David Lerner Associates, the long-time purveyor of high-risk, house-managed alternative investments, will not be selling any more proprietary investments for at least two years, according to a settlement this week with the Financial Industry Regulatory Authority (FINRA).

This FINRA settlement with David Lerner Associates involves sales of energy limited partnerships; FINRA claimed the firm’s brokers made unsuitable sales recommendations to 200 customers to buy the limited partnerships from 2015 to 2019. Davd Lerner Associates also agreed to pay $1 million in restitution to clients to settle the matter.

After two years, the firm can begin selling such products again if it meets a variety of compliance thresholds mandated in its settlement.

For decades, the bulk of the retail brokerage industry has moved away from selling expensive, proprietary funds managed by an affiliate because of the hazards for conflicts of interest when recommending such products.

“The regulatory issues the firm faced going back between six and ten years have been settled and are behind it,” a David Lerner Associates spokesperson wrote in an email. “Investors currently holding the investments at issue have net, unrealized profits and are currently receiving approximately 7% in annual distributions.”

Meanwhile, in a separate but related matter, Daniel Lerner, the son of the founder of the firm, was suspended from the securities industry for two months and fined $5,000.

“In March 2019, [Daniel] Lerner recommended that a customer invest in an illiquid, proprietary limited partnership without having a reasonable basis to believe that the investment was suitable for the customer based on her investment profile,” according to his settlement with FINRA.

FINRA in 2022 said it was investigating Daniel Lerner, a senior executive with the firm at the time, over the sale of proprietary investment funds to clients and whether his investment recommendations were suitable.

Based on Long Island, David Lerner Associates is a longtime purveyor of municipal bonds and REITs and has had problems with FINRA in the past.

In 2013, FINRA hit David Lerner Associates with millions in penalties for alleged unfair sales practices and excessive markups, ordered the firm to pay $12 million in restitution to clients who bought shares of a nontraded real estate investment trust known as Apple REIT 10.

FINRA at the time also fined David Lerner Associates more than $2.3 million for charging unfair prices on municipal bonds and collateralized mortgage obligations. The firm's founder and owner, David Lerner, was also suspended from the securities industry at the time.

FINRA does not name the proprietary energy funds at issue in the industry sales violations.

But the firm marketed Energy 11 LP, which was formed in 2013 by Glade Knight and David McKenney of the Apple REIT companies, along with Anthony Keating and Michael Mallick, according to the company.

It raised $374 million from investors over two years starting in 2015. The firm charged a 6% sales commission to clients, according to filings with the SEC.

Financial advisors right now typically charge an annual fee to clients of less than 1%, or about 80 basis points, to manage customers' funds.

LifeMark Securities has faced scrutiny in the past for its sales of GWG L bonds.

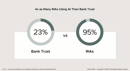

New data from F2 Strategy shows 95% of RIAs are using AI - four times the adoption rate of banks. Trust companies account for 90% of firms not using AI, raising alarms about their ability to stay competitive.

The ex-registered broker facilitated a series of transactions, including nine trades totaling nearly $130,000 and eight withdrawals amounting to $85,000, for a fourteen-month period after the client's death.

The wealth tech giant is offering advisors a natural, intuitive way to use AI through its new business intelligence and insights engine features.

Sometimes letting clients lead conversations, rather than having all the answers, can be the most powerful trust-builder.

How intelliflo aims to solve advisors' top tech headaches—without sacrificing the personal touch clients crave

From direct lending to asset-based finance to commercial real estate debt.