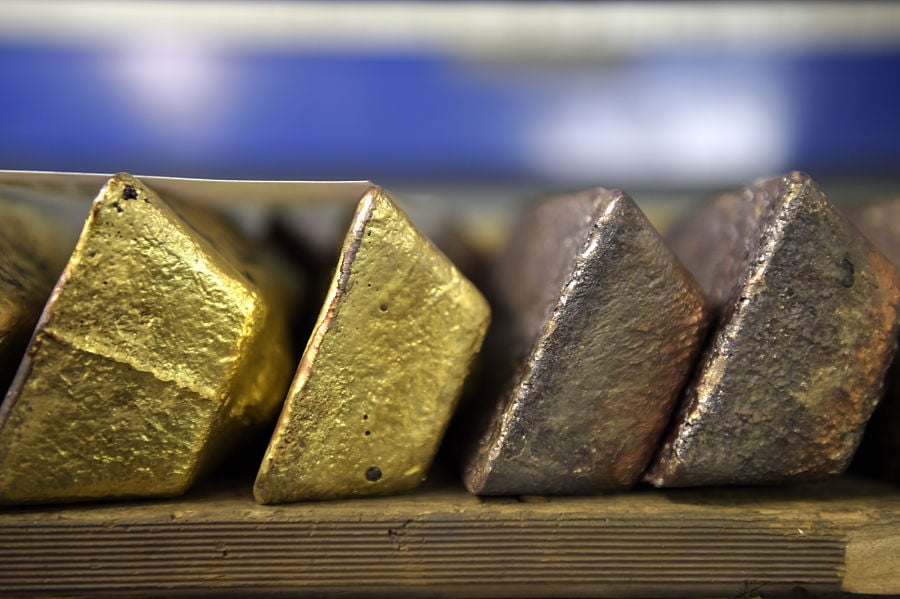

Investors are continuing to pour cash into gold exchange-traded funds, with 2020 inflows already exceeding any full year on record even as stocks post their biggest earnings-season rally in six years.

ETFs tracking the precious metal, seen as a safe haven during economic downturns, have attracted $14.5 billion in less than five months, topping the $11.7 billion that flowed into the funds in 2009, according to data compiled by Bloomberg.

The biggest contributor to the gains is State Street’s SPDR Gold Share ETF (GLD), which saw its best month of inflows since 2009 in April and has taken in an additional $1.4 billion in May. BlackRock’s iShares Gold Trust (IAU) is just shy of its yearly record with $3.7 billion in inflows so far this year.

“There is still skepticism in the market,” said Mohit Bajaj, director of ETFs for WallachBeth Capital. “I think investors are using it as a hedge just in case equities do pull back.”

Money continued to flow into the funds as U.S. stocks rallied more than 30% from their March lows. Unprecedented stimulus and lower interest rates to mitigate the economic fallout from the Covid-19 pandemic have stoked demand for risk assets, including equities.

The Federal Reserve has allocated $2.3 trillion of credit through nine programs so far, backed by $215 billion of Treasury funds, sparking worries about currency debasement. Some investors are also concerned that the stock rebound will fade as economic data paints an increasingly dreary picture of the pandemic’s impact, with 20.5 million jobs lost in April, and President Donald Trump reignites threats of tariffs on China.

Last week, gold holdings in ETFs rose to more than 3,000 tons, an all-time high, as year-to-date inflows already surpass the volume added during 2019.

Gold ETFs are typically used in a buy-and-hold fashion, whereas gold futures and options usually attract speculative investors. So the gold ETF flows show investors are concerned about the inflation risk the pandemic has caused in the long run.

“We haven’t seen inflation in a long, long time, but the Fed just continues to say they will keep rates low as long as they don’t see inflation,” said Sandy Villere, portfolio manager at Villere Balanced Fund. “All the money that is sloshing around and the ridiculous amount of jobs that have been lost, those jobs could come right back and then you have an extreme amount of stimulus. With all that cash in the economy, you could see some form of overheating.”

Integrated Partners is adding a mother-son tandem to its network in Missouri as Kestra onboards a father-son advisor duo from UBS.

Futures indicate stocks will build on Tuesday's rally.

Cost of living still tops concerns about negative impacts on personal finances

Financial advisors remain vital allies even as DIY investing grows

A trade deal would mean significant cut in tariffs but 'it wont be zero'.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.