Displaying 2261 results

Fired $2.5 billion Merrill adviser finds home at Wells Fargo

Marc D. Lowe, who was terminated over alleged “inappropriate workplace behavior,” joins Wells' employee channel.

Merrill loses $800 million private banking team

Two advisers from the elite unit broke away to start their own RIA in Texas.

Morgan Stanley hit with $20M whistleblower suit from ex-brokers

Married brokers claim they were retaliated against after reporting alleged illegal sales tactics at the firm's midtown Manhattan office.

Wells Fargo fined $1.5 million for AML failures

The wirehouse failed to comply with anti-money-laundering requirements by not properly vetting some 220,000 new client accounts over a nine-year period, Finra charged.

American Funds making inroads with fee-based advisers

In its sales turnaround, third largest U.S. fund company relies on retention of existing advisers and lower-cost share classes.

Ex-JPMorgan banker partnered with his dad in a multi-year insider-trading ring

Breakfast with Benjamin The banker was caught sharing insider information with his dad, who then used golf jargon to try and disguise the scheme.

‘Culture clash’ led to $2.5 billion Merrill firing: Lawyer

A $2.5 billion broker who was fired this month for “inappropriate workplace behavior,” according to employment records, may have been too bullheaded for the thundering herd, his attorney said.

Under regulatory pressure, Voya restricts sales of more variable annuities

Voya Financial Advisors has restricted sales of variable annuities for the second time in two months, as the brokerage firm faces increased pressure from regulators questioning the suitability of the products for retirement savers.

Morgan Stanley ordered to pay $2.4M arbitration award over former broker’s trades

Broker Steven Mark Wyatt was accused of unauthorized and excessive stock-market trading during and after the 2008 financial crisis.

Fund conversion takes toll on UBS’ fee revenue

Fund conversion takes a toll on UBS' fee revenue, but AUM and revenue per adviser hits a record as the firm sheds lower producers.

Morgan Stanley head count dips to record low

Largest firm by number of advisers cedes ground with 3% one-year drop; executives point to shedding of lower producers.

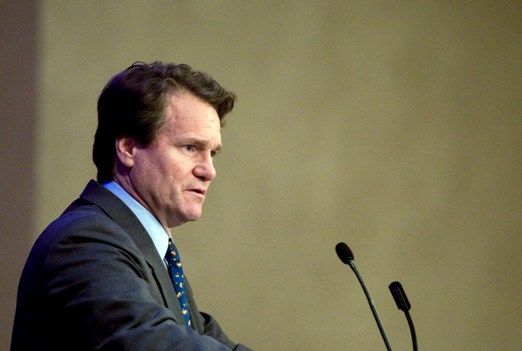

Merrill sacrifices productivity for head count growth

Bank of America CEO Brian Moynihan warned that adviser productivity and profit margins at Merrill may continue to fall as the firm sacrifices short-term profitability for long-term growth.

New BofA wealth chief to deepen bank ties

Merrill Lynch and U.S. Trust advisers can expect an even closer relationship with Bank of America Corp. when Terry Laughlin takes over for David Darnell as head of the BofA's wealth division later this year.

Attrition and breakaways have shrunk head counts at wirehouses

Attrition and breakaways have shrunk head counts at wirehouses, threatening the big four firms as they look to keep pace. (Plus: Our full Spotlight on Wirehouses special report)

Credit Suisse to focus on wealth management

New CEO says firm will also shrink investment bank because of "unsupportive" and "unfavorable" regulation.

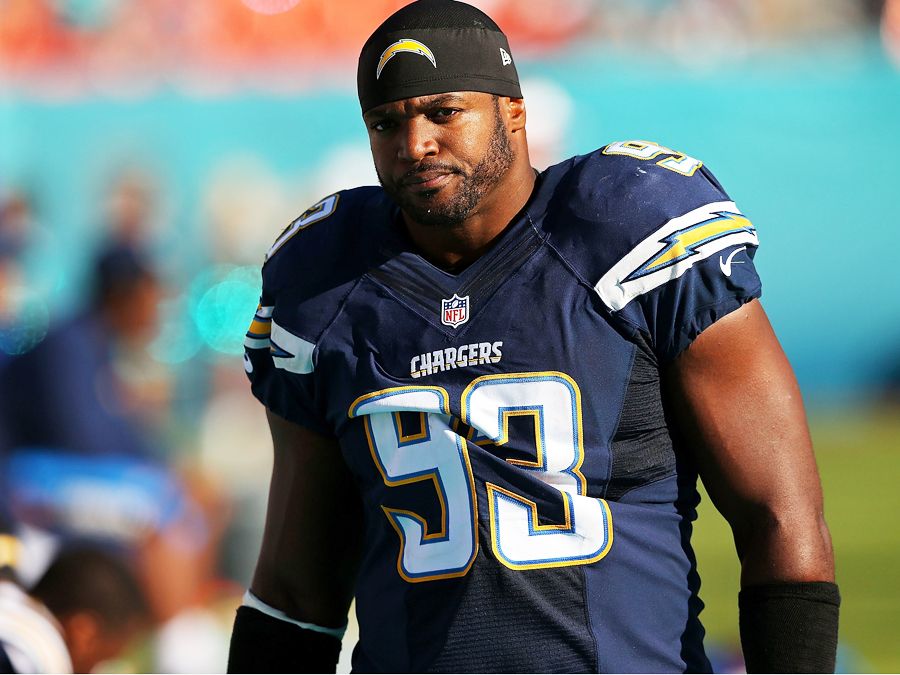

BofA wins dismissal of NFL star Dwight Freeney’s $20 million suit

Bank of America has dodged a high-profile, $20 million lawsuit brought by NFL star Dwight Freeney, who sued the company and his Merrill Lynch adviser, but the star's attorney says he plans to refile.

Merrill Lynch nabs $1.3 billion UBS team

The carousel of wirehouse advisers continues to spin.

Merrill fires $2.5 billion-plus adviser

A top broker in California, Marc D. Lowe was dismissed earlier this month for "inappropriate workplace behavior;" circumstances still unclear.

John Thiel: Learn from the past or lose out in the future

On the wall just inside the door of John Thiel’s corner office in downtown Manhattan’s World Financial Center…

Citi to pay $180 million for hedge fund sales linked to Smith Barney

Citigroup has agreed to pay $180 million to settle charges tied to two hedge funds the SEC said were improperly marketed and sold by private bankers and Smith Barney brokers.