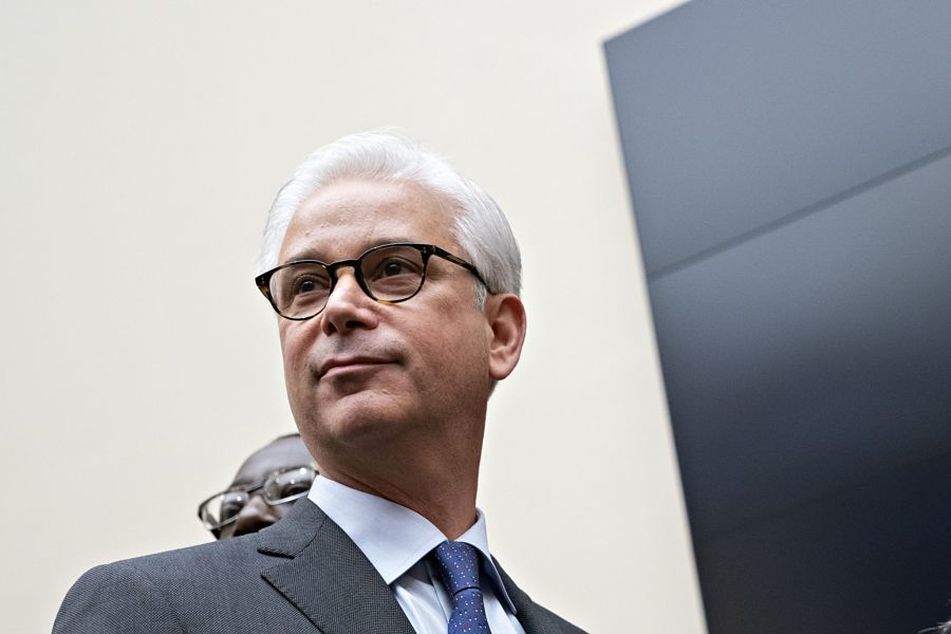

Wells Fargo boosts CEO Scharf’s pay 20% for 2021

Charlie Scharf earned $24.5 million last year, up from $20.3 million for 2020.

Wells Fargo & Co. raised Chief Executive Charlie Scharf’s pay 20% for 2021, a year in which the bank’s profit recovered and shares advanced more than most of its rivals.

The board paid Scharf $24.5 million for his second full year atop Wells Fargo, up from $20.3 million for 2020, according to a filing Monday. The package consisted of a $2.5 million salary, a $5.4 million cash bonus, $10.8 million in performance shares awards and $5.8 million in restricted share rights.

With a 59% gain last year, Wells Fargo’s stock was the third-best performer in the 24-member KBW Bank Index — a stark contrast to 2020, when it was the worst performer of the group. Profit rebounded to above pre-pandemic levels last year after shrinking dramatically in 2020. The San Francisco-based bank, which has been beset by scandals since 2016, also cleared some key regulatory hurdles last year, including the termination of a consent order.

Still, Wells Fargo has nine public regulatory orders that remain in place, including a costly Federal Reserve-imposed asset cap. The firm was handed a fresh consent order from the Office of the Comptroller of the Currency in September over its lack of progress in addressing longstanding problems. Scharf has repeatedly cautioned that while he believes the company is making progress, there will likely be setbacks along the way.

As Scharf’s pay is reported, compensation is in focus across Wall Street this year after pay pressures arose from the junior ranks through the C-suite last year. Morgan Stanley CEO James Gorman, JPMorgan Chase & Co. CEO Jamie Dimon, Goldman Sachs Group Inc. CEO David Solomon and Bank of America Corp. CEO Brian Moynihan also scored raises for 2021 after their respective firms reported annual profit records.

[More: More consolidation to come for Wells Fargo Advisors?]

Learn more about reprints and licensing for this article.