Blackstone, Wellington Management and Vanguard Group this month filed to launch a multi-asset interval fund, called the WVB All Markets Fund, aimed at bringing private markets exposure to a wider base of retail investors. The fund now faces the typical scrutiny of alternative investments that offer investors some exposure to investments that don’t trade on a daily basis and cost more than low-priced exchange-traded funds pegged to stock and bond indices.

According to a filing with the Securities and Exchange Commission (SEC) dated May 7, the WVB Fund will be structured as an interval fund – an investment vehicle that allows limited quarterly redemptions of between 5% and one-fourth of the fund’s net asset value.

Wellington will act as the fund’s investment advisor.

The pedigree of the three firms involved in the new product, which will be sold at first by financial advisors, is exceptional.

“Vanguard and Blackstone stand at opposite ends of the asset-management spectrum,” noted Jason Kephart and Bridget Hughes, both senior principals for Morningstar, in a research note last week.

“Vanguard champions low-cost, predominantly passive strategies in public markets, while Blackstone leads in private-market investing, offering access to less liquid, often less transparent opportunities that come with the potential for higher returns, albeit at a much steeper cost than Vanguard’s razor-thin fees,” they wrote. “But as the poets say, opposites attract.”

There are benefits to such public and private investment partnerships, the Morningstar analysts noted.

“For public-market asset managers, partnering with private-markets specialists, rather than acquiring them or building in-house capabilities, offers several advantages,” according to Morningstar. “First, it‘s faster: Partnerships can be negotiated quickly and come with built-in implied credibility. They’re also typically less expensive upfront and help preserve a firm’s culture and identity. Add potential broader distribution benefits from both sides, and the appeal grows stronger. And if things don’t work out, partnerships are easier to unwind than acquisitions.”

But, the Morningstar analysts asked, is any such investment partnership greater than the sum of its parts? The ratings agency noted other high-profile investment managers have recently announced similar funds.

“The biggest question for investors is whether these high-profile partnerships deserve a place in their portfolios,” they wrote. “Despite the brand-name pedigree of the asset managers involved, most of these strategies are untested.”

“Some have only recently launched; others, like the WVB All Markets Fund, won’t debut until late 2025,” according to Kephart and Hughes. “Even the partnerships themselves are new. Their promise of seamless collaboration is more aspiration than a proven advantage.”

“What is known is that private assets bring added complexity, reduced liquidity, and higher fees,” they wrote. “Investors must weigh whether the potential benefits of private-market exposure are enough to clear those hurdles.”

LifeMark Securities has faced scrutiny in the past for its sales of GWG L bonds.

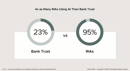

New data from F2 Strategy shows 95% of RIAs are using AI - four times the adoption rate of banks. Trust companies account for 90% of firms not using AI, raising alarms about their ability to stay competitive.

The ex-registered broker facilitated a series of transactions, including nine trades totaling nearly $130,000 and eight withdrawals amounting to $85,000, for a fourteen-month period after the client's death.

The wealth tech giant is offering advisors a natural, intuitive way to use AI through its new business intelligence and insights engine features.

Sometimes letting clients lead conversations, rather than having all the answers, can be the most powerful trust-builder.

How intelliflo aims to solve advisors' top tech headaches—without sacrificing the personal touch clients crave

From direct lending to asset-based finance to commercial real estate debt.