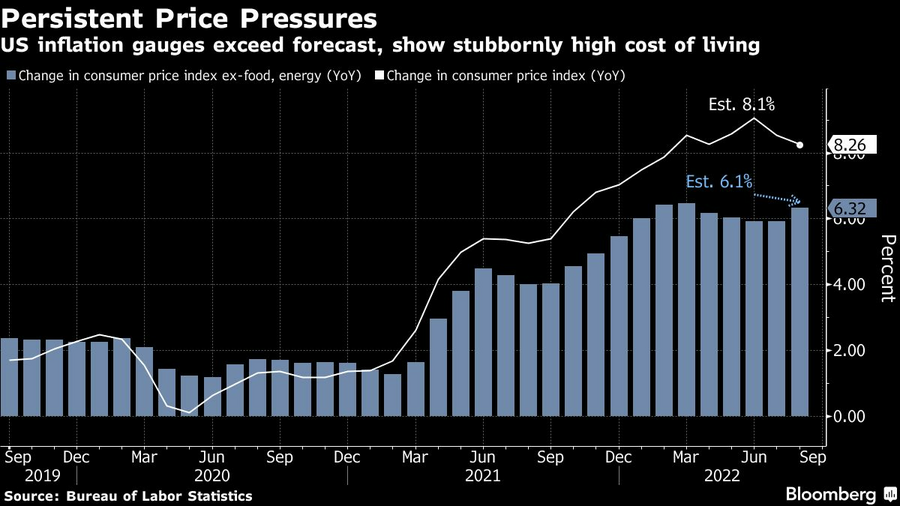

U.S. consumer prices were resurgent last month, dashing hopes of a nascent slowdown and likely assuring another historically large interest-rate hike from the Federal Reserve.

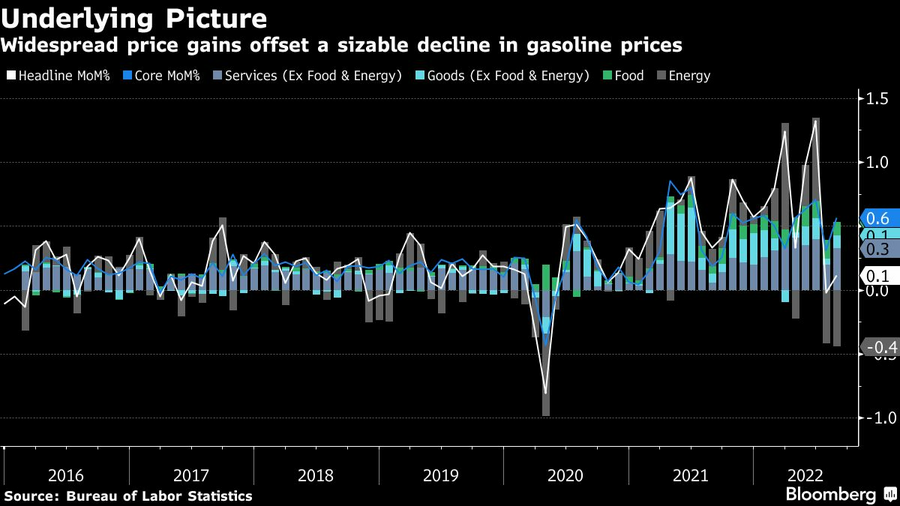

The consumer price index increased 0.1% from July, after no change in the prior month, Labor Department data showed Tuesday. From a year earlier, prices climbed 8.3%, a slight deceleration, largely due to recent declines in gasoline prices.

But so-called core CPI, which strips out the more volatile food and energy components, advanced 0.6% from July and 6.3% from a year ago, the first acceleration in six months on an annual basis.

All measures came in above forecasts. Shelter, food and medical care were among the largest contributors to price growth.

The acceleration in inflation points to a stubbornly high cost of living for Americans, despite some relief at the gas pump. Price pressures are still historically elevated and widespread, pointing to a long road ahead toward the Fed’s inflation target.

Chair Jerome Powell said last week that the central bank will act “forthrightly” to achieve price stability, and some policy makers voiced support for another 75 basis-point rate hike. Officials have said their decision next week will be based on the “totality” of the economic data they have on hand, which also illustrates a strong labor market and weakening consumer spending.

Treasury yields surged, the S&P 500 index opened lower and the dollar rose. Traders boosted bets that the Fed will raise interest rates by three-quarters of a percentage point, now seeing such an outcome as locked in.

“If there was any doubt at all about 75 — they’re definitely going 75” at next week’s Federal Open Market Committee meeting, Jay Bryson, chief economist at Wells Fargo & Co., said on Bloomberg Television. “We thought they’d be stepping it back to 50 in November. At this point, you’d say 75 is certainly on the table in November.”

Food costs increased 11.4% from a year ago, the most since 1979. Electricity prices rose 15.8% from 2021, the most since 1981. Gasoline prices, meanwhile, fell 10.6% in August, the biggest monthly drop in more than two years.

Shelter costs — which are the biggest component of services and make up about a third of the overall CPI index — continue to rise. Overall shelter costs increased 0.7% from July and 6.2% from a year ago, both the most since the early 1990s.

Persistently high inflation has dragged down President Joe Biden’s approval ratings and threatened Democrats’ chances of retaining their thin congressional majorities in November’s midterm elections.

Biden, in a White House ceremony later Tuesday, plans to argue that he and his fellow Democrats have helped steer the economy back to firmer footing as they tout a sweeping new climate, energy and health care law dubbed the “Inflation Reduction Act.”

Inflation Snapshot

| Category | Annual increase | Historical |

|---|---|---|

| Outdoor equipment, supplies | 13.1% | Record |

| Housekeeping supplies | 11.7% | February 1981 |

| Food | 11.4% | May 1979 |

| Health insurance | 24.3% | Record |

| Veterinary services | 10% | Record |

| Toys, games | 6.9% | Record |

| Rent of primary residence | 6.7% | April 1986 |

| Personal care products | 6% | July 1983 |

Excluding food and energy, the cost of goods was up 0.5% from a month ago while services costs less energy climbed 0.6%. Economists have been expecting goods prices to cool as pent-up demand leads consumers to shift more of their spending toward travel and entertainment, but both remain elevated.

Used car prices fell for a second month. Airfares also dropped, likely due to the decline in fuel prices.

Nonprescription drugs rose the most on record on an annual basis. Overall medical care goods posted the largest advance since 2017. As far as health services, health insurance surged a record 24.3% year-over-year.

Inflation continues to erode Americans’ wage gains. A separate report Tuesday showed real average hourly earnings fell 2.8% in August from a year earlier, continuing a steady string of declines since last April. On a monthly basis, however, real wages grew for a second month.

The alts giant's latest executive hire builds on its continuing strategy to expand into the private wealth space.

While it's a useful rule of thumb, wealth industry experts agree Social Security benefits, retirement income planning, and individual expenses should also be factored in.

The holdout optimist from Wells Fargo sees market "past peak uncertainty" as trade war fears push many cheerleaders to pare back their predictions.

Last year's standout winners reflect on their triumph as the wealth industry gears up for another unforgettable night in New York City.

Financial advisors are becoming a bit more leery that fees, particularly for their wealthiest clients, are on the verge of taking a hit.

From direct lending to asset-based finance to commercial real estate debt.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.