The Bitcoin fever is starting to break as worries about a market bubble discourage investors from buying in.

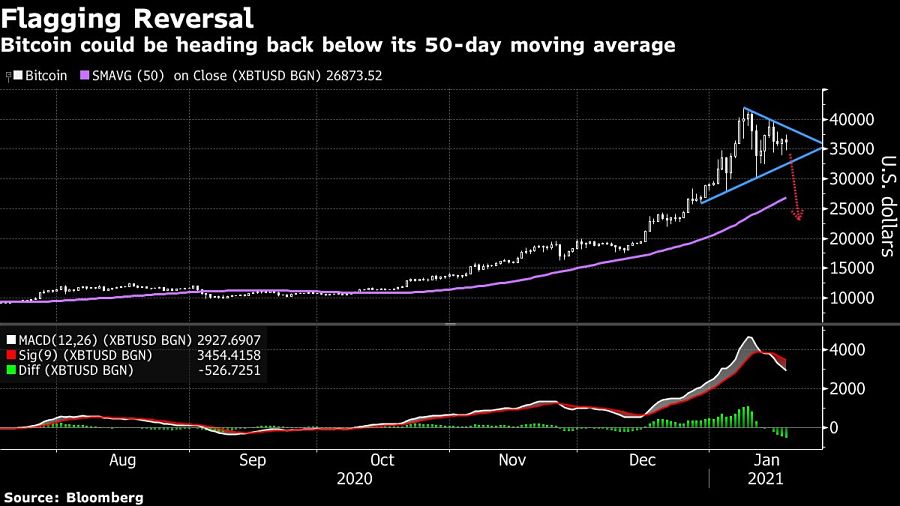

Prices for the largest cryptocurrency dipped as much as 6.8% on Wednesday and traded below $35,000. Ever since the market shot through all-time highs in early January, Bitcoin has been beset by volatility and skepticism that the run-up has been excessive.

Analysts have pointed to $40,000 as the key level that Bitcoin needs to surpass in order to draw fresh money from investors riding cryptocurrency momentum. They argue that recent gains could prove fleeting if the rally stalls and traders looking for quick returns shift their money elsewhere.

“Many cryptocurrency traders are diversifying into other coins in fear that Bitcoin could see another collapse if $41,500 is not reached sometime soon,” said Edward Moya, senior market analyst at Oanda Corp.

There are also concerns among Wall Street pros that Bitcoin’s 400% rally in the past year makes it too dangerous for them to jump in. In Bank of America Corp.’s monthly survey, fund managers called Bitcoin the world’s most crowded trade -- the first time it’s held that title since 2017.

Driven by robust transaction activity amid market turbulence and increased focus on billion-dollar plus targets, Echelon Partners expects another all-time high in 2025.

The looming threat of federal funding cuts to state and local governments has lawmakers weighing a levy that was phased out in 1981.

The fintech firms' new tools and integrations address pain points in overseeing investment lineups, account monitoring, and more.

Canadian stocks are on a roll in 2025 as the country prepares to name a new Prime Minister.

Carson is expanding one of its relationships in Florida while Lido Advisors adds an $870 million practice in Silicon Valley.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.

As inheritances are set to reshape client portfolios and next-gen heirs demand digital-first experiences, firms are retooling their wealth tech stacks and succession models in real time.