The Securities and Exchange Commission wants advice from the public about whether exchange-traded funds linked directly to the price of Bitcoin could be a vehicle for fraud, highlighting concerns about a submission from one of the biggest trusts holding the token.

The regulator issued a notice Friday calling for members of the public to submit written comment regarding Grayscale Investments’ application to turn its Grayscale Bitcoin Trust (GBTC) into an ETF tied to Bitcoin’s spot price. The SEC had done the same a few days earlier in a notice regarding another application to launch a Bitcoin ETF, this one submitted by Bitwise.

The notice requested feedback on whether the proposed ETFs would be susceptible to manipulation and fraud, and whether Bitcoin itself could be held to the same standard. The SEC has denied six similar applications since November, including those from VanEck, WisdomTree and SkyBridge Capital.

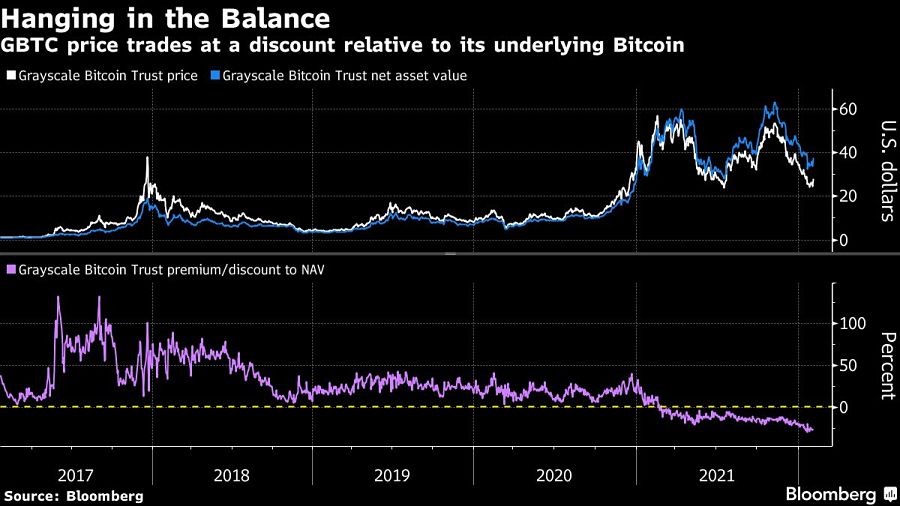

Grayscale’s $27 billion fund has been a key way for financial institutions to gain exposure to crypto since its launch in 2013, which is why it has historically traded at a premium to Bitcoin’s actual price. However, GBTC now trades at a discount after the surge in crypto prices and the launch of ETFs backed by crypto derivatives on Wall Street.

Despite the recent price volatility, demand for an ETF tied to Bitcoin’s spot price may be sustained in the near term, analysis from Bloomberg Intelligence showed Monday. BI’s Rebecca Sin and James Seyffart said trading volume among crypto ETFs remained stable in January, with relatively small flow declines.

“GBTC’s discount has weighed on shareholders for months but provides Bitcoin exposure at below-market prices,” they said in an earlier note. The gap would disappear if the SEC greenlights Grayscale’s ETF application on July 6, however, the analysts expect a denial.

Carson is expanding one of its relationships in Florida while Lido Advisors adds an $870 million practice in Silicon Valley.

The approval of the pay proposal, which handsomely compensates its CEO and president, bolsters claims that big payouts are a must in the war to retain leadership.

Integrated Partners is adding a husband-wife tandem to its network in Missouri as Kestra onboards a father-son advisor duo from UBS.

Futures indicate stocks will build on Tuesday's rally.

Cost of living still tops concerns about negative impacts on personal finances

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.