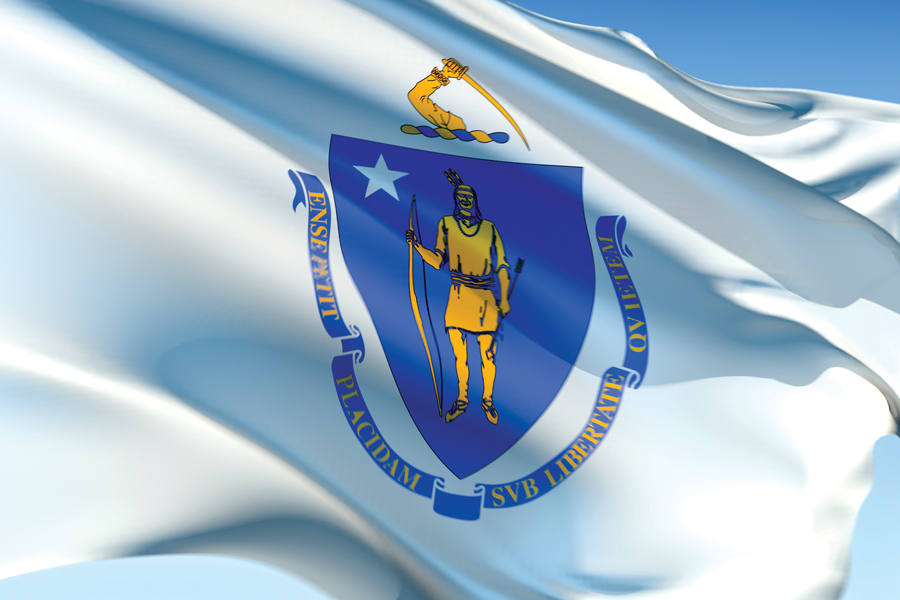

Massachusetts state securities regulators have fined U.S. Data Mining Group Inc. $1 million over charges that the company, incorporated in Nevada with offices in Florida and New York, sold fraudulent and unregistered securities to Massachusetts investors.

William Galvin, Massachusetts secretary of the commonwealth, described the case as a warning for individuals who were thinking of investing in Bitcoin mining or cryptocurrencies.

In a consent order, the state’s securities division accused the company of selling nearly $4 million in unregistered securities to Massachusetts investors, while also failing to appropriately disclose the involvement of several people who had previously been charged by the Securities and Exchange Commission with conspiring to commit securities fraud by operating a “pump-and-dump” scheme. Two of the individuals who formed U.S. Data Mining Group are considered “bad actors” under securities laws as a result of their prior involvement in a series of schemes, Massachusetts securities officials said in a release.

According to the securities division, Massachusetts investors weren't properly warned or advised of the involvement of these men and others when they purchased shares of the company in 2021. In addition to the $1 million fine to be paid to the Commonwealth of Massachusetts, the consent order also requires the company to make offers of rescission to Massachusetts investors, and to refund the total amount of investors’ stock with interest, if investors so choose.

Last week's layoffs totaled at least 130 Cetera employees, according to a senior industry executive.

Four of the Magnificent Seven will report this week.

Easing anxiety has seen the haven asset slide from record high.

Uncertainty remains challenging for Treasuries traders.

Move will raise concerns of inflationary impact of tariffs.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.